Raft Finance, a project in the LSDFI segment, is appearing with extremely interesting operating mechanisms. Does the project have enough potential for development and receive great investment from the community?

Let’s find out with Crypto Chill!

What does RAFT mean?

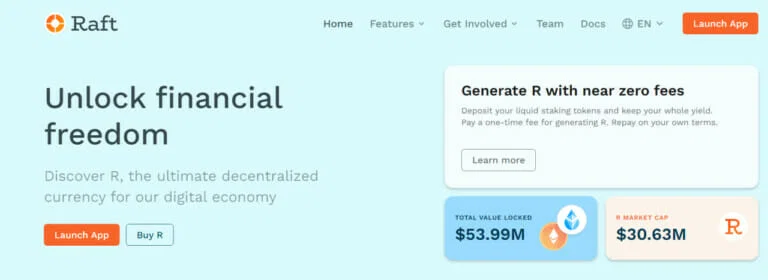

Raft is a DeFi protocol built on Ethereum that allows users to create stablecoins (R) by depositing Liquid Staking tokens (LST) as collateral. Raft can be classified as a project that belongs to the LSDFI puzzle piece, similar to Lybra Finance.

$R is an Ethereum USD stablecoin backed by LST tokens such as stETH and rETH, providing the best way to borrow with LSD collateral and optimize capital efficiency by applying hard and soft peg mechanisms to the USD.

Outstanding features of the project

$R stablecoins

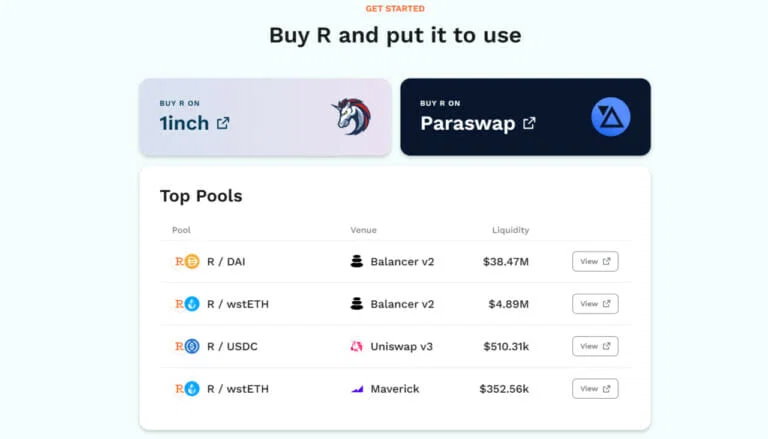

R is a stablecoin on Ethereum that has LST tokens like stETH (Lido Staked Ether) and rETH (Rocket Pool ETH) as backing. R aims to be the leading stablecoin in the decentralized ecosystem, with high liquidity across multiple trading pairs.

With the combination of the two mechanisms, Hard peg and Soft peg, R always remains at peg $1, equivalent to USD.

- Hard peg: This concept is based on arbitrage trading opportunities to maintain the stablecoin price in line with its supporting asset and always within the price range of $1 to $1.10. In the case of R, which is backed by the LSD token, two mechanisms are used to achieve that hard peg: redemption and over-collateralization.

With Redemption, the mechanism allows holders of R stablecoins to exchange for the equivalent value in LSD collateral when the value of R depeg is out of $1. When users redeem their R tokens, these tokens are burned by smart contracts, reducing the circulating supply of R and helping the price of R rise again.

With Over-collateralization, the mechanism creates an upper boundary for the price of $1.20. Users can deposit LSD tokens when the price reaches the $1.2 mark, then mint 1 R and sell it on the market for more than 1.2 USD to lock in risk-free profits when the price of R exceeds this level.

- Soft peg: Unlike hard peg, soft peg is based on the design ability of a stablecoin to encourage users to act on the expectation that a peg will be held in the future.

Potential users can take advantage by borrowing and selling R in the market when the stablecoin crosses the mark. Knowing in advance the expected behavior of an economic system creates a self-fulfilling mechanism that will help the system work as intended in the future.

How does the project’s product work?

Borrowing

Borrowing R requires users to create a position by depositing their LSD at a collateral rate of at least 120% for each R borrowed.

In which, the minimum amount of R borrowed is 3,000 tokens (~3,000 USD).

Returning

There are 3 ways to reimburse R:

- Loan repayment: The borrower needs to proceed to repay the previous loan with R+ interest rate and take back LSD tokens as collateral.

- Redemption: The holder of R when buying R in the market can acquire other borrower’s collateralized LSD assets.

- Liquidated: The liquidator pays the Borrower’s R debt at the Minimum Mortgage Rate (MCR) and in return receives LSD collateral plus a Liquidation Bonus from the previous borrower.

The amount of R will then be burned to ensure the stability of the economy.

Flash Mint

Flash Mint is a powerful tool that allows users to mint up to 10% of the total R supply without payment at the same time, provided that they return in the same transaction with a 0.5% Fast Mint Rate. This rate initially stands at 0.5% but can later be pushed to 5% if the market works effectively.

Oracle

Oracle systems are designed to be adaptable and maintained in a multisignature configuration.

This structure allows multisig participants to make the necessary updates, ensuring the system remains robust and reliable.

Token Overview

Updating…

Raft’s Team

Updating…

Investors & Partners

Investors

It is not clear what the total amount of money raised by the Raft Finance project is, but it can be seen that the project has received investment from leading investment funds such as Jump Crypto and Wintermute.

Partner

Updating…

Frequently Asked Questions

What is the minimum mortgage rate?

- Users need at least R3,000 to open a position. This helps ensure that in the event that your position needs to be liquidated, there will be sufficient incentive for others to join and protect it while maintaining the health and stability of the Raft protocol.

Will Raft have a testnet?

- No, the project will deploy directly to the Ethereum Mainnet; currently, users can experience the product.

Contact

Website: https://www.raft.fi/

Twitter: https://twitter.com/raft_fi

Discord: https://discord.com/invite/raft-fi

Telegram: https://t.me/raft_chat

Summing up

Through the above article, CryptoChill has helped you know about the Raft and the highlights of the project.

Disclaimer: This post is not investment advice. You will be 100% responsible for your investment decisions.

Please follow and subscribe to support the CryptoChill.news.

No Comment! Be the first one.