What is a JPEG? Currently, is JPEG coin a viable investment option? Using Crypto Chill, let’s find out!

What is JPEG’d?

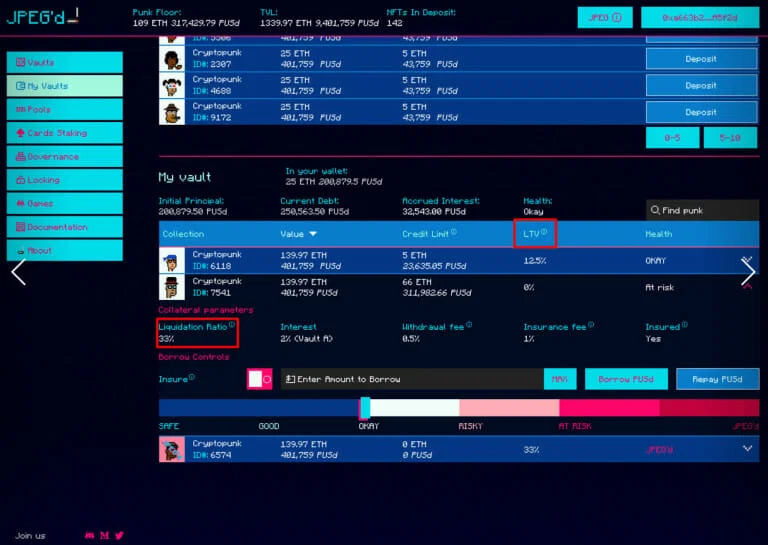

JPEG’d (token name: JPEG) is an Ethereum blockchain protocol for NFT lending that optimizes investor returns by leveraging the available elements of DeFi. The protocol enables holders of NFTs to open collateralized debt positions using NFTs as collateral. PUSd, the native stablecoin of the Mint protocol, enables users to effectively leverage their NFTs.

Jpeg’d operates solely on a decentralized finance platform, without licensing transactions from a specific organization. To bridge the gap between DeFi and NFTs, participants will use their NFTs as collateral on the protocol via DAO.

JPEG coin is the governance token for Jpeg’d.

How does the project work?

Jpeg’d makes use of a peer-to-protocol lending mechanism, independent of external liquidity providers.

Users can receive mint PUSd or pETH for their supported NFTs deposited in JPEG’s pool, which is used for protocol options such as ensuring the floor price of NFTs from Chainlink oracle on various exchanges, empowering loan contracts, and providing liquidity insurance.

To participate in the transaction, users can pledge their NFT as collateral in exchange for PUSd or pETH, depending on the value of their previously deposited NFT. When using the Lending mechanism, this NFT will be locked and users must return the original stablecoin salary plus interest in order to receive it back.

PUSd’s annual interest fee is 2%, while pETH’s is 5%.

Additionally, when the loan term expires and the borrower is unable to make payments, the previously mortgaged NFT will be liquidated. Jpeg’d provides an insurance plan that allows a user to redeem an NFT after paying the outstanding balance (principal plus interest) and a premium equal to 25% of the debt.

For example, users may choose to spend 10,000 USD on insurance and borrowing. The sum of the 5% premium and 0.5% deposit fee should not exceed $9,450. Eventually, this position’s debt rose to $15,000 USD, and the user was liquidated due to unfavorable market conditions. Users must repay a DAO debt of 15,000 PUSD in addition to a liquidation fee of 3,750 (25 percent). After the DAO receives these funds, the user’s NFT will be returned. If the funds are not transferred to the DAO within 48 hours of the liquidation, the insurance will lapse, and the NFT will become the property of the DAO.

Typically, liquidated NFTs are sold at auctions known as Open Ascending. The auctions last 24 hours, and the winner can receive an NFT at the conclusion. If a new bid is placed with less than five minutes remaining, the auction will be extended by 10 minutes. This procedure is repeated until no bidders remain.

Outstanding features of the project

- Numerous exceptional collections are supported, including CryptoPunks, EtherRocks, Bored Ape Yacht Club, Mutant Ape Yacht Club, Doodles, Azuki, Pudgy Penguins, Clonex, and Autoglyphs.

- Own Lending Mechanism: Jpeg’d employs the Non-fungible Debt Position (NFDP) for Lending, thereby resolving the issue of declining liquidity in the NFT market.

- Liquidity insurance: For overdue and liquidated NFTs, Jpeg’d provides an insurance mechanism (equivalent to 5% of the value of the non-refundable fee) to assist users in redeeming the NFT.

