What is Umami Finance?

Umami Finance is a DeFi platform that facilitates the rapid expansion of ecosystem liquidity by creating markets and providing liquidity. The project is built on the blockchain protocol Arbitrum.

It might be stated more simply: Umami Finance owns a profit-generating fund. The earnings of the initiative will be given to holders of $UMAMI tokens, who will then wager these tokens on Marinate v2.

Purchasing $UMAMI Staking Receiving “dividends” based on mUMAMI number. The primary objective of the initiative is to create vaults and distribute monies from them to mUMAMi holders. The unique aspect, though, is that “dividends” are paid in WETH (wrapper of ETH).

What is the difference of Umami Finance?

Umami Finance has four fundamental distinctions:

- RealYield: Umami Finance aims at organic sources of profit rather than large emits of other tokens.

- Legal: Advised by Umami Advisors to comply with the laws in the US market.

- Targeting institutional clients: Through Umami Advisors to reach large institutional investors in TradFi.

- The development roadmap is extremely detailed and specific.

Tokenomic

Basic information about Umami Finance token

- Token Name: Umami Finance

- Code: UMAMI

- Blockchain: Arbitrum

- Token classification: ERC – 20

- Contract: 0x1622bf67e6e5747b81866fe0b85178a93c7f86e3

- Total Supply: 1,000,000

Token Allocation, Release

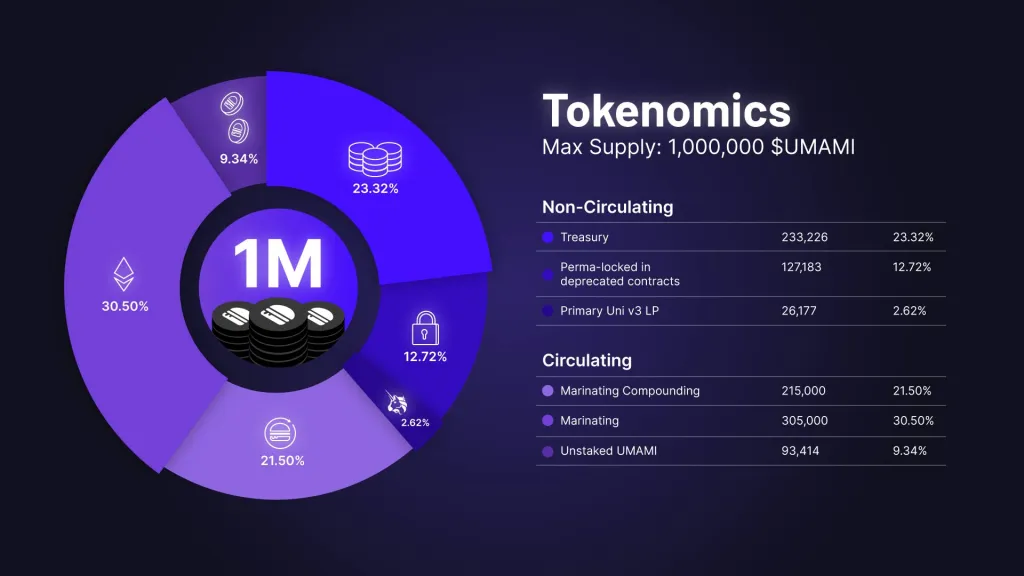

The maximum supply of $UMAMI is one million dollars. This is the final outcome of the community vote held on May 26, 2022. However, more tokens can still be issued under certain circumstances for platform development.

$UMAMI are separated into Non-Circulating and Circulating Supply, with the following distinctions:

- Non-Circulating: accounted for 275,401 $UMAMI including 104,135 permanently locked $UMAMI. The rest is in the platform’s coffers.

- Circulating: 724,599 $UMAMI included in Pools Marinate, Auto Compound and UniSwap V3

Token Use Case

Umami offers token holders two sorts of services:

Allows users to participate in UMAMI staking in order to obtain mUMAMI. Monthly holding of mUMAMI gives users a piece of the project’s revenue. The revenue you receive is wETH and not a project token.

Automatically reinvest revenue gains and pay in ETH to purchase and stake additional $UMAMI.

