Binance has said that it will start trading Gains Network (GNS) on February 17 at 18:30 (VN). So, what is GNS (Gains Network)? What makes this project stand out? Let’s use Crypto Chill to find out.

What is Gains Network?

Gains Network is a decentralized trading platform for derivatives on the Polygon network. It can also be used on other blockchain networks.

On Gains Network’s gTrade trading platform, users can trade with up to 150x and 1000x leverage. This lets them use synthetic assets and decentralized lending protocols.

The project’s leverage system saves money on lending fees that would have to be paid on other platforms that use leverage. Native $GNS tokens are used to run and vote on DAOs that are part of the Gains Network.

The goal of the project is to make a decentralized leveraged exchange that is fast, strong, and easy to use so that it becomes the most popular decentralized leveraged trading platform.

On May 2, 2015, Gains Network launched gTrade, a decentralized leveraged exchange that runs on the Polygon blockchain.

Since it started, it has handled more than 728,000 trades from more than 11,000 different traders and a total trading volume of more than $28 billion. Gains Network has said that it wants to make this product available on other blockchain networks.

At the moment, transaction fees for the protocol have brought in more than $20 million for the project.

How does trading work for Gains Network?

Today, platforms for trading with leverage are too centralized and have low leverage limits. Gains Network fixed this problem by making the gTrade platform, which lets traders start trading without making an account or putting money into the platform.

To trade on the gTrade platform, users only need to connect a simple wallet. The trader’s money stays in their wallet and can only be moved with permission from the owner of the wallet. Smart contracts tell us how to do these things. A modified version of Chainlink’s Decentralized Oracle Network provides the asset price on the platform (DON).

To make trading easier, gTrade gives its users a wide range of assets they can trade:

- Traders can use the platform to trade cryptocurrencies, corporate stocks, and the foreign exchange market (Forex).

- gTrade gives users up to 150x leverage for cryptocurrency trades, 100x leverage for stock trades, and up to 1,000x leverage for forex trades. This helps users make the most money possible when trading.

Gains Network has made a group contribution structure for gTrade users so that they can join the leverage requirement and get profits as part of an extra way to make money and give people incentives.

Gains Network uses four “tools” that work together to make sure everything runs smoothly. These are decentralized vaults and liquidity pools, multifunctional tokens, and a protocol that brings together other facilities and controls how they work.

gTrade also has special NFTs called GFARM2 NFTs that give owners special rewards and benefits on the platform.

DAI VAULT

The DAI vault is what gTrade is based on. The DAI vault is a group that lets traders borrow money to trade with more money. The staker puts money into the DAI vault, which earns interest based on how much money the vault makes.

Vaults have too much collateral and are spread out. To trade on gTrade, users have to sign up with DAI and put money in DAI vaults as collateral. The collateral makes sure that traders have enough money and keeps the platform steady.

The collateral for the vault is set at 30% to make sure it stays stable. When this mortgage level drops below the 30% mark, steps are taken to get it back to where it was before. One of the first things that can be done is to trade GNS tokens for more DAI and fill up the vaults. But the Gains Network team said that the solution wouldn’t work in harsh conditions.

At the moment, the solutions that are being used to avoid negative PNL indicators are increasing the mortgage level of the vault and limiting DAI capital flows.

Traders contribute to DAI by doing business as usual. DAI vaults are made to make money when traders lose money and to shrink when traders make more money than they lose. Traders get their money from the DAI vault when they win a trade. When traders lose money and their negative PNL is paid into the vault, the vault will grow.

GNS token overview

Token Data

- Token Data: Gains Network

- Ticker: GNS

- Token Type: Utility

- Blockchain: Polygon, Arbitrum

- Contract Polygon: 0xE5417Af564e4bFDA1c483642db72007871397896

- Contract Arbitrum: 0x18c11FD286C5EC11c3b683Caa813B77f5163A122

- Total Supply: 30,291,000 GNS

- Max Supply: 30,291,000 GNS

Token allocation

Here are some use cases of GNS token:

- Pay trading fees on the gTrade decentralized trading platform.

- Exchange and trade GNS together on cryptocurrency exchange platforms.

- Use GNS in the wagering program and get rewards.

