Options Trading is a new and potential segment in Defi, currently there are many projects urgently building and competing to lead this segment. One of them is Lyra Finance. In this article, let’s find out what Lyra is and the investment potential of this project.

What is Lyra?

Lyra is a decentralized project that develops according to the Options Trading trend that operates on the Ethereum Blockchain network. The project is designed according to the AMM model. Lyra’s core mission is to increase the scalability of the Ethereum Layer. Thereby, users’ transactions are processed in a timely, efficient, powerful and secure manner.

Lyra is a decentralized project that develops according to the Options Trading trend that operates on the Ethereum Blockchain network. The project is designed according to the AMM model. Lyra’s core mission is to increase the scalability of the Ethereum Layer. Thereby, users’ transactions are processed in a timely, efficient, powerful and secure manner.

Some outstanding features of Lyra

Low transaction fees

In fact, the transaction fee on the Ethereum Layer 1 network is extremely expensive. This is considered the biggest concern of investors when participating in trading on these platforms.

To overcome this situation, the Lyra development team deployed its platform on Optimism – a fairly popular Layer 2 at the moment. The platform inherits the Rollups security feature of the traditional Ethereum network. At the same time, Lyra also optimizes the user’s transaction process, saving time and cutting transaction fees significantly.

Speed “lightning fast”

As mentioned, Lyra’s transaction processing times are optimized to the fullest extent. Many experts say that Lyra has a “lightning-fast” execution speed, helping users save a lot of time. Each user’s transaction will be confirmed in just a few seconds. In particular, users are allowed to access Layer 2’s extended features through Lyra.

Safe, reliable

To conquer and strengthen the trust of the user community, Lyra has participated in audits conducted by reputable units. Some of the world’s leading attestation companies have participated in the audit of the feature, solution provided by Lyra. Therefore, you can be completely assured when participating in transactions, making profits on the Lyra ecosystem.

Intuitive UX

One of the biggest plus points of Lyra is the design of an intuitive, beautiful interface that is suitable for all users. Lyra uses the main color tones: blue, black and white, making the interface more attractive.

In addition, the features on Project are also very easy to manipulate and use. The platform also provides detailed and specific usage instructions. So, no matter what level you are at, you can easily participate in activities on Lyra.

Risk management system

No one can deny the riskiness of the cryptocurrency market. Many platforms have left customers “empty” because of a little volatility in the market or attacks from cybercriminals. However, Lyra has overcome this limitation by establishing an extremely effective risk management system.

Through Synthetix, Projectprovides LPs with hedging insurance. This means that when something goes wrong, users can still preserve their money thanks to Lyra’s insurance.

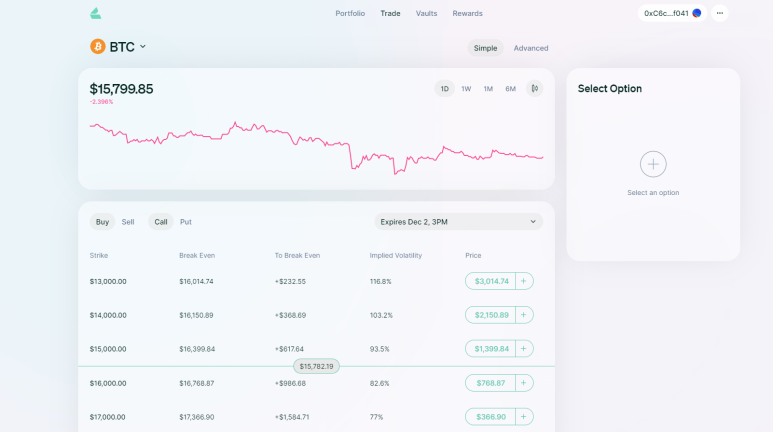

Sell options, earn yield

This is the core feature and also the top goal of Project. Options or options allow the user to hold the right to buy or sell a particular asset at a specified price within a certain period of time.

Similar to other Options projects, Project offers 2 types of Options: call (call) and put (put). In which, call allows the holder to fix the price to buy token, and put is the tool to fix the selling price. You can buy orders thinking that the token will increase and vice versa.

Options will have different strike prices and durations. As a result, traders can reduce the risk when choosing the right option. As mentioned, the Options are finite. That is, they only last for a certain amount of time. After that period, the holder cannot buy or sell the asset at a “bargain” price. Therefore, you need to consider and choose wisely.

What is LYRA coin?

LYRA coin is a native token issued by Lyra Protocol. The main task of LIRA coin is to support holders to participate in voting for project proposals. Besides, Lyra is also a factor attracting users to participate in the ecosystem, creating the best environment for Options Trading. Finally, the LIRA coin can be used as collateral, helping users to earn more profit.

Key Metrics

- Token Name: Lyra Finance.

Ticker: LYRA. - Blockchain: Ethereum.

- Token Standard: ERC-20.

- Token Type: Governance, Utility.

- Contracts: 0x01ba67aac7f75f647d94220cc98fb30fcc5105bf

- Total Supply: 1,000,000,000.

