Recently, the LSD (Liquid Staking Derivatives) trend is making a comeback as a result of Ethereum’s upgrade that enables users to withdraw staked ETH. Stader Labs cannot be omitted from the list of significant LSD projects (SD).

So what is Stader Labs? What is the value of an SD coin as a token? Does this project have the potential to lead to future price increases? What distinguishes this project? Discover the answer with Crypto Chill!

What is Stader Labs?

Stader Labs (also known as Stader, SD) is a staking-related endeavor. Here, according to their risk tolerance, users can place bets with relative ease and still earn substantial profits.

Stader achieves this by developing Proof-of-Stake (PoS) network middleware infrastructure. This infrastructure serves as an intermediary for a variety of clients, including crypto users, exchanges, custodians, and mainstream FinTech users.

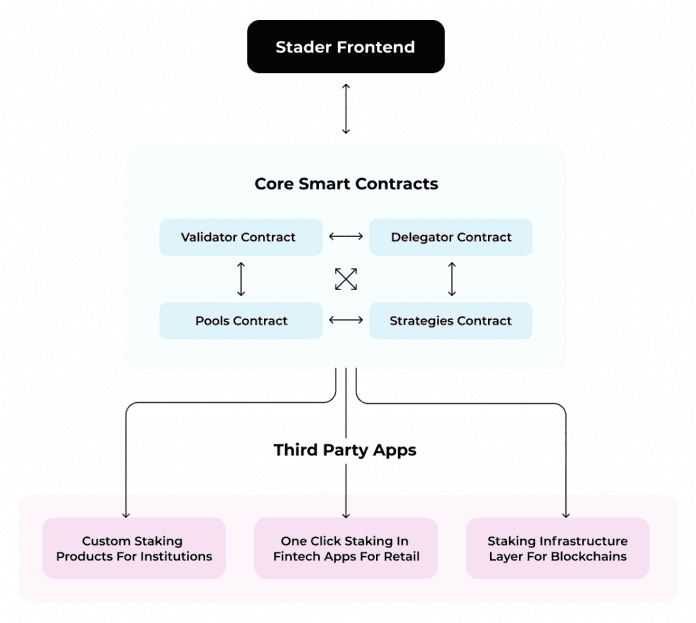

Moreover, Stader’s smart contracts are designed with a modular model structure so that third parties can utilize and create new staking solutions.

Stader Labs intends to broaden the staking of profits from traditional assets to derivative assets. Stader will become a DAO platform in the future, enabling development teams to create new staking solutions.

Stader’s operating model

The structure of Stader’s smart contract system is modular. This allows users to create their own staking solutions using Stader components. As staking evolves in the future, Stader’s architecture may expand to include new features.

In particular, Stader’s architecture includes a system of highly interactive smart contracts. Therefore, whenever they need to expand or add a new pool, they need only modify a specific independent contract, and the entire network will take over immediately.

Through separate contracts, Stader Labs separates the underlying capital and rewards. This will ensure that the underlying capital is always isolated from protocol interactions when staking.

Here are several of Stader’s most important smart contract platforms:

- Delegator Contract: Allow users to stake and unstake through this type of contract.

- Validator Contract: The fund is authorized. Used to claim rewards and airdrops.

- Pools Contract: Manage validation contracts. Monitor the amount staked on each validator pool and support multiple pools.

- Strategies Contract: Take advantage of staking rewards and synthetic assets to increase exchange performance with other DeFi/Gaming protocols.

Project Highlights

Before Stader was born, staking had problems with delegates such as:

- Difficulty in choosing nodes: Most authorizers do not fully understand the complex and risky metrics of staking.

- Performance monitoring: The delegate will monitor the performance of validators. This is quite difficult for those who do not understand the necessary indicators and knowledge.

- Reward management: Delegators need to invest time and effort to monitor, monitor and distribute rewards to validators in the fairest way.

Stader Labs solves these issues by providing delegators with a superior staking performance management platform. These solutions consist of:

- Empowering Delegator: Delegators will be selected nodes and liquidity pools.

- Improved user interface: Stader’s interface will be improved to be as user-friendly as possible for both users and delegators.

- Generate a level of profit that matches the risks of staking

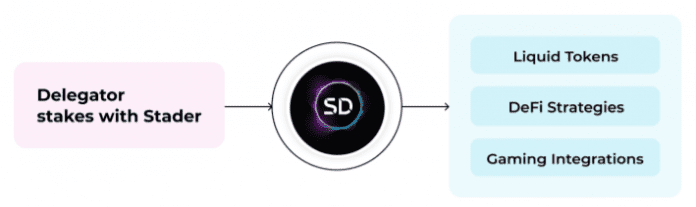

- Provides access to cross-chain lending protocols, liquid staking derivatives and gamify staking pools.

Basic information about the token

The primary token of the Stader Labs project is SD. These token holders can stake them for rewards or use them for various platform utilities.

Token data

- Token Name: Stader

- Ticker: SD

- Blockchain: Ethereum

- Token Standard: ERC-20

- Contract: 0x30D20208d987713f46DFD34EF128Bb16C404D10f

- Token Type: Utility, Governance.

