LSDfi is becoming a relatively popular topic of interest thanks to its superior profitability compared to other fields. Lybra Finance’s V2 update has just been completed to stay ahead of this trend.

Let’s find out with Cryptochill what is outstanding about the project!

What is Lybra Finance?

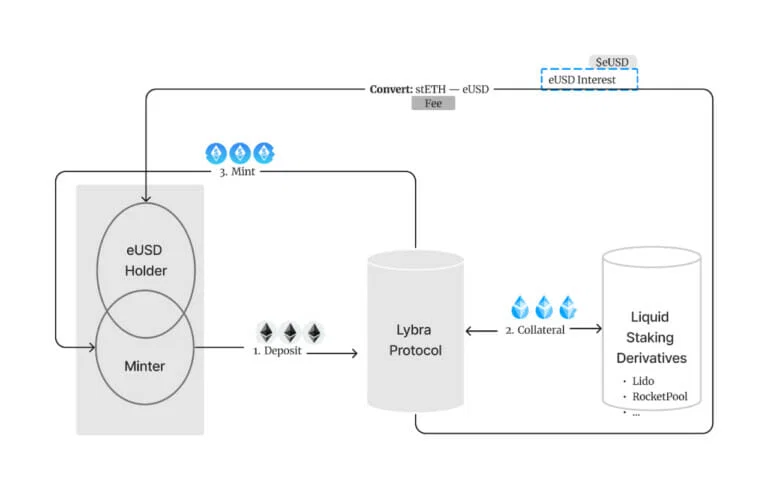

The Lybra protocol is an advanced DeFi platform on the Ethereum network that allows users to deposit ETH and create eUSD stablecoins without paying any fees or interest. Built on LSD (Liquid Staking Derivatives), the protocol initially leverages the Proof-of-Stake ETH issued by Lido Finance and stETH as its main component, with plans to support additional LSD assets in the future.

The project offers an interest-bearing stablecoin (self-yielding token) called eUSD to ensure security and stability.

On Lybra Finance, users can participate in a variety of roles, including miners, Holders, Liquidators, Redemption Providers, Keepers, and others.

The project’s token is the LBR.

Outstanding features of the project

eUSD: This is a stablecoin pegged to the price of USD and backed by an overcollateralization of ETH. Users who simply hold eUSD will generate a steady income with an APY of approximately 8%. Thanks to its low volatility and stable interest income, eUSD is resistant to inflation that negatively affects users.

Specifically, ETH will automatically be converted into STETH via Lybra. stETH will continue to increase over time, and the amount of profit stETH converts to eUSD is based on the USD value of ETH at that time, with a base APY of around 8%.

Example:

Alice deposits $135,000,000 ETH and mints 80,000,000 eUSD.

Bob deposits $15,000,000 ETH and mints 7,500,000 eUSD.

Total current eUSD = 80,000,000 + 7,500,000 = 87,500,000

Current collateral = $135,000,000 + $15,000,000 = $150,000,000 STETH

One year later,

LSD Income = $150,000,000 * 5% = $7,500,000 STETH

Bob uses his 7,500,000 eUSD holdings to buy rising stETH.

Service fee for the last 1 year = circulation eUSD (i.e., 87,500,000) * 1.5% = 1,312,500 eUSD

7,500,000 eUSD Dividend: 1,312,500 eUSD = 6,187,500 eUSD is distributed among all eUSD holders (Alice and Bob).

Mechanism of action

Minting

Lybra Finance offers negative-interest loans. The protocol allows borrowing eUSD using ETH as collateral. The project’s requirement is to oblige users to ensure that their collateral ratio is higher than the safe collateral ratio of 160%.

As long as users maintain a collateral ratio of at least 150%, they are allowed to continue lending and repaying at any time.

Let’s say ETH is priced at $2,000 and you deposit about 10 ETH into Lybra. If the mint (borrowed) 10,000 eUSD, then the minimum mortgage rate will be 10,000*150% = 15,000 USD, which is equivalent to 7.5 ETH.