- Circulating Supply: Updating…

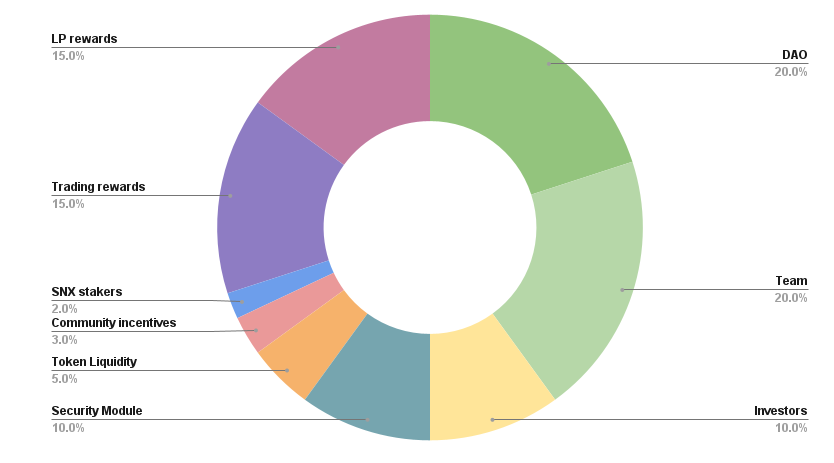

Allocation

- DAO: 20%.

- Team: 20%.

- LP Rewards: 15%.

- Trading Rewards: 15%.

- Security Module: 10%.

- Investor: 10%.

- Token liquidity: 5%.

- Community Incentives: 3%.

- SNX Stakers: 2%.

Release Schedule

- Pre-seed: February 2021 sold 34,000,000 or 3.4% of total supply at $0.0015/token.

- Seed: May 2021 sell 66,000,000 or 6.6% of total supply at $0.05/token.

- OTC: September 2021 sold 5,000,000 equivalent to 0.5% of total supply at $0.10/token.

All private investor tokens will be locked until January 1, 2022 and then linearly over two years. The last tokens will be unlocked on January 1, 2024.

Roadmap

- March 2021: Deploy the project mechanism.

- April 2021: The project is technically completed.

- May 2021: The project completed the Audit.

- June 2021: Launched project testnet.

- July 2021: The project launches Trading Competition feature.

- Q3 2021: Launched project Mainnet.

Team, Investor & Partner

Team

Nick Forster | Co-Founder: Nick has over 3 years of experience working as an options trader at SIG a market maker in derivatives trading.

Timothy Gorham | Mechanism Contributor: Timothy used to have 16 years of experience as CEO at Consolidated Trading, a Market Maker company in the Options field. After retiring, he became the founder of 2142 Ventures fund and an investor at M1 Finance fund (the fund was invested $ 150M by Soft Bank in series E).

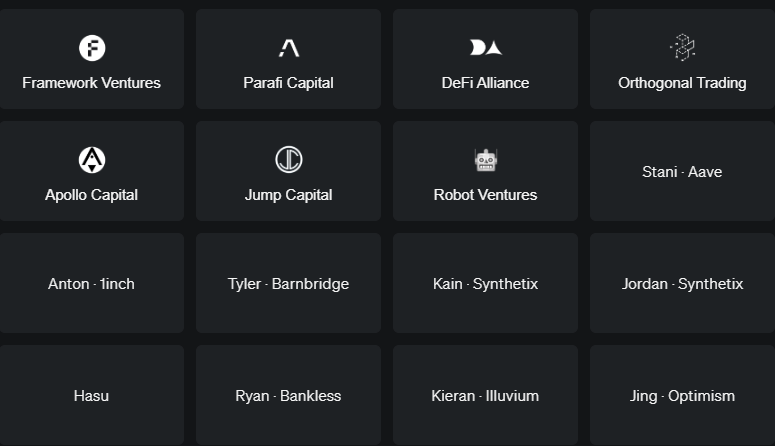

Investor

The Lyra project has raised $3.3 million from major investors such as: Parafi Capital, DeFi Alliance, Framework Ventures, etc. Besides, the project also received support from individuals, such as: : Tyler (Barnbridge), Jordan (Synthetix), Stani (Aave),…

Partner

Lyra’s biggest partner is Synthetix.

Where to buy and sell LIRA coin?

You can find and own LYRA coin at some exchanges such as:

- UniSwap: https://uniswap.org/

- BKEX: https://www.bkex.com/

- SushiSwap: https://www.sushi.com/

You can follow Lyra’s information live at:

- Website: https://www.lyra.finance/#home

- Discord: https://discord.com/invite/P49mj6UbmC

- Twitter: https://twitter.com/lyrafinance

- Snapshot: https://snapshot.org/#/lyra.eth

Final thoughts

Lyra is not the first Options Trading project. However, this is a pioneer project in pricing all Options using the Black Scholes model. In addition, Lyra also has the ability to automate pricing and hedging for LPs. These are considered the things that make the difference between Lyra and other Options Trading platforms.

Through the article, CryptoChill believes that you have a better understanding of Lyra as well as the Lyra coin. We hope you will soon make the most accurate and optimal investment decisions! Good luck!

No Comment! Be the first one.