Introduction

The long-awaited upgrade to ETH 2.0 has resolved a significant number of Ethereum’s ongoing issues. However, Eth2 is still in its infancy and faces a number of obstacles. To become full validators, for instance, users must stake multiples of 32 ETH. In addition, any staked ETH is locked and cannot be utilized elsewhere for the term stated.

Through noncustodial staking, Lido DAO intends to alleviate issues with Ethereum 2.0. Since its introduction in December 2020, the liquid staking method has demonstrated significant promise. With its derivative token, stETH, Lido DAO enables ETH frozen during its genesis phase to be staked in other protocols. The Lido DAO network dominates the ETH 2.0 staking market with a market share of over 80%, and its native token, LDO, is performing well with consistent gains (green candlesticks) on its chart. Within a year, the price of LDO has increased by more than 1,200%, from its beginning price of about $1.50 to its all-time high of $18.62.

What Is Lido DAO?

Lido DAO (decentralized autonomous organization) is an ETH 2.0 solution for liquid staking. Since the initial staking of Eth2’s Beacon Chain locks the funds, Lido DAO permits the assets to be liquefied and utilized for other protocols. Receiving liquid tokens in exchange for depositing tokens is referred as as liquid staking. It is possible to stake various blockchain systems with liquid tokens.

A DAO governs Lido, which was founded in December 2020, a few weeks after the launch of ETH 2.0. P2P Capital, KR1, and Semantic Ventures are essential Lido DAO members. In addition, it is supported by notable investors such as Kain Warwick, Banteg, and Julien Bouteloup.

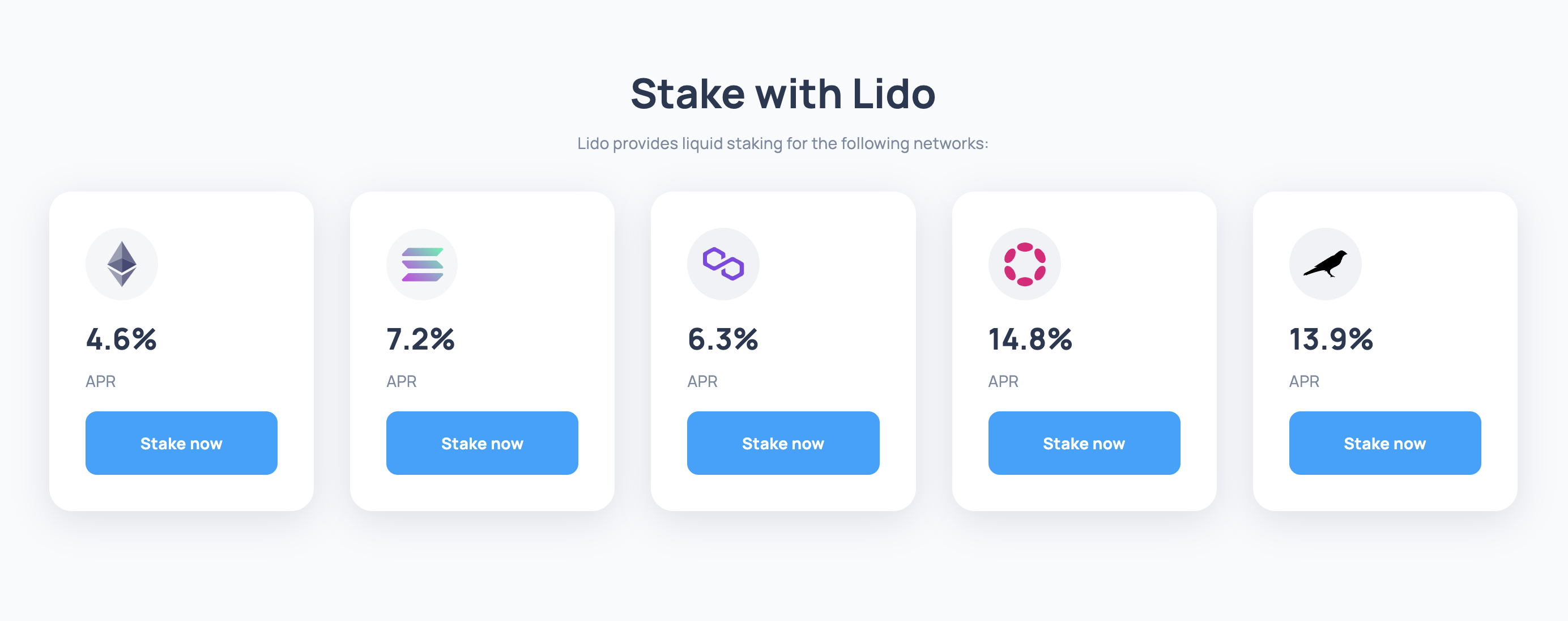

Within a year of its creation, Lido DAO has become one of the most popular platforms for liquid staking, with over $13 billion in staked assets. Initially designed with Ethereum in mind, Lido is now extending to other blockchain networks such as Terra and Solana. Terra and Solana were staked in March and September of 2021, respectively.