Rigid redemption

This is the process of exchanging the eUSD peg for USD for ETH.

Users can exchange their eUSD for ETH at any time without restrictions. However, a flat conversion fee of 0.5% is charged on top of the conversion amount, and this fee is paid in full to the conversion provider.

For example, if the current conversion fee is 0.5%, the price of ETH is $1,500, and you convert 1,200 eUSD, you will receive 0.796 ETH (0.8 ETH minus 0.004 ETH conversion fee).

Liquidation

If the mortgage rate falls below 150%, the collateral will be liquidated to secure the eUSD stablecoin backed by the collateral.

Token Overview

Token Metrics

- Token name: Lybra

- Ticker: LBR

- Blockchain: Ethereum

- Token Standard: ERC-20

- Contract: 0xc98835e792553e505ae46e73a6fd27a23985acca

- Token Type: Utility, Governance

- Total supply: 100,000,000 LBR

- Circulating supply: 9,737,911 LBR

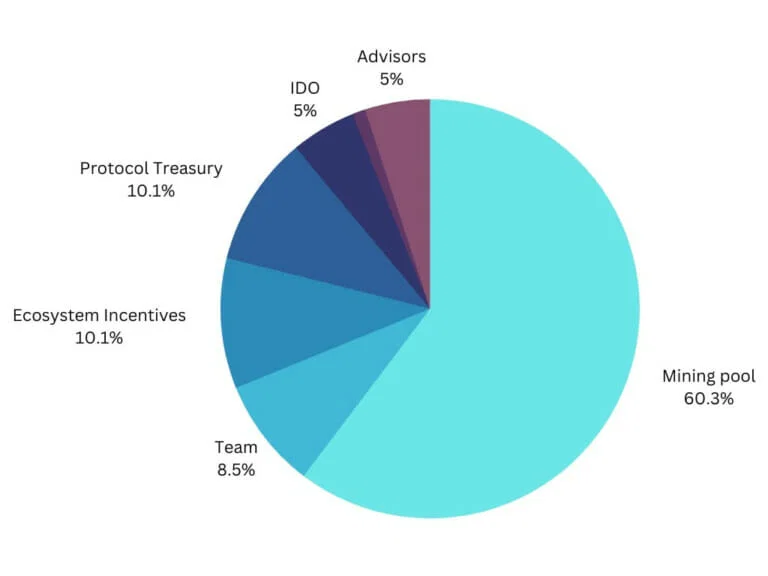

Allocation of tokens

- Advisors: 5%

- IDO: 5%

- Protocol Treasury: 10.1%

- Ecosystem Incentives: 10.1%

- Team: 8.5%

- Mining pool: 60.3%

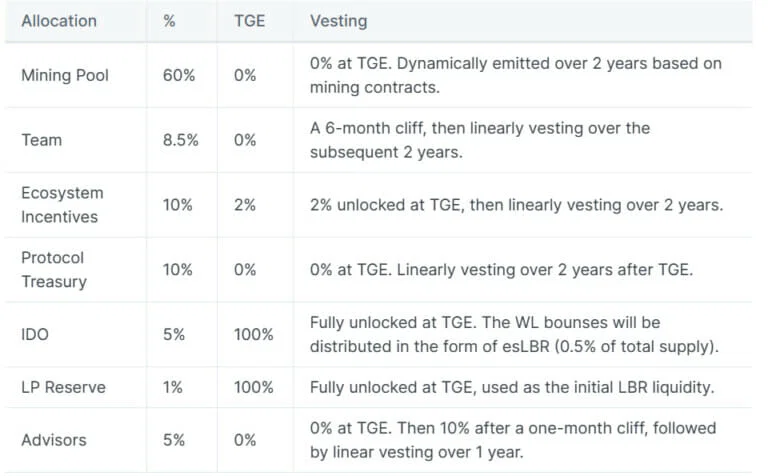

Token circulation schedule

Token utilities

The LBR token is used in the following roles:

- Voting and platform administration

- Awards

- Deal

- Provide liquidity

LBR Storage and Exchange Wallets

Storage wallets:

Updating…

$LBR Exchanges

Currently, you can trade LBR on CEX exchanges such as Kucoin, BingX, and the Uniswap v3 Ethereum network!

