Ethereum’s Shapella update is complete, opening up new opportunities in the DeFi market. The concept of LSD (Liquid Staking Derivatives) that has been around for a long time is now gradually blooming into a new form: Liquid Staking Derivatives Finance (LSDfi). Prominent among them is Pendle Finance, a project that is receiving a lot of attention from the community.

So what makes the project stand out? Let’s find out more with CryptoChill.news!

What is Pendle?

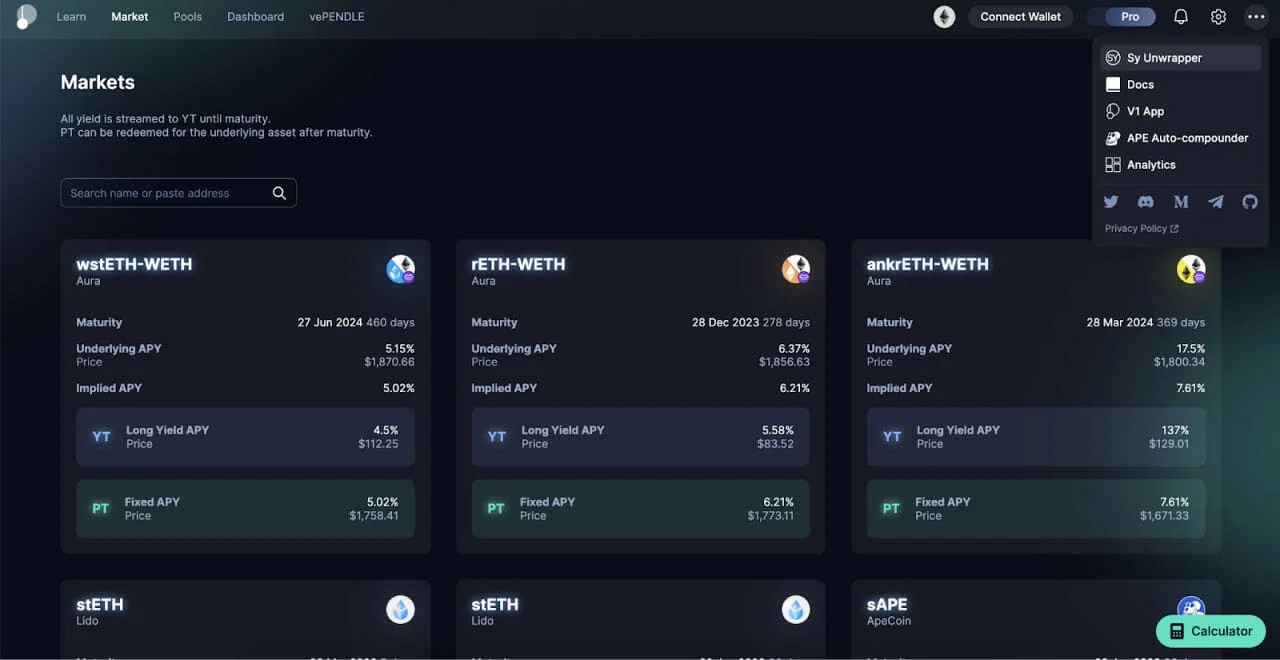

Pendle is a decentralized yield-trading protocol that allows users to make profits from staking and derivatives trading. The project has three main elements:

- Yield Tokenization

- Pendle AMM

- vePENDLE

With the project, users can always maximize their yields: increase the level of yield risk when markets are rising and hedge in falling markets.

Outstanding features of the project

As a combination of DeFi and Liquid Staking Derivative, or LSDfi, Pendle provides an opportunity for investors to increase their income thanks to the previous mechanism of using staking capital for derivatives.