Another appealing component of Lido DAO is its decentralized nature (unlike most other liquid staking platforms). Lido also offers a high annual percentage rate (APR) for staking Ethereum, Terra, and Solana of 4.8%, 8.1%, and 6.6%, respectively.

What Is LDO?

LDO is the governance token for the Lido DAO, which allows the staking platform’s objective of constructing a trustless liquid staking service. It drives the decentralized ownership and decision-making of Lido’s autonomous structure, with governance decisions in the Lido DAO community based on LDO.

LDO holders are permitted to vote on all decisions affecting the future of the platform. This affords everyone a voice, hence preserving decentralization.

Beginning in December 2020, LDO tokens were completely unavailable for an entire year. Between December 2020 and December 2021, they could only be used for governance and could not be transferred. They were freed and made available for per-block mobility beginning in December 2021.

What Is LDO Used For?

LDO primarily offers members of the Lido community with governance rights. Every LDO holder has the right to vote in all decision-making processes, with the quantity of LDO staked determining their voting power.

In addition to assisting with the control of fee settings, LDO tokens can be used to add or remove any network node.

How Does the Lido DAO Platform Work?

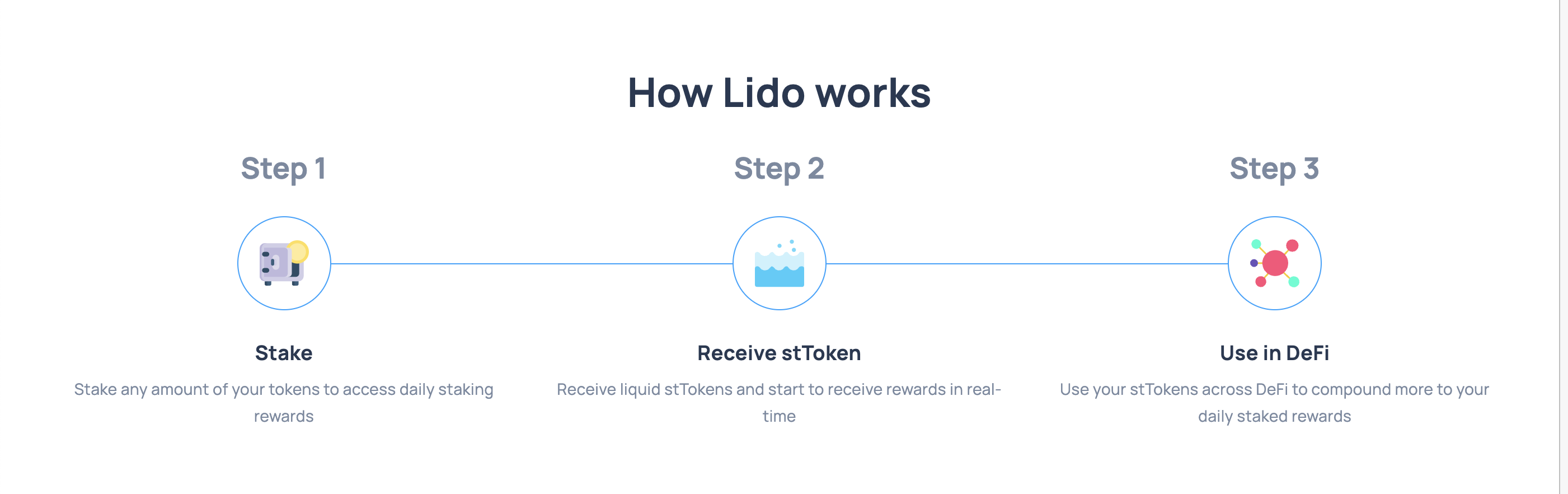

Liquid staking on the Lido DAO platform may be broken down into three primary steps: staking, minting, and DeFi.

- Staking: Users can select any amount to stake in ETH. Lido receives the amount of ETH selected by the users.

- Minting: In return for ETH, Lido returns minted or Lido-native liquid representatives of ERC20 coin (stETH). The value of coins returned is in a 1:1 proportion with the actual amount of ETH staked by users.

- DeFi: stETH tokens can be used across the DeFi ecosystem to yield more, thus eliminating the need to lock up multiples of 32 ETH in Eth2 to acquire rewards.

The Lido DAO platform enables users to stake as much (or as little) ETH on the Beacon Chain as they choose, without locking them, for a 10% fee.

Key Features of Lido DAO

The key features of Lido DAO are as follows.

Staking Platform

The Lido staking platform enables users to link a cryptocurrency wallet and stake any amount of ETH. As previously stated, the exchange rate between ETH and stETH is 1:1, with a transaction charge of $38.40 and a 10% reward fee removed from the total amount of rewards.

Curve

Curve is a liquidity pool for stablecoin trading on Ethereum that enables the acquisition and use of stETH.

