How does Injective, as a dedicated project of Injective Labs, innovate in the context of traditional financial markets and the expanding Web3? Discover the answer with Crypto Chill!

What is Injective Protocol?

Injective is an interoperable, cross-chain, Layer 1 protocol for finance that powers DeFi applications such as derivatives exchanges, decentralized spot, and lending protocols…

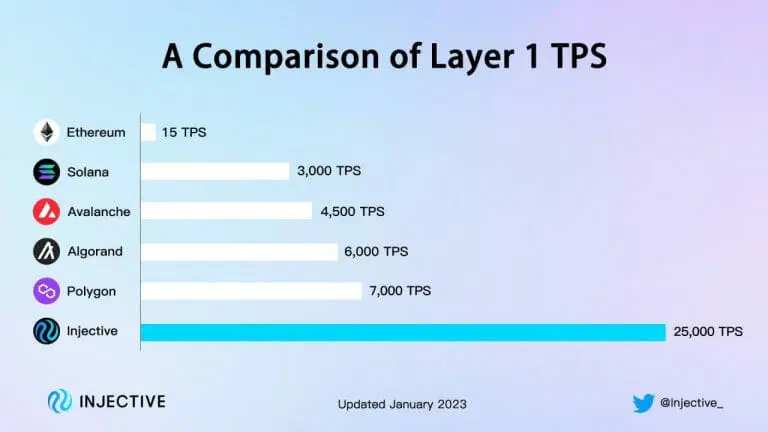

Injective is built on the Cosmos SDK and utilizes the Tendermint-based Proof-of-Stake consensus mechanism, which enables it to achieve instant transaction results at high speeds (10,000+ TPS) and low cost.

How does the project’s product work?

Injective Hub provides direct access to Injective. Here are some of Injective Hub’s primary features.

- Wallet: Injective Wallet enables asset tracking on Injective. Assets can be native tokens on Injective, assets bridging Ethereum, Moonbeam, and other IBC-enabled chains, or assets native to Injective.

- Bridge: Injective capacity to conduct multi-chain transactions with the vast majority of prominent blockchains. The following blockchains can be used with Injective Bridge to transfer assets into and out of Injective: Ethereum, Solana, CosmosHub, Osmosis, Evmos, Persistence, Axelar, Moonbeam, Persistence, Secret Network, Stride, and Terra are all cryptocurrencies.

- Staking: This is a Proof-of-Stake project in which users can assign their tokens to specific injective validators so that validators can validate transactions; users need only wait until the specified time to profit.

- Governance: This is a Proof-of-Stake project in which users can assign their tokens to particular injective validators so that validators can validate transactions; users only need to wait until the specified time to profit.

- Burn Auction: 60% of the transaction fees collected by Injective Protocol in order to hold a weekly auction for the INJ. At the conclusion, the winner will receive the entirety of the asset, while the winning price (paid in INJ) will be destroyed. This exerts deflationary pressure on the supply of INJ tokens.

- Insurance Funds: In Injective, users can create insurance funds for the derivatives market.

In addition, Injective Protocol includes the following four technical components:

- Injective Chain nodes

- Injective’s bridge smart contracts and orchestrator

- Injective API nodes

- Injective dApps and tools

Outstanding features of the project

Blockchain open for DeFi: Injective Chain is a public blockchain network that prohibits consensus participation from any individual or entity. Each participant in this public blockchain network can anonymously read or write to the network. All transactions are traceable or readable, demonstrating a high level of confidence. Users have complete authority over their trades and can even create a new derivatives market.

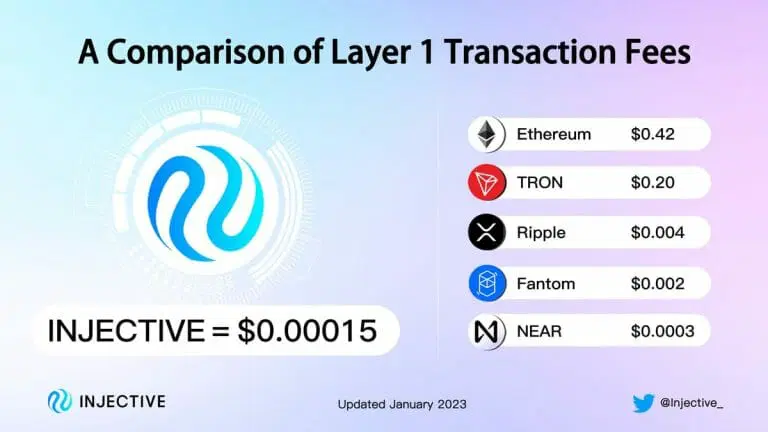

Injective Chain supports a variety of DeFi operations with a block creation time of just 1.1 seconds and an average transaction cost of less than $0.01

Injective Chain is a public blockchain network that prohibits consensus participation from any individual or organization. Each participant can anonymously read or write to this public blockchain network. All transactions are traceable or readable, which demonstrates a high level of trust. Users have full control over their transactions and can even establish a new derivatives market.

Injective Chain supports numerous DeFi operations with a block creation time of just 1.1 seconds and an average transaction cost of less than $0.01.

Injective Protocol possesses a token-burning mechanism that effectively reduces the INJ coin inflation rate. There have been a total of 5,646,332 INJs burned.

Basic information about INJ and tokenomic

Basic information about INJ and tokenomic

INJ is the primary Injective Protocol token. Holders of this token will have access to a variety of platform utilities and participate in project management voting.

