What is Magpie Protocol?

Magpie Protocol is a decentralized liquidity aggregation protocol for cross-chain swaps. It offers the best trading for any asset, on top blockchains, without connecting any assets.

The end result is an extremely fast and gas-efficient solution to cross-chain swaps. At launch, Magpie supported Ethereum, Polygon, Avalanche, and BSC. Then more strings will be gradually added.

What is special about Magpie Protocol?

Magpie is resolving two crucial DeFi issues: connectivity and liquidity.

Magpie focuses on speed, security, usability, gas fees, user experience, and aggregation in these two areas.

How does Magpie solve the problem?

Magpie Protocol addresses the aforementioned issues by enabling cross-chain swaps without bridging. Magpie’s new architecture primarily employs bridges as the data transfer layer for inter-chain swap signals. The outcome is a highly efficient and secure solution for cross-chain swaps.

Instead of requiring users to lock or burn tokens and then mint them on the target chain, Magpie uses the stablecoin liquidity pool and Magpie liquidity aggregation protocol, which are implemented on all of the most popular chains, to initiate token swaps.

This results in users receiving their tokens very quickly and using significantly less gas, including but not limited to swapping stablecoins or native gas tokens of the chain, and all of which use a super-smooth user interface in which users do not need to use any other dapps.

Unique Aspects of the Magpie Protocol

Magpie is comparable to the liquidity aggregation protocol and the cross-chain swap protocols 0x, Paraswap, and 1inch; however, Magpie has more advantages. One of the major advantages of Magpie is that when users cross-chain swap, they do not have to go to the appropriate bridge and spend between 15 pence and three hours transferring their tokens to the new chain before beginning swaps on the new chain.

According to tests, Magpie’s unique liquidity aggregator consistently outperforms 0x and provides competitive pricing with 1 inch. However, with the added benefit of cross-chain, it is incredibly easy without the need to connect your assets. Since Magpie does not manufacture bridges, smart contract bridges are much safer than other bridges because they do not store exploitable assets.

FLY Tokenomics

Key Metrics

- Ticker: FLY.

- Blockchain: Updating…

- Contract: Updating…

- Token Standard: Updating…

- Token Type: Utility, Governance.

- Circulating Supply: Updating…

- Total Supply: Updating…

Token Use Case

FLY will serve as both a governance and liquidity token. Fees will be redistributed among liquidity providers, FLY investors, and operating funds.

FLY token storage wallet

Can be stored on Coin98 Wallet.

Magpie Protocol Team

Magpie is a group of over fifteen crypto enthusiasts with a passion for making DeFi accessible, efficient, and enjoyable.

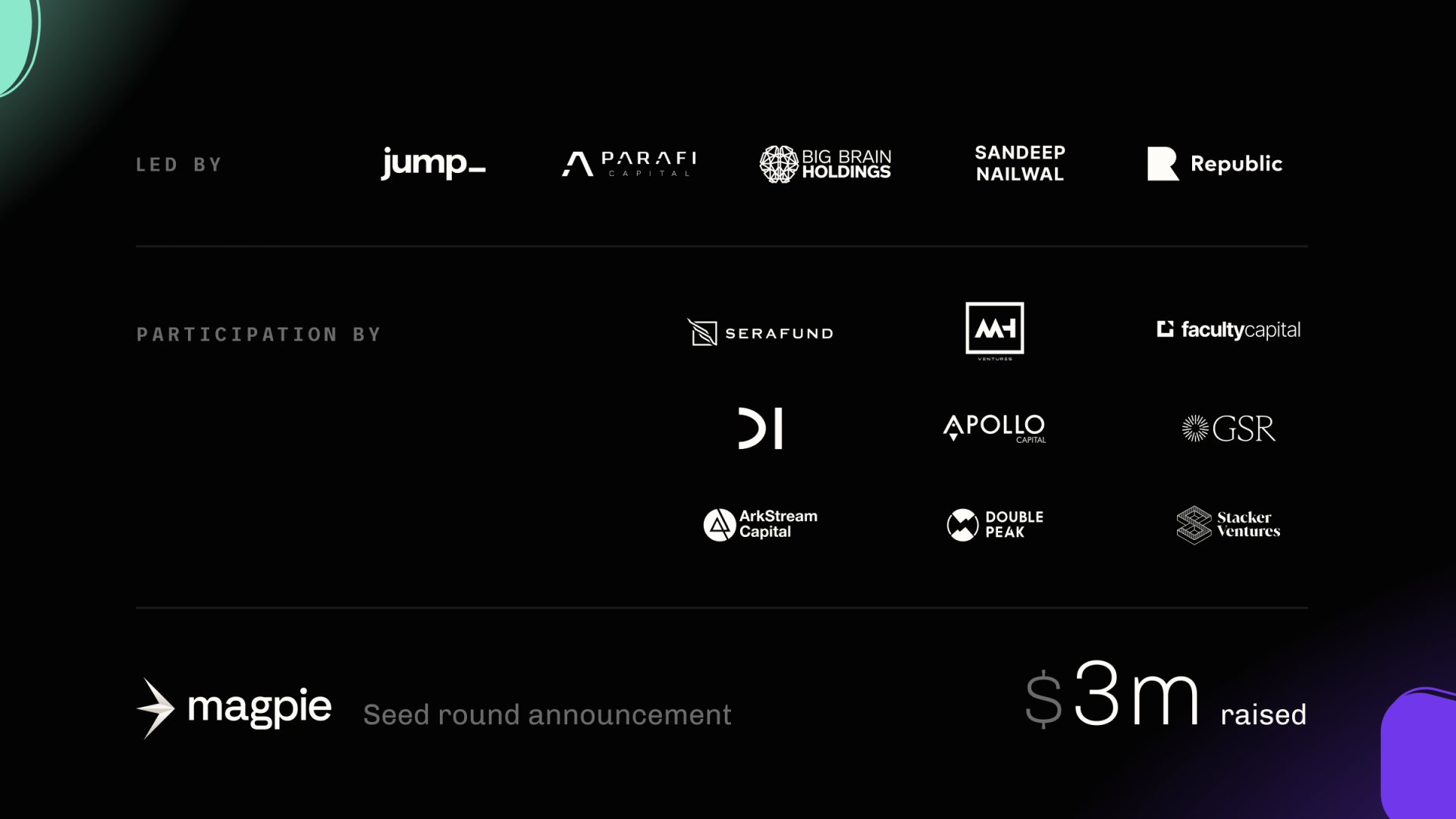

Investor & Partner

Magpie Protocol raised $3 million in a seed round led by Jump Crypto and backed by prominent investors including Sandeep Nailwal, GSR Markets, Parafi Capital, Republic Capital, Big Brain Holdings, Serafund, MH Ventures, D1 Ventures, Arkstream, Apollo Capital, and others.

External links

Contact

Website: https://www.magpiefi.xyz/

Twitter: https://twitter.com/magpieprotocol

Medium: https://medium.com/@Magpieprotocol

Discord: https://discord.com/invite/CwJuFeHp6f

Telegram: https://t.me/magpieprotocol

Summing up

Through the above article, CryptoChill has helped you know about the Magpie Protocol and the highlights of the project.

Disclaimer: This post is not investment advice. You will be 100% responsible for your investment decisions.

Please follow and subscribe to support the CryptoChill.news.

No Comment! Be the first one.