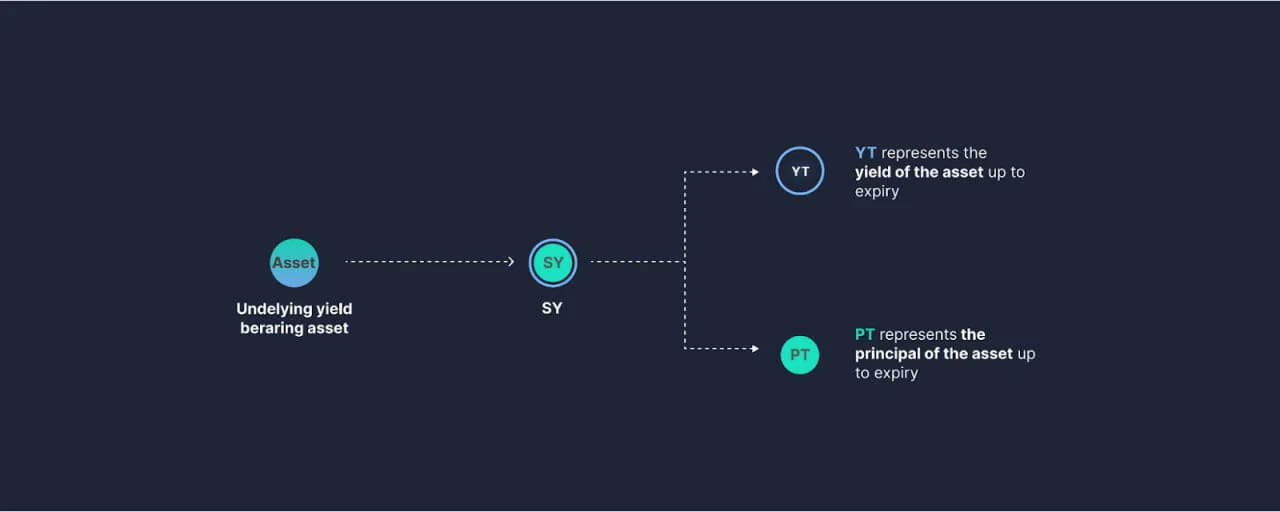

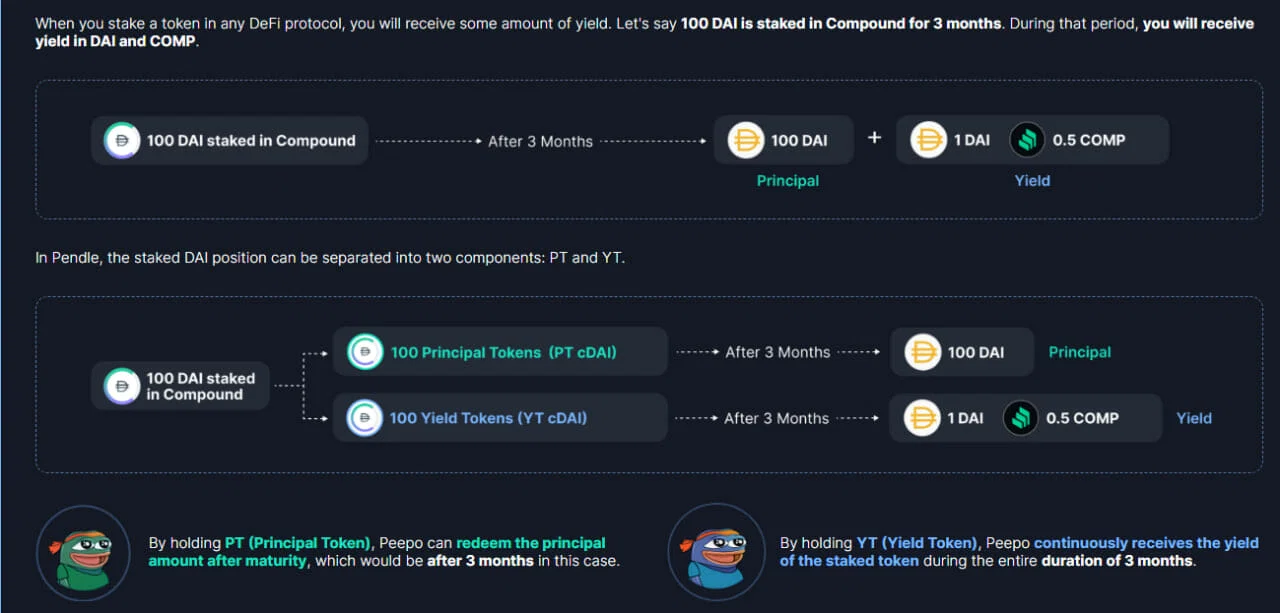

- Specific token: yield in the project uses up to 2 types of tokens: Principal Token (PT) and Yield Token (YT). PT represents the original amount of the native token, while YT represents all the profits of the native token.

For example, holding 1 YT-stETH allows users to receive all profits from that 1 ETH, while 1 PT-stETH will be converted into 1 stETH (= 1 ETH).

For example, normally, when staking 100 DAI in Compound for 3 months, users will receive a principal and yield of 1 DAI and 0.5 COMP. If Pendle pushes 100 DAI to Compound, 100 PT cDAI represents 100 DAI principal assets, and 100 YT cDAI represents yield after 3 months, which is 1 DAI + 0.5 COMP. By holding 100 YT cDAI, Users will continuously receive interest during that 3-month period.

