Tokenlon – Trusted decentralized exchange protocol

After experiencing many fluctuations due to the influence of centralized exchanges, decentralized exchanges began to receive more attention from the cryptocurrency community in the world and the Tokenlon project is one of the exchanges. Featured DEX on Ethereum ecosystem. Let’s learn more about Tokenlon project with CryptoChill through the article below!

What is Tokenlon (LON)?

Launched in 2018 as a part of imToken, Tokenlon is a decentralized exchange (DEX) and payment settlement protocol based on Ethereum blockchain technology. It currently powers Tokenlon DEX, a decentralized exchange and payment settlement protocol which aims to provide a secure, reliable and seamless trading experience to the masses.

When it launched, two of its most touted aspects were its ability for token-to-token trading and a function called Instant Exchange, which works to deliver speedy settlement at fair prices for users.

What Makes LON Unique?

LON tokens have the following two main use cases:

Fee discount: Tokenlon currently charges a standard 0.30% fee for most transactions. By holding LON, users can get corresponding fee discounts based on the number of tokens held.

Governance: LON will give the community the right to participate in the governance of Tokenlon. LON holders can improve LON by initiating Tokenlon Improvement Proposal (TIP) proposals and voting, such as determining the use of the treasury, fee parameters, buyback parameters, supporting assets, product features, etc.

Economic Mechanisms

Tokenlon’s characteristics are as follows:

- Permissionless: Anyone can access without permission.

- Trustless: Because Tokenlon’s operation is based on the execution of smart contracts, the exchange is transparent and secure to be transparent and secure without having to trust a third-party.

- Anti-censorship: Without a centralized entity controlling who has access to the exchange, anyone is able to interact with the exchange.

- Robustness: the exchange is able to run 24/7 uninterrupted even during protocol upgrades and configuration, and because Tokenlon’s administrator account, which is responsible for the execution of protocol upgrades and configuration, is a multi-signature account, which means that the protocol won’t suffer a failure at a single point of operation.

How does Tokenlon work?

Tokenlon utilizes a Request for Quotation order matching model, which helps give users the best prices for each trade pair. How this works is it aggregates volume from various other DEXes. Thus far, it has been able to aggregate volume from Uniswap V2, Uniswap V3, Curve and Sushiswap, with plans to aggregate more liquidity pools in the future.

Currently, Tokenlon’s exchange functions are as follows:

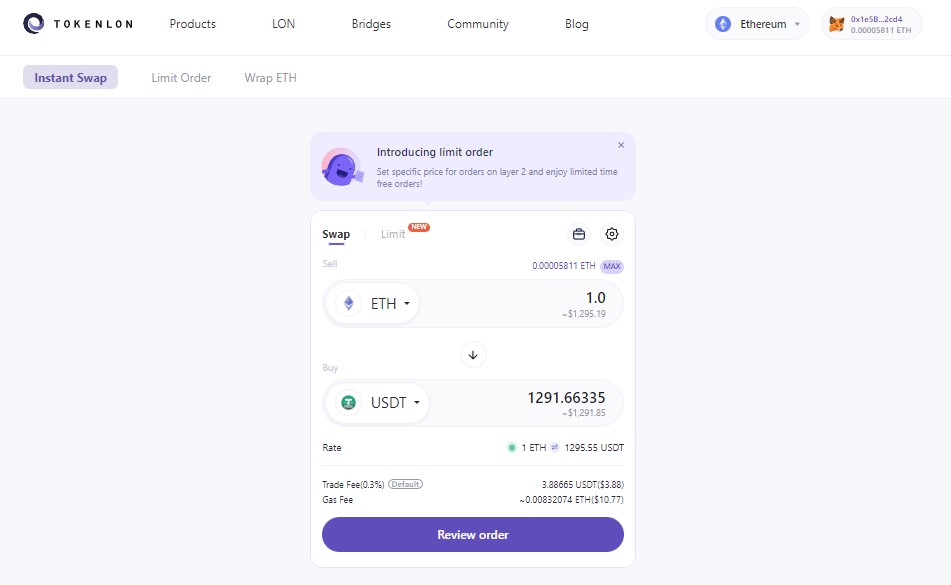

- Instant Swap: Available on the ETH mainnet. Swap between tokens instantly, with or without ETH to pay for gas fees in your wallet

