What is the dHedge project?

dHedge is a decentralized investment fund management project for synthetic assets on Ethereum. dHedge makes it possible for you to centrally manage a group of assets, create your own private investment fund on the Ethereum blockchain, or invest in a fund managed by another party in a completely non-custodial way. using Synthetics Assets. dHedge is a fully automated and public asset management protocol.

What is DHT Token?

The DHT token is a governance token in the dHedge ecosystem running on the Ethereum blockchain, it has 3 main functions:

- Encourage investors to pool assets with the best performing fund managers.

- Reward managers for motivating activities on the app.

- Valuable for voting in decentralized governance.

The dHedge ecosystem is governed by a decentralized autonomous organization (DAO) who holds the DHT token. The DAO is responsible for developing and ensuring smooth governance. Initially, governance participants will only be able to vote on some network operations while the rest will be executed with off-chain consensus.

The DHT token will have a fixed supply of 100 million. Tokens will initially be issued to active users of the protocol through a liquidity mining strategy.

Team, Investors and Supporters

The dHedge team consists of three key members:

Henrik Andersson

In addition to leading dHedge, Andersson is also an asset manager in the traditional financial world.

Henrik Andersson is currently the CIO of Apollo Capital, which won Crypto Fund Research’s 2019 Best-performing Multi-Strategic Cryptocurrency Fund.

Ostrowski

Responsible for data engineering and blockchain development. He has also been a founding member of several crypto-related companies including Startonchain.com and RelayPay.

Nurovic

As Co-Founder of Upstreet, Nurovic serves as dHedge’s consolidator and technical supporter as a systems engineer.

Nhà đầu tư và người ủng hộ

The list of dHedge backers includes Framework Ventures, Three Arrows Capital, BlockTower Capital, DACM, Maple Leaf Capital, Cluster Capital, Lemniscap, LD Capital, IOSG Ventures, NGC Ventures, Bitscale Capital, Divergence Ventures, Genblock Capital, Trusted Volumes, Altonomy, Continue Capital, The Lao, bitfwd (比特未来), Loi Luu, Co-Founder and CEO of Kyber Network.

Information about DHT token

- Token Name: DHT token

- Ticker: DHT

- Blockchain: Ethereum

- Token Standard: ERC-20

- Contract Address: 0xca1207647ff814039530d7d35df0e1dd2e91fa84

- Token Type: Utility

- Total Supply: 100,000,000 DHT

- Total circulating supply: 6,230.936 DHT

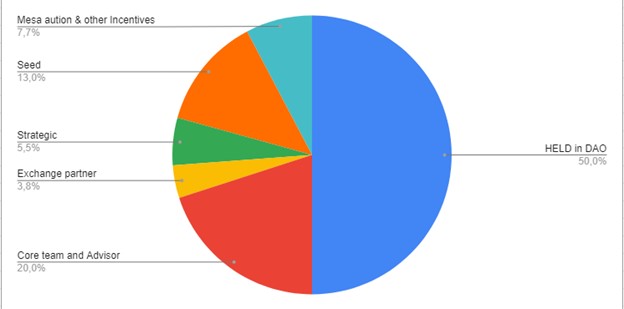

Token Allocation

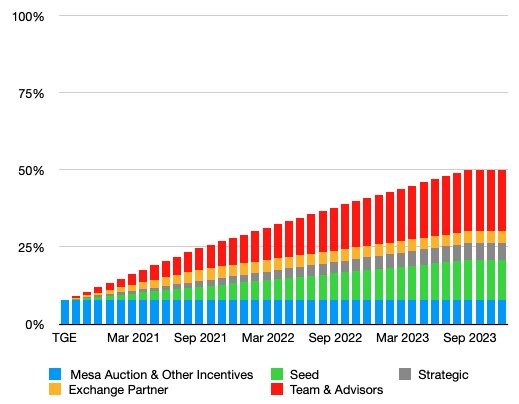

Token unlocking process

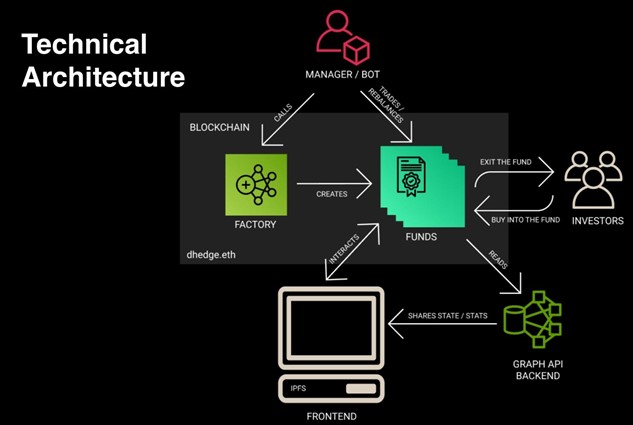

What are the components of the dHedge protocol?