MakerDAO

The MakerDAO platform enables users to link a cryptocurrency wallet and use stETH tokens as loan collateral.

Lido Referral Program

A referrer can earn 1% of the total ETH staked through their link in LDO tokens through this scheme. Lido DAO has implemented a whitelist option for referral programs, which means that only Lido-approved partners will earn incentives.

LDO Tokenomics

At the time of writing, the current LDO token price is $2.95, with a 24-hour high of $2.99 and a 24-hour low of $2.69. With a current market capitalization of roughly $69 million, LDO’s 24-hour trading volume is close to $4 million. More than 24 million LDO out of a total supply of 1 billion are currently in circulation.

In its first year on the crypto market, despite being a newcomer, the LDO coin reached an all-time high of $18.62. In August 2021, it reaches a peak of almost $7 on the chart.

Recent LCO price fluctuation. Bybit was the source.

Presently, just 0.4% of LDO tokens are allocated via airdrops to early adopters (i.e. holders and stakers of stETH, and users who exchanged stETH:ETH and yvsteth for Uniswap LP tokens before 28 December 2020). The original members hold 64% of the tokens, which are locked for one year and then vest. The total quantity of LDO tokens is distributed to the following Lido DAO community segments:

- DAO Treasury: 36.32%

- Initial Lido Developers: 20%

- Investors: 22.18%

- Founders and Future Employees: 15%

- Validators and Signature Holders: 6.5%

Pros and Cons of Lido DAO

Like any other protocol, Lido DAO has its pros and cons.

Pros

Decentralized

In contrast to the majority of other liquid staking platforms, Lido DAO is entirely decentralized. Whoever owns LDO has the opportunity to vote on Lido’s future.

Flexibility with Staking

The platform of Lido DAO permits any amount of Ethereum 2.0, Terra, or Solana to be staked and withdrawn. Users are not required to stake multiples of 32 ETH, in contrast to the ETH 2.0 Beacon Chain.

Cons

Expensive

As a MiniMe ERC20 token, LDO has a higher transfer fee than the majority of other ERC20 tokens. Lido must review its balance history to verify the vote-transfer-vote exploit is not in play, as it increases the total cost.

Associated Risks

Although Lido DAO is a secure platform, it does present possible security threats. First, the Lido code is open-source and may therefore contain exploitable smart contract flaws.

Lido is built on Eth2, which is still in development. Therefore, if any problems are discovered on ETH 2.0, they could have an effect on Lido DAO. Lido also faces acceptance risks: if ETH 2.0 is not accepted by consumers at the projected rate, ETH and stETH prices could fluctuate significantly.

Is Lido DAO (LDO) a Good Investment?

The Lido DAO (LDO) token has had a recent downward trend. After reaching $7 in August 2021, the current price of the coin is $2.75. Despite the fact that the price of LDO is directly dependent on the acceptance of ETH 2.0, experts predict that LDO will enjoy a positive market over the next several years owing to Ethereum’s domination on the crypto market, as Ethereum is Bitcoin’s only long-standing opponent.

According to WalletInvestor, LDO coin is an excellent short- and long-term investment that could shortly surpass $6 and $21 by 2026, yielding a return of about 700%. DigitalCoin forecasts that the price of the coin will surpass $4 this year and $11 by 2028.

The price of LDO tokens is anticipated to hit new heights as more users use ETH 2.0 following the conclusion of active testing. In the next months, a greater number of investors will likely incorporate LDO into their portfolios.

How Does Lido Pay Out?

Lido invests the assets of consumers in Ethereum 2.0. All user deposits are refunded in the form of stETH, the native asset of the Lido platform. Lido pools the actual ETH deposits and stakes them through a trusted collection of node operators on ETH 2.0. Consequently, Lido earns payments from Ethereum for staking, which are then dispersed to investors.

Lido also pays out through a referral program: each referrer receives 1% of the total ETH staked via their referral link as stETH. It is important to note, however, that the referral scheme is currently restricted to a small number of whitelist partners approved by the Lido DAO community.

Is Lido Secure?

Existing and potential Lido investors have one pressing concern: Is Lido secure? There are numerous dangers related with Lido DAO, including smart contract issues, adoption risks, and technological concerns. Nonetheless, it is regarded as one of the most safe wagering platforms for convincing reasons:

- Continuous analysis of all codes

- Top-notch validators to minimize risks

- Noncustodial staking to mitigate counterparty issues

- DAO governance to eliminate risk factors

Contact

Website: https://lido.fi/

Whitepaper: https://docs.lido.fi/

Twitter: https://twitter.com/lidofinance

Telegram: https://t.me/lidofinance

Summing up

Through the above article, CryptoChill has helped you know about the Lido Dao token and the highlights of the project.

Disclaimer: This post is not investment advice. You will be 100% responsible for your investment decisions.

Please follow and subscribe to support the CryptoChill.news.

No Comment! Be the first one.