Instant Swap

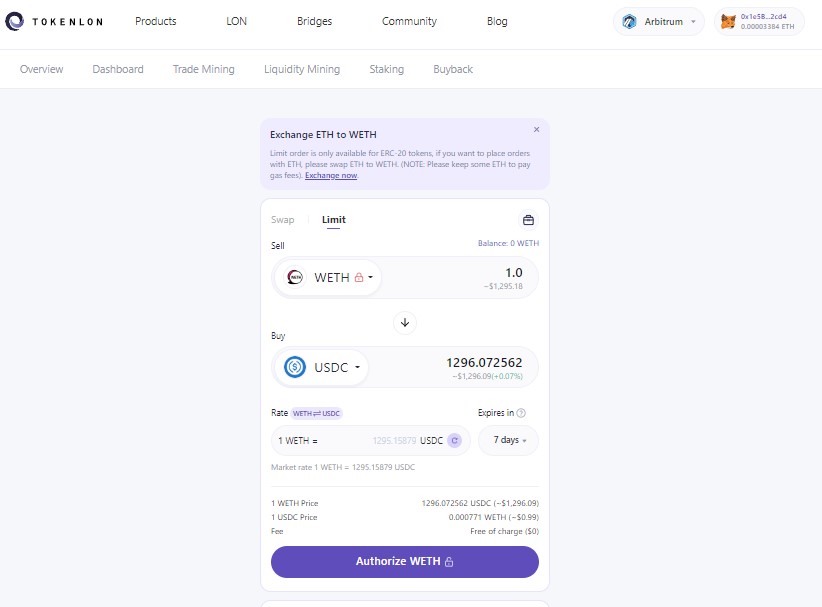

- Limit Order: Available on Arbitrum — an Ethereum Layer 2 network. Place an order at the exact intended price. Once the price hits your order price, your order will be executed.

limit order

Tokenlon boasts a swap success rate of 99% due to its on-chain broadcasting mechanism.

What is $LON and what can you do with it?

LON is Tokenlon’s native utility token. It is used to align all parties involved in the ecosystem and incentivize participation and expansion of the ecosystem.

- Token name: Tokenlon

- Token Symbol: LON

- Blockchain: Ethereum ERC-20

- Contract Address: 0x0000000000095413afc295d19edeb1ad7b71c952

- Token supply: 200.000.000 LON

- Circulating Supply: 85,633,563.36 LON

- Market cap: 14.718.874$

LON token Utilities

- Fee discount: Tokenlon currently charges a standard 0.30% fee for most transactions. By holding LON, users can get corresponding fee discounts based on the number of tokens held. The more LON held by a user, the higher fee discount received

- Governance: LON will give the community the right to participate in the governance of Tokenlon. LON holders can improve Tokenlon by initiating Tokenlon Improvement Proposal (TIP) proposals and voting, such as determining the use of the treasury, fee parameters, buyback parameters, supporting assets, and product features.

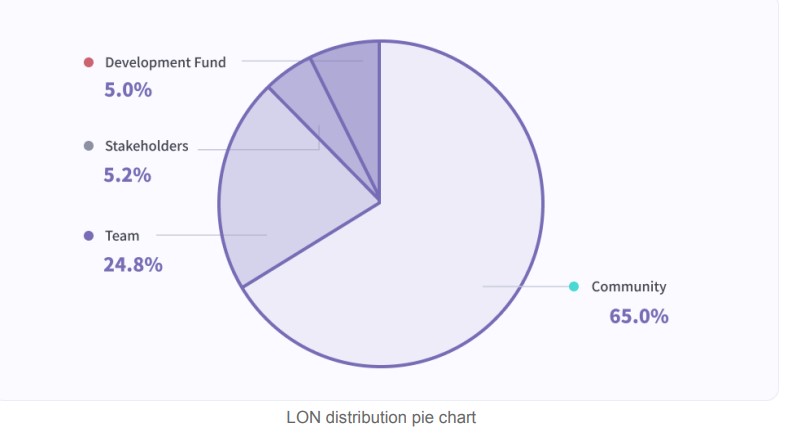

$LON token allocation

$LON token are allocated as follows:

- Community: 65%

- Team: 24.8%

- Stake Holders: 5.2%

- Development Fund: 5%

Fees charged by the LON protocol will be used to buyback LON on the open market, and the LON obtained from the buyback will be used for staking rewards and treasury reserves