External links

- In the first stage, Gains Network is focused on the trading route. The development team is expected to keep adding new features to gTrade, like leveraged trading, token swaps, and better liquidity. Gains Network also plans to work with other exchanges to make it easier for more people to use GNS. Gains Network’s goal is to give traders a safe and reliable place to trade, and Phase 1 will help them get there.

- Stage two is the growth of the ecosystem. During this time, Gains Network will continue to develop and grow its products and services. For example, the gTrade trading platform will get more features, cross-platform cryptocurrency wallet apps will be made, and independent communities will be built that are connected to the Gains Network ecosystem.

- Stage three: The Gains Network’s long-term plan is to add more products. During this time, Gains Network will keep making new products and services to meet user needs. For example, they will make DeFi products, make new cryptocurrency apps, and add GNS tokens to larger exchanges.

Use cases of GNS tokens

The gTrade platform and the Gains Network ecosystem are built around the GNS token. It is used as a utility token to store value for the ecosystem and will have more uses in the future when the Gains Network’s DAO is set up.

The GNS token used to be called the Gfarm token, but it has since changed its name. Before, people who owned Gfarm tokens could trade them for GNS tokens at a rate of 1:1000, which meant that for every Gfarm token they owned, they got 1,000 GNS tokens.

GNS tokens are used to support the DAI vault and the overall liquidity of the gTrade platform for leveraged trading. At the moment, the GNS/DAI team holds more than $5 million in locked assets. This gives DAI vaults strong support and traders good liquidity. Users can also switch between GNS and DAI on QuickSwap.

The Gains Network team is also working on a DAO that will run on GNS tokens. Investors who own GNS tokens will be able to join the DAO and give their opinions on how the platform should be run by voting on proposals for improvements. GNS token holders will be able to stake their tokens to get veGNS, which is a governance token used to vote on proposals.

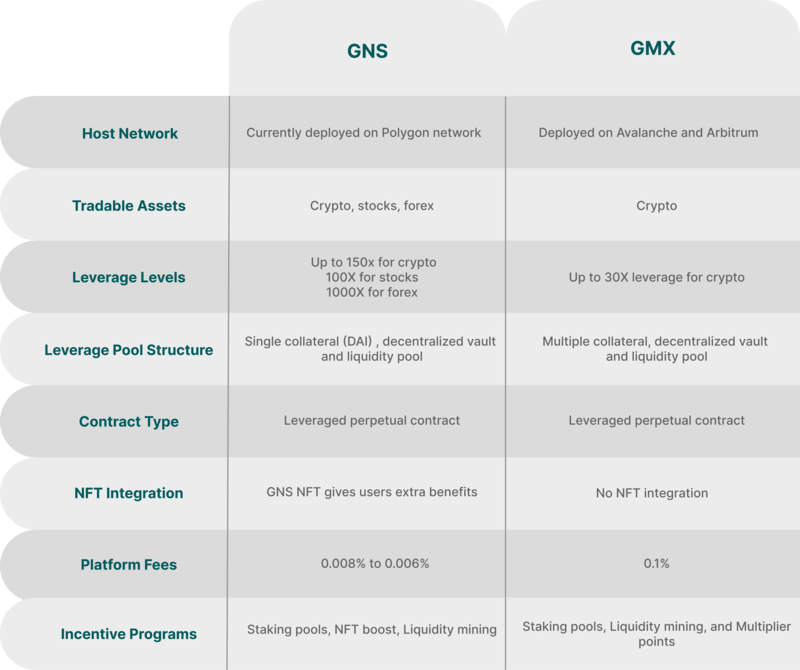

GNS vs. GMX

Like GNS, GMX lets you trade derivatives in a decentralized way. Its leverage and trading protocol are very good. Both have a lot in common, and this is how they stack up against each other.

Frequently Asked Questions

Where to buy and sell Gains Network (GNS token)?

You can learn about GNS token at the following online exchanges: UniSwap (v2, v3), MEXC Global, Gate.io, etc.

Where to create a wallet & store GNS tokens?

You can make wallets and store GNS in wallets that are popular and have their own private keys, such as:

- Metamask

- Trustwallet

- Wallet Connect

No Comment! Be the first one.