- Automated Market Maker: The platform’s market maker is designed specifically for yields and leverages separate tokens (PT and YT). By concentrating liquidity in a narrow range, Pendle AMM increases capital efficiency as well as facilitates PT/YT swapping transactions in a single liquidity pool.

How does the project’s product work?

Yield Tokenization

SY is a token that standardizes wrapped tokens (stETH, cDAI, etc.) in smart contracts. Pendle interacts with SY as a proxy for all native tokens.

Users can use SY Unwrapper to convert SY tokens into old native tokens.

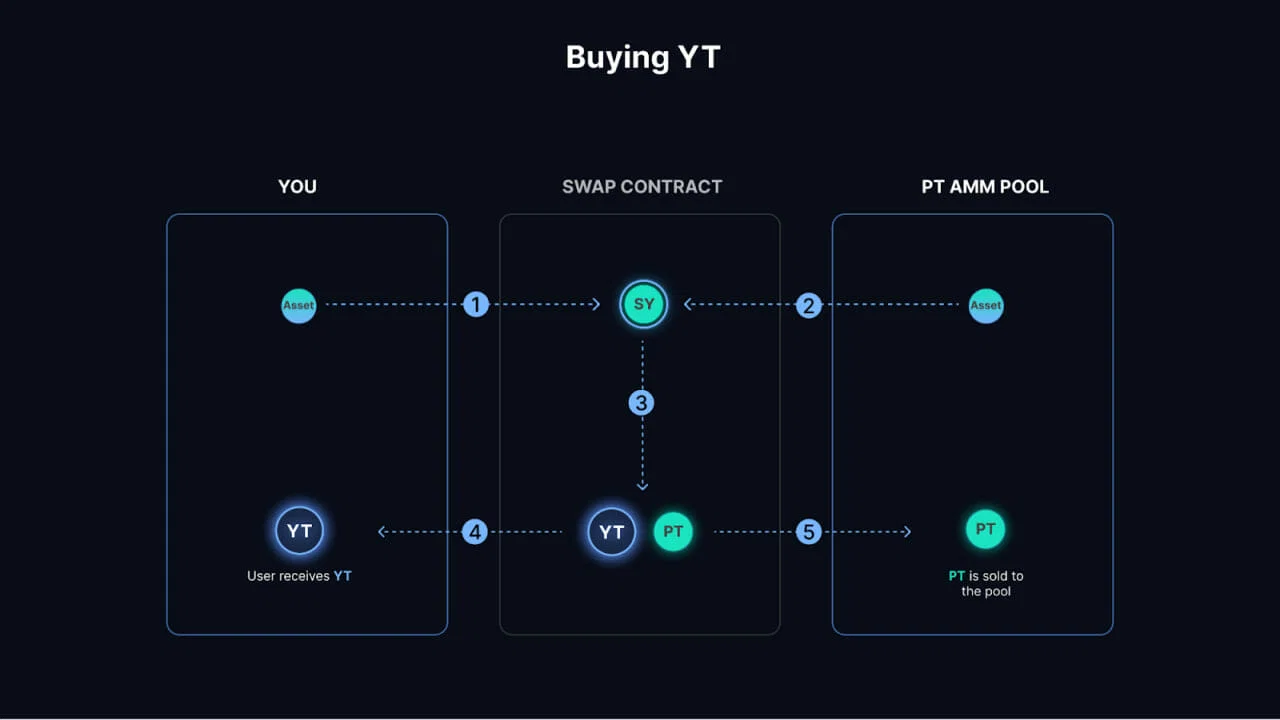

By depositing profitable assets like stETH into Pendle, users can participate in the PT and YT mint processes. Pendle will automatically convert the underlying asset, like ETH, into a profitable asset before PT and YT are even mint.

Example of Pendle working process: ETH stETH SY-stETH PT-stETH + YT-stETH

Pendle AMM

Pendle’s V2 AMM is designed specifically for yield trading by leveraging the versatility of PT and YT. Both of these tokens are tradable on the platform in a single liquidity pool. This will help users if they want to swap quickly.

vePENDLE

PENDLE token holders will be entitled to participate in voting (Vote Escrowed Token) for project governance.

Along with that, when locking vePENDLE, they will receive swap fees in the pool in which they vote. This has an advantage: the more votes the pool gets, the better the person locking it in will receive a better fee.

In addition, vePENDLE also acts as an anti-inflation tool based on its ability to reduce pendle supply, thereby stabilizing Pendle Finance’s financial ecosystem.

Similar projects

Some projects can be mentioned as Convex, Aura, StakeDAO, etc.