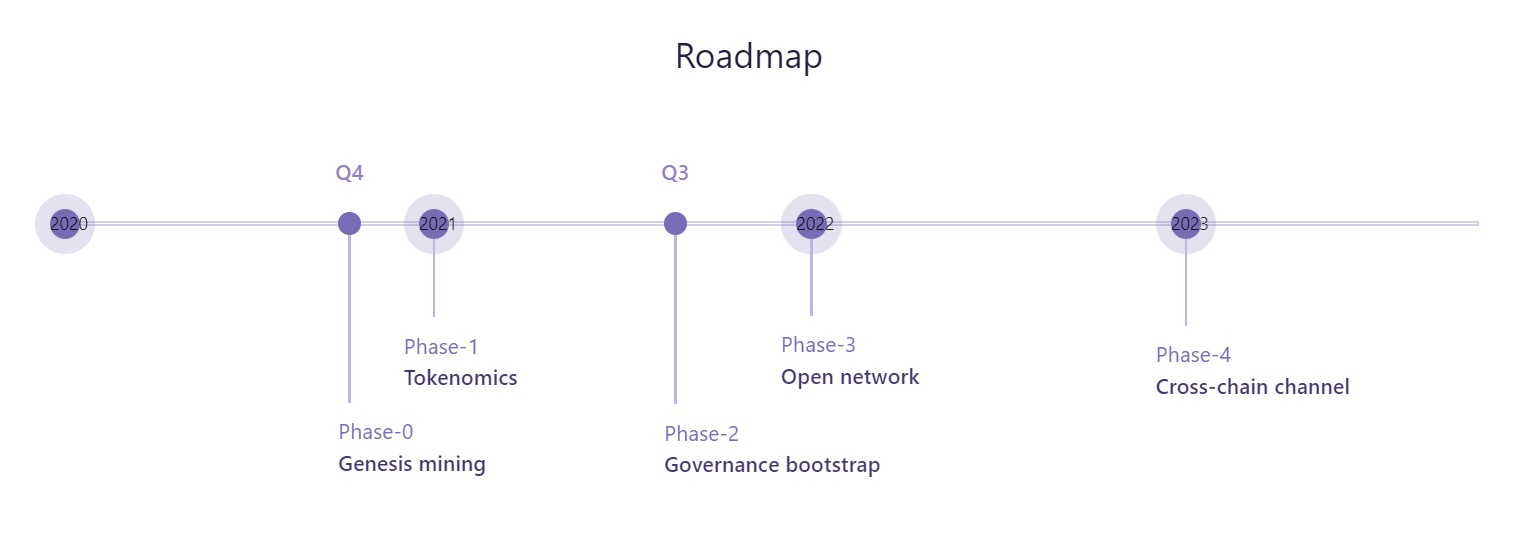

Roadmap

In order to realize Tokenlon’s vision, the following are the objectives the core team plans to

achieve in the coming years.

2020 – Genesis Mining

Establish a reward system to motivate traders, referrers, and market makers among ecosystem

participants; and reward LON to early Tokenlon contributors and complete 30 million genesis

LON distribution to the community.

2021 – Tokenomics

Complete the release of Tokenlon 5.0. Start trading, referral, market making and other

continuous community incentive programs, launch liquidity pool incentives, introduce buyback,

staking and other mechanisms. Improve the LON economic model, and make LON the main

driving force to promote the development of the Tokenlon network.

2022 – Open Network & Community Governance Bootstrap

Through the establishment of a P2P relay network, allow developers other than core team to

become Tokenlon relayers, making Tokenlon a liquidity network supported by many relayers. At

the same time, a permissionless strategy platform will be established for liquidity providers to

freely design and deploy trading strategies based on protocol standards and access the

Tokenlon network.

2023 – Cross-chain Channel

To start building the cross-chain channels to support atomic settlement of cross-chain

transactions based on the developed cross-chain solutions in the space. Leveraging the

cross-chain liquidity network built by Tokenlon to launch open payment and settlement services

and inject decentralized liquidity into more real life use cases such as payment.

Tokenlon Project Team

Tokenlon was founded by a team led by Bin He, the founder of imToken Wallet, which has been established since May 2016. imToken has become the most popular digital asset management tool in the world, providing digital asset services to millions of high net worth users at home and abroad.

The team has an international, multi-national composition, which is distributed in two office locations in Hangzhou and Singapore, with some positions supporting remote collaboration.

The ImToken wallet team is low-key and pragmatic, with unlimited enthusiasm for the blockchain industry.

Future of Tokenlon project, should invest in LON token?

With the launch of the Tokenlon project, it aggregates the 3 largest decentralized exchanges today, making it possible for users to use large amounts of liquidity on Uniswap, Sushiswap and Curve. LON is one of the first projects in the DEX Aggregator array, so the project’s leading advantage is enormous.

With the announced Tokenlon commitment, the project will become an infrastructure platform of the global financial market, connecting the blockchain ecosystem in an open and inclusive way.

Through this article, you must have somewhat grasped the basic information about the project to make your own investment decisions. CryptoChill is not responsible for any of your investment decisions. Wish you success and make a lot of profit from this potential market.

Learn more about the project:

Website: https://tokenlon.im

Twitter: https://twitter.com/tokenlon

No Comment! Be the first one.