Token data

- Token name: Injective Token

- Ticker: INJ

- Blockchain: Injective

- Token Standard: ERC-20

- Contract: 0xe28b3b32b6c345a34ff64674606124dd5aceca30

- Token Type: Utility Governance

- Total Supply: 100,000,000 INJ

- Circulating Supply: 73,005,554 INJ

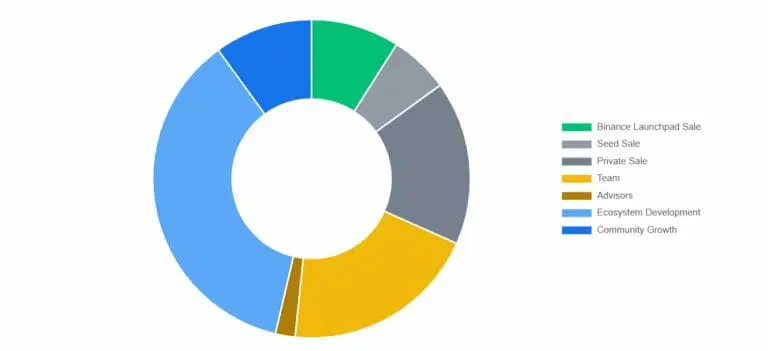

INJ Token Allocation

- Binance Launchpad Sale: 9%

- Seed Sale: 6%

- Private Sale: 16.67%

- Team: 20%

- Community: 10%

- Advisors: 2%

- Development: 36.33%

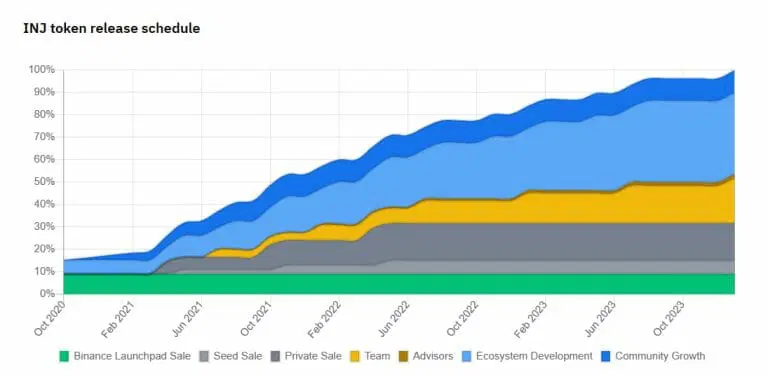

INJ token payout schedule

INJ Token Utility

- Governance: INJ token holders have the right to vote on the roadmap of the system.

- INJ is used as a distribution reward for users who contribute liquidity to the platform through Liquidity Mining.

- Accumulation of Exchange Fee Value: Sixty percent of transaction fees paid in INJ will be redeemed and burned, reducing the total supply of INJ coins.

- As an alternative to stablecoins, INJ will be used as escrow and collateral for Injective’s derivatives.

INJ Token Exchange and Storage Wallet

Storage wallet for INJ tokens

- SafePal

- Ledger

- Trezor

- Metamask

- …

INJ Token Exchange

- Binance

- MEXC Global

- Coinbase

- KuCoin

- …

External links

Q4/ 2022

- Injective Explorer V2

- Wormhole Bridge integration to bring EVM and Solana assets into Injective

- Fiat for dApps

Q1/2023

- Injective Hub V2

- External links

Q2/2023

- Injective Exchange Module V2

- Casablanca upgrade

Q3/2023

- Injective Orbital Chains

Q4/2023

- Mesh chain network

- Carcosa Upgrade

Q1/2024

- Multi VM Chains

- Volan Upgrade

Project Team

- Eric Chen (CEO & Co-founder): is an experienced Researcher at Innovating Capital, Product Manager at Splash and studied at NYU Stern School of Business.

- Albert Chon (CTO & Co-founder): Graduated with a Bachelor and Master of Computer Science from Stanford University, Albert has experience at Amazon and auditing at Open Zeppelin.

Investors and partners

Investors

In 5 funding rounds, Injective Labs’s product has raised a total of $56.7 million from investors such as Jump Crypto, Binance Labs, Pantera Capital, and Mark Cuban, an extremely cool billionaire in the field of cryptocurrency investing (prominent with AXS or MATIC). The project has continued to receive up to 40 million USD from Jump Crypto and BH Digital as of October 8, 2022.

On January 15, 2023, Injective launched Injective Venture Group to promote the ecosystem and support new protocols coming to Injective with the participation of numerous organizations, including Pantera Capital, Kucoin Ventures, Jump Crypto,…

Introducing the $150M Injective Ecosystem Fund to accelerate developer adoption 🚀

The initiative is supported by the largest institutions in the space including @PanteraCapital, @KuCoinVentures, @jump_, @idgcapital, @gate_labs, @delphi_labs, and more.https://t.co/yTnWgOILQs

— Injective 🥷 (@Injective_) January 25, 2023

Partner

In addition to collaborating with funds to open ecosystem development funds, Injective has actively collaborated with various blockchain partners like KardiaChain, Cartesi (CTSI), etc. to integrate products and optimize the user experience.

Contact

Website:https://injective.com/

Twitter: https://twitter.com/Injective_

Discord: https://discord.com/invite/NK4qdbv

Telegram: https://t.me/joininjective

Summing up

Through the above article, CryptoChill has helped you know about the Injective Protocol and the highlights of the project.

Disclaimer: This post is not investment advice. You will be 100% responsible for your investment decisions.

Please follow and subscribe to support the CryptoChill.news.

No Comment! Be the first one.