- Total Supply: 150,000,000 SD

- Circulating Supply: 10,149,100 SD

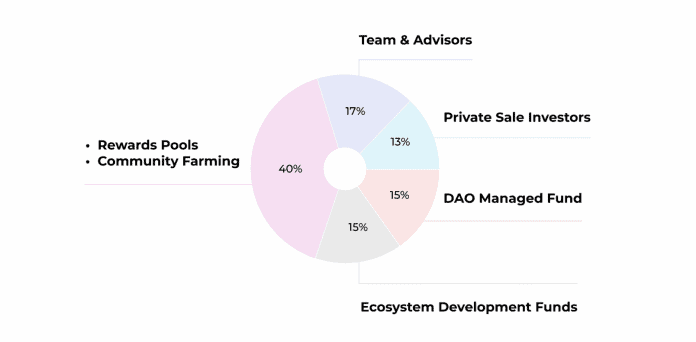

SD Token Allocation

- Rewards + Community Farming: 40%

- Team & Advisors: 17%

- DAO Managed Fund: 15%

- Ecosystem Development Funds: 15%

- Private Sale Investors: 13%

SD token payout schedule

The TGE of SD tokens is on March 15, 3.

- Rewards + Farming: The release schedule depends on the individual rewards program.

- Team + Advisors: 6 months out of 36 months.

- Private Sale: TGE: 0-5% TGE allocation. Vesting: 36 months after TGE.

- TGE DAO Fund: Determined through administration.

- Ecosystem Fund: TGE unlock 0.5%-1.5%. The allocation of the remainder is determined through the governance vote.

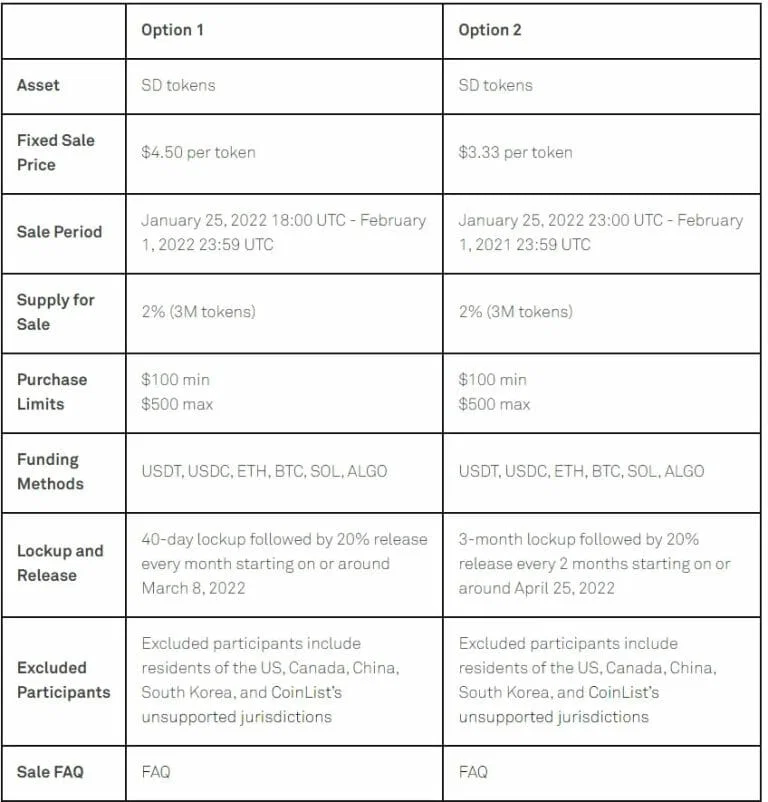

- Public Sale: Follow 2 different options on Coinlist. Specifically, you can see the information section of the ICO SD sale below

SD token utility

- Administer: Users who stake SD will receive xSD tokens. Those who hold xSD will have the right to vote on the platform.

- Slashing Insurance: Validators can stake xSD to later have hedge insurance unless they are slashed (roughly understood as they are punished by the network for bad behavior and the validator’s stake will be partially “chopped”).

- Liquidity Pools: Liquidity providers will be rewarded with SD, xSD

- Stader Infrastructure: 3rd party projects can stake xSD to support contract upgrades and platform infrastructure.

In addition, SD tokens are used to:

- Make transaction fees on the system.

- Staking receives rewards from the project.

- …

ICO SD Sale Information

You can see specific information through the following photo:

How to earn and own SD Tokens

- Staking rewards

- Provide liquidity on the platform to receive rewards in SD, xSD

Project Team

- Amitej: CEO and Co-founder. He has over 10 years of experience in strategy consulting and startup management. Amtej also worked at Swiggy, ATKearney and is an IIT & IIM alumnus.

- Sidhartha: CTO and Co-founder. He has deep expertise in cryptocurrency mining. He also has more than 10 years of building and expanding technology applications. Sidhartha is a Columbia and IIT alumnus.

- Vijay: Product Lead. Vijay has spent more than 10 years working in Silicon Valley. Vijay has worked at LinkedIn, Blend, PayPal and is an IIT & UT Austin alumnus.

- Dheeraj: Engineer Lead.

- Vamshi: Protocol and Community Strategy.

- …

Investors and partners

Stader’s Investors

Stader has raised a total of $16.5 million in funding from several leading venture capital funds and blockchain platforms.

Stader Partners

Currently Stader has partnered with over 15 funds, more than 4 blockchains and 11 different angel investors.

A look at SD’s potential

Recently, the LSD (Liquid Staking Derivatives) trend is making a comeback as a result of Ethereum’s upgrade that enables users to withdraw staked ETH. Considering that SD is a typical LSD project, this project may benefit.

As the current market capitalization of this token is quite low, it is prudent to view this as a “lottery” opportunity and invest only a small amount of capital.

Contact

Website:https://www.staderlabs.com/

Twitter: https://twitter.com/staderlabs

Discord: https://discord.com/invite/xJURAhSmav

Telegram: https://t.me/staderlabs

Summing up

Through the above article, CryptoChill has helped you know about the Stader Labs and the highlights of the project.

Disclaimer: This post is not investment advice. You will be 100% responsible for your investment decisions.

Please follow and subscribe to support the CryptoChill.news.

No Comment! Be the first one.