Roadmap

In Q2 2023, Lybra completed the LBR Public Sale, deployed on Ethereum in cooperation with auditors.

Entering Q3 2023, the project has completed Multi-Sig Safe and is aiming for the following goals:

- LayerZero

- Live on Arbitrum

- Finalize the loan protocol.

- Omnichain

- DAO and DeFi development

Project Team

Updating…

Investors and partners

Investors

Updating…

Partner

Updating…

Frequently Asked Questions

How do I become a Liquidator?

You can do this by simply activating the Liquidator Feature, which can be deactivated at any time to stop the automatic liquidation process. By enabling the liquidation feature, you can earn an additional 9% spread profit whenever the eUSD balance in your account is automatically converted into more stETH through liquidation.

Judge

With the release of Lybra V2, the project’s tokenomics are expected to see some changes to the token burn mechanism and an update to mining. As a result, the economy of the platform will be more stable.

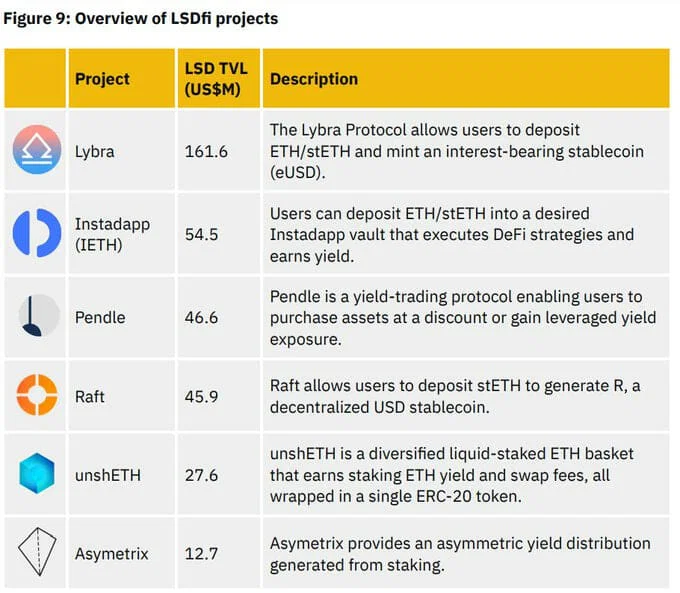

Among LSDfi platforms, Lybra is leading the way in TVL with $161.6 million, according to Binance Research (this has jumped to $284 million at the time of writing).

Meanwhile, the ATH of the LBR token also just reached ATH on May 29. With the market recovering as BTC surpassed the 05k mark, the community is waiting for the flow of money to altcoins. This is also an opportunity for the Lybra Finance home token to break the old peak.

With the new Pendle project listed on Binance amid the MAV Launchpool not yet finished, is this a signal that CZ wants to bullish a trend like LSDfi?

Another point that helps the project have a lot of growth potential is that the current circulating supply is only 9,737,911 LBR (accounting for 9.7% of the total supply), proving that MM can easily collect and push up prices. However, the most important is still the entry point for the brothers. When the trend is too clear, it is also risky for FOMO investors to buy.

Personally, a market correction when people have stopped FOMO will make it more reasonable to hunt for LSDfi pieces like this.

In addition, you also need to pay attention to whether $LBR tokens are constantly unlocked from Mining Pool, Team, Advisor to make short-term or long-term investment decisions!

Summing up

Through the above article, CryptoChill has helped you know about the project.

Disclaimer: This post is not investment advice. You will be 100% responsible for your investment decisions.

Please follow and subscribe to support the CryptoChill.news.

No Comment! Be the first one.