What is Radiant Capital?

Radiant Capital is an Arbitrum-based lending protocol platform. In addition, Radiant Capital intends to develop a cross-chain lending platform that will enable users to borrow and lend on a single platform while interacting with multiple blockchains.

The Radiant Capital Difference

Radiant is built on Layer 0 for cross-chain interoperability, with the V1 version taking advantage of Stargate’s stable router interface. Lenders wish to withdraw their collateral from this chain and easily transition to other chains.

Transaction fees: Built on arbitrum, transaction fees will be minimized, combined with Ethereum’s security and the adoption of a mechanism that allows the team to build an ecosystem that provides an opportunity for users to earn interest while maintaining high security.

Optimize user experience: Radiant removes middlemen from trading assets, futures, and savings accounts. Give users the most optimal experience.

Security: Radiant focuses on protecting core services against vulnerabilities, and the project has also spent more than $2 million on security audits conducted by Layer Zero and Stargate. The project itself is also audited by Solidity Finance and is undergoing a second audit by Peckshield.

The project is currently opening up about Radiant v2 on Discord, with v2 Radiant completely becoming a single cross-chain lending and borrowing system thanks to the support of LayerZero and BNB Chain. In addition, the majority of tokens are still with the team and VCs, so it is likely that the decision-making power will still be with the project team.

Basic information about RDNT tokens

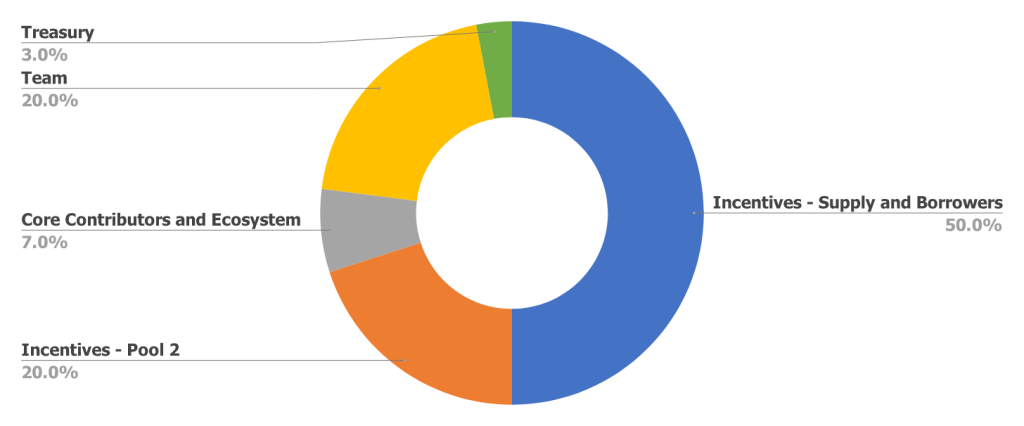

Tokenomic

- Token Name: Radiant Capital

- Horse: RDNT

- Blockchain: Arbitrum

- Token Contract: 0x0C4681e6C0235179ec3D4F4fc4DF3d14FDD96017

- Token classification: ERC – 20

- Total Supply: 1,000,000,000

Incentives – Supply and Borrowers: 50%

Core Contributors and Ecosystem: 7%

Incentives – Pool 2: 20%

Treasury: 3%

Core Team: 20%

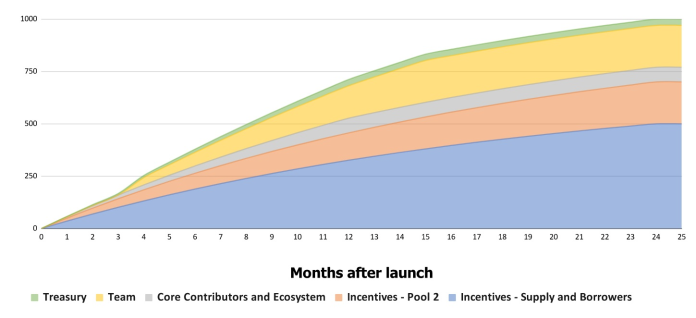

Token Realease

- 50% is issued as incentives for both borrowers and lenders: for a period of 2 years

- 20% is issued as incentives for Pool 2: for a period of 2 years

- For those who make significant contributions to the project, 7% will be paid in installments for 1 year.

- 20% for the core team with a 3-month lock period and installment payment for more than 1 year.

- 3% is reserved for Tresuary

Token Use Case

- Participate in DeFi: Liquidity Pool, Staking.

- Governance: Join Voting.

- Reward liquidity producers.

Investors

The project is developed, contributed, ignored by the community, so there will be no participation of VCs, so of course there will be no seed, private,…

Partner

Currently the project is in partnership with Layer Zero Labs and Chainlink. Besides, Radiant has been selected by Offchain Labs to list on Arbitrum’s official portal.

Contact

- Twitter: https://twitter.com/RDNTcapital

- Discord: https://discord.gg/radiantcapital

- Telegram: https://t.me/radiantcapitalofficial

- Youtube: https://www.youtube.com/c/RadiantCapital

- App: https://radiant.capital/

Summing up

Radiant Capital is a Defi project that simplifies borrowing or transferring assets across multiple chains in a simple way. This is a fairly potential project that can be followed in the near future. However, the project team and investors still do not have clear information, are still quite vague.

Through the above article, CryptoChill has helped you know about the Radiant Capital and the highlights of the project.

Disclaimer: This post is not investment advice. You will be 100% responsible for your investment decisions.

Please follow and subscribe to support the CryptoChill.news.

No Comment! Be the first one.