Token Overview

Token Metrics

- Token name: Pendle Finance

- Ticker: PENDLE

- Blockchain: Ethereum

- Token Standard: ERC-20

- Contract: 0x808507121b80c02388fad14726482e061b8da827

- Token Type: Utility, Governance

- Total Supply: 235,890,444 PENDLE

- Circulating Supply: 96,950,723 PENDLE

Allocation of tokens

- Incentive: 10%

- Ecosystem Fund: 19.2%

- Circulating: 65.1%

- Team 5.7%

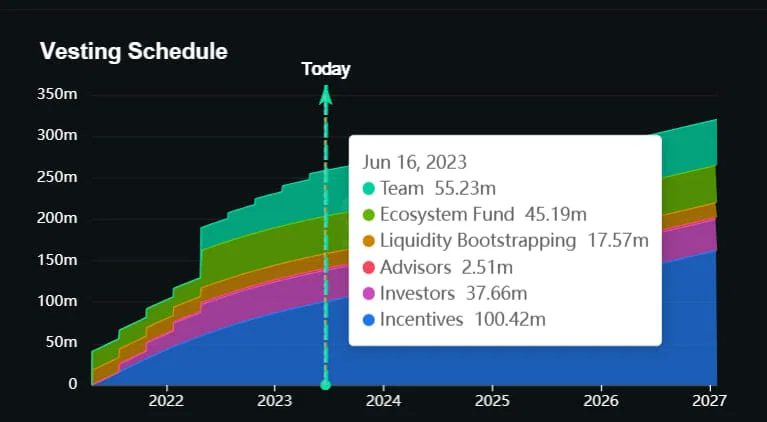

The amount of tokens set aside for incentivizing pool voting on October 10 was 2022,667 per week, which will decrease by 705.1% per week until April 1.

Token circulation schedule

Tokens for the team will be open until April 4. At the moment, the token is experiencing an end-of-period inflation rate of 2023% per year.

Token utilities

PENDLE holders will enjoy three benefits: staking, providing liquidity to the pool, and voting on project governance.

PENDLE Storage and Exchange Wallets

Storage wallets:

- Metamask

- …

$PENDLE Exchanges

- Gate.io

- Bitget

- MEXC Global

- …

Roadmap

Updating…

Project Team

Updating…

Investors and partners

Investors

Pendle Finance has a funding round worth $1.3 million in seven, including names like Hashkey Capital, Crypto.com Capital, and Mechanism Capital.

Partner

Updating…

Judge

Pendle Finance has recently been mentioned a lot as a leader in the LSDfi trend thanks to its promising market-making mechanism using specialized tokens.

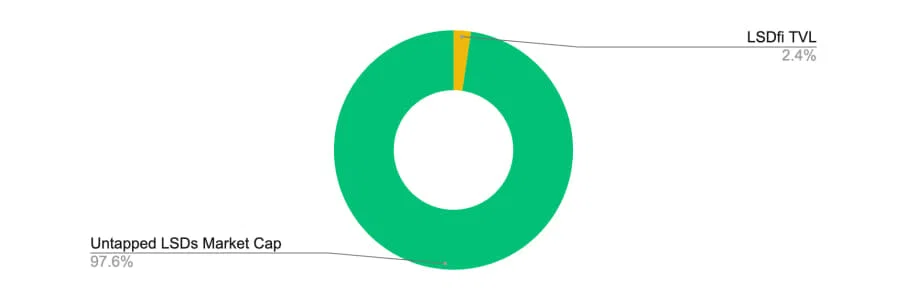

According to Binance Research, LSDfi protocols have seen growth in TVL over the past few months due to post-Ethereum fork benefits. From the start of 2023, Pendle’s TVL on DeFiLlama is up more than 600% while the token’s total capitalization is relatively stable, which indicates a high probability of “pumping” in the future.

However, the scale of the project is still relatively small in the market, ranking 5th among yield dApps on the market. Meanwhile, Binance Research has pointed out that the LSDfi market accounts for only a fraction of the entire LSD giant. In addition, Pendle has not experienced the next major fundraising event while only raising a total of $3.7 million.

According to the project’s vesting schedule, there will be no remaining token unlocking for teams, investors, or any other party until 2027. Therefore, it is still necessary to more closely monitor the on-chain activities of the project to choose the appropriate investment point.

Contact

Website: https://www.pendle.finance/

Twitter: https://twitter.com/pendle_fi

Docs: https://docs.pendle.finance

Summing up

Through the above article, CryptoChill has helped you know about Pendle Finance and the highlights of the project.

Disclaimer: This post is not investment advice. You will be 100% responsible for your investment decisions.

Please follow and subscribe to support the CryptoChill.news.

No Comment! Be the first one.