- The mechanism of action is straightforward: users need only mortgage the NFT in order to receive the equivalent amount of stablecoins for trading. Users should monitor the NFT-Fi market, particularly the Lending segment in Jpeg’d, due to its convenience and rapid profitability.

- LTV (Loan to Value Ratio): To ensure the correct operation of the protocol, Jpeg will set the LTV for loans, which is the ratio of the loan amount to the collateral value. Currently, Jpeg’d allows users to borrow up to 32% of the value of the collateral; however, if the LTV Ratio exceeds 33%, the loan position will be liquidated. If the Crypto Punk lending limit of 10 million USD is reached, users will no longer be able to borrow additional funds.

Basic information about the token

JPEG is the project’s primary governance token. This token can be used for administrative tasks such as voting by token holders… JPEG is also utilized for staking and trading on the network.

Token data

- Token name: Jpeg’d Token

- Ticker: JPEG

- Blockchain: Ethereum

- Token Standard: ERC-20

- Contract: 0xE80C0cd204D654CEbe8dd64A4857cAb6Be8345a3

- Token Type: Governance

- Total Supply: 69,420,000,000 JPEG

- Circulating Supply: 20,826,000,000 JPEG

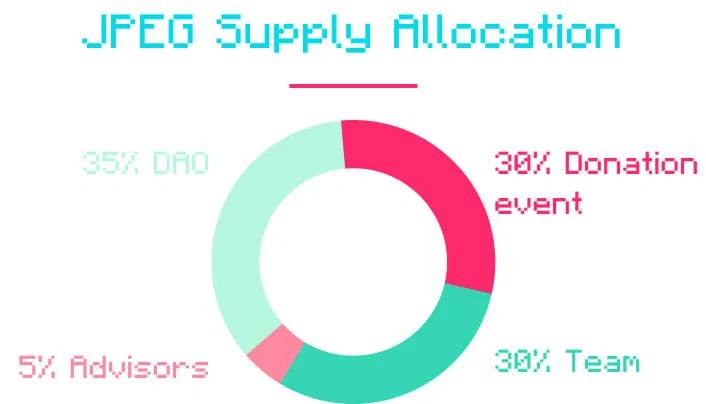

JPEG Token Allocation

- KNIVES: 35%

- Donation event: 30%

- Advisors: 5%

- Team: 30%

JPEG token payout schedule

Team and Advisors tokens are unlocked for two years and are locked for six months following the conclusion of the Donation event on March 1, 2022.

JPEG token utility

- DAO, governance token

- Network trading

- Staking

How to earn and own JPEG coins

- Staking, Farming…

- Trading on exchanges

JPEG coin storage wallet & exchange

JPEG coin storage wallet

Metamask

JPEG coin exchange

$JPEG’s exchange:

- MEXC Global

- Uniswap (V3)

- Sushiswap

External links

- Liquidation free vaults.

- Add new features to JPEG Token instead of just governance.

- Support adding new sets of NFTs on the platform.

- Permissioned Liquidators.

- Develop decentralized derivative products on prominent collectible NFTs.

A look at the potential of JPEG coin

As one of the earliest NFT marketplaces on the market, Jpeg’d is confident in its ability to lead the competition for market share.

Jpeg’d has not received much attention from the community, despite the fact that it possesses exceptional mechanisms and has the potential to be profitable in the Lending NFT market. This is evidenced by the low number of followers on social networking platforms like Twitter or Telegram.

The protocol’s total locked assets amount to only $54.5 million, which is significantly less than the leading Lending NFT exchange BendDAO ($199.73 million). The market’s focus has recently shifted to NFT-Fi platforms, and a mini-trend is expected to emerge in the near future, predicting greater explosions on this “potential” land.

Lastly, with an ecosystem containing a low-to-mid cap token such as $JPEG, it will be simple for Market Makers to rapidly increase the price of the system’s tokens whenever there is a positive signal from the market; therefore, it is important to monitor market developments.

Contact

Website: https://jpegd.io/

Twitter: https://twitter.com/JPEGd_69

Discord: https://discord.com/invite/jpegd

Telegram: https://t.me/jpegd

Summing up

Through the above article, CryptoChill has helped you know about the JPEG Coin and the highlights of the project.

Disclaimer: This post is not investment advice. You will be 100% responsible for your investment decisions.

Please follow and subscribe to support the CryptoChill.news.

No Comment! Be the first one.