Project Team

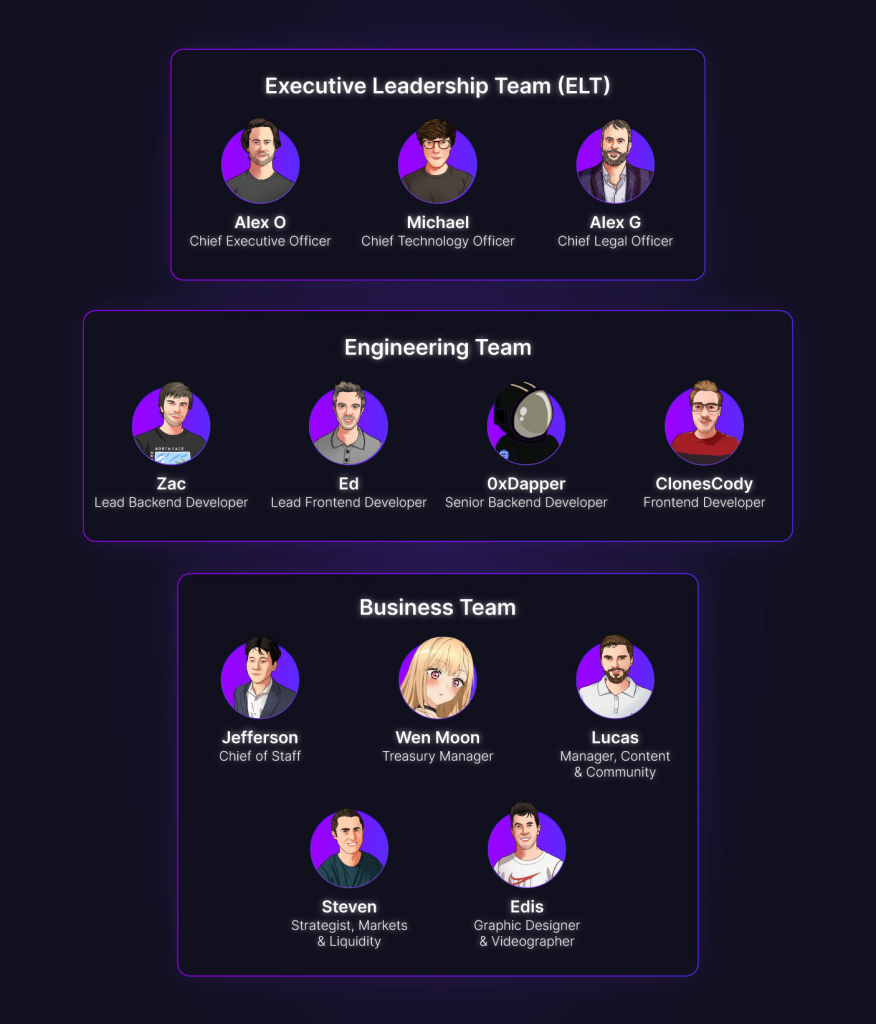

The project team consists of seasoned individuals:

Alex O, the CEO, engaged in Web 3 as a core contributor for Umami DAO and as a strategic marketing officer for Socket.

Michael E – Chief Technology Officer: responsible for directing the creation of Umami’s product suite. In addition, I have led software teams for nine years, most recently at multiple defense industry companies.

Alex Golubitsky, General Counsel: Since 2007, Alex has specialized in territorial income tax benefits in the U.S. Virgin Islands and Puerto Rico while practicing law.

Investors and partners

There is no information on the project’s investor. However, the initiative has significant ecosystem partners, including Banxa, JonesDAO, Dopex, GMX, Socket, and TracerDAO.

Roadmap

Q4/2022

Implementing USDC, ETH, BTC Vault

- Network: Arbitrum

- Capacity: 200M$

- Fees: 2% Administration Fee and 20% Enforcement Fee

Q1/2023

Eth2 product deployment: USDC, ETH Vault.

- Ethereum Network

- Capacity: 1B$

- Fees: 2% Administration Fee and 20% Enforcement Fee

Increased Umami Fund Advisors’ managing size from $5 million to $25 million.

In the traditional financial market, at least one institution is a customer.

Trading Platform

Currently you can trade Umami at MEXC or Uniswap on the Arbitrum network.

Contact

Website: https://umami.finance/

Whitepaper: https://umami.finance/Umami-Litepaper.pdf

Twitter: https://twitter.com/UmamiFinance

Discord: https://discord.com/invite/zn6hsTmTSM

Summing up

Through the above article, CryptoChill has helped you know about the Umami Finance and the highlights of the project.

Disclaimer: This post is not investment advice. You will be 100% responsible for your investment decisions.

Please follow and subscribe to support the CryptoChill.news.

No Comment! Be the first one.