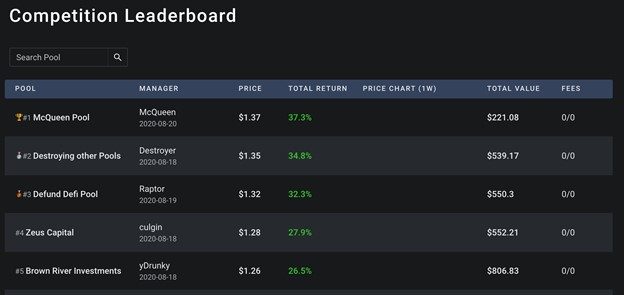

Manager

Managers in the dHedge protocol are those who make investment decisions on behalf of the pools and compete on the dHedge leaderboard. If the manager’s decisions are beneficial, the manager can charge a performance fee as a percentage of the total profit generated by the team. Fees are collected based on the team’s tokens, which means that if a manager is successful, their overall ownership of the group will increase over time.

Managers must invoke the dHedge smart contract to create pools, they can choose to create public pools that allow anyone to become an investor or only allow certain Ethereum addresses. Managers can use active management strategies, algorithmic strategies or invest in other pools on dHedge.

Investors

Investors are those who want to invest in dHedge’s protocol, they are forced to use Synthetix’s original Stablecoin, sUSD to invest in the pool. After investing in the pool they will receive the token of that pool, that token represents the investor’s request in the pool. Investors can enter or exit a pool at any time by interacting with the pool smart contract.

Pool

The pool is a key component of the dHedge protocol, where investors keep custody of their assets for the duration of the investment. When an investor joins a pool, i.e. they buy a share and receive the group’s token, this token is how investors can exchange money from smart contracts. Fund managers cannot withdraw investors’ funds thanks to dHedge smart contracts.

dHedge managers trade synthetic assets using a unique model known as peer-to-peer (P2C) liquidity, which allows for slip-free trading. The smart contracts that provide this functionality are essentially drawn from dHedge, Synthetix, and Chainlink.

Bot SDK

The administrator can be a bot or a real user, or both. You can find code, documentation, and examples for the dHedgeBot SDK on this Github repository: https://github.com/dhedge/dhedge-sdk

Instructions on how to implement a custom strategy for auto-execution can be found here: https://medium.com/dhedge-org/dhedge-bot-sdk-e825e6f469c8

How to earn and own DHT tokens:

500,000 DHT will be rewarded in 3 months trial starting from December 2020.

50,000 DHT will reward early users of the dHedge protocol.

450,000 DHT distributed over 90 days to users performance mining.

Or you can buy on exchanges like Uniswap, Huobi, Hotbit…

What is dHedge Performance Mining?

How Performance Mining Works

You will receive DHT when you invest in groups on the dHedge platform that perform well. This is a way to incentivize participants, distribute DHT to real members of the dHedge ecosystem, and to reward good performers.

Criteria for Performance Mining Rewards

Only investments in qualified pools will count towards the reward. Eligibility criteria are subject to change.

Pool needs to meet the following 3 criteria:

- Have a Positive Rate of Return reaching a certain milestone.

- Sponsored over 2 weeks ago

- Public, i.e. open to anyone.

Eligible pools are clearly marked with a mining icon on the dHedge Leaderboard. Note that Managers who invest in their own pool are considered investors and can earn rewards like everyone else.

The reward is locked for 3 months, after which it will be available to receive. This initial performance mining program is set to run for 90 days. The program will then be effectively evaluated by the dHedge DAO for revision.

The rewards are distributed proportionally based on everyone’s investment value. Every day for 90 days, 5,000 DHT will be distributed to investors on the dHedge platform.

Project evaluation

dHedge is a potential DeFi project that allows investors to profit by sending assets to managers without having to worry that they might run away with their money. The dHedge platform also benefits financial managers as they can make profits as partners, not employees. dHedge promises to lead a new revolution in the financial investment market when in just a few months, the profits of some dHedge investors have even increased by more than 50%.

However, currently you should not buy DHT tokens due to the high ICO valuation ($1.29). It is difficult to make profits in the short term when the DeFi market has not recovered. Instead, you should use the app of this platform to invest, it will be more profitable.

Socials

- Website: https://dhedge.org/

- Twitter: https://twitter.com/dhedge_dao

- Telegram: https://t.me/dHedge

- Discord: https://discord.com/invite/m6NzChg

- Reddit: https://www.reddit.com/r/dHedge/

Final thoughts

Through the article about What is dHedge above, the CryptoChill team hopes everyone gets an overview of dHedge . All opinions as well as information in the article are objective opinions and researched by Cryptochill, not considered investment advice, you should learn enough before making a decision for yourself. Good luck!

No Comment! Be the first one.