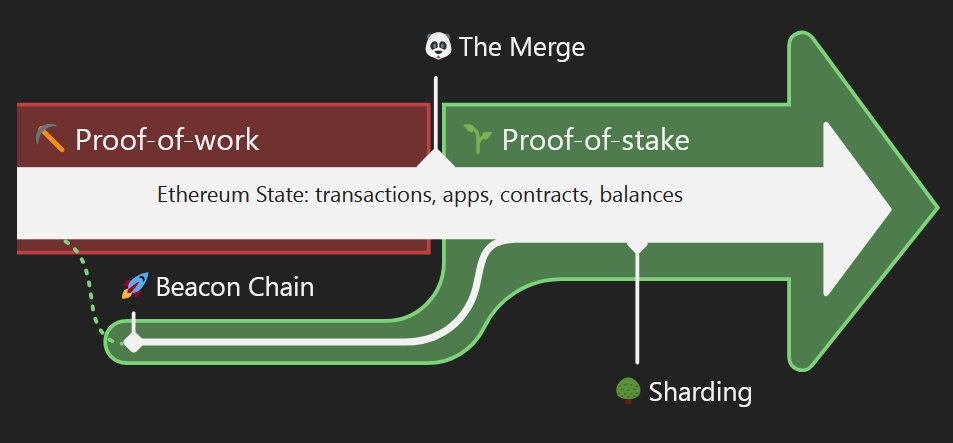

Pre-Event Background The Merge and Definition of ETHW – ETHS

On September 19, 2022, The Merge, the most awaited event in the cryptocurrency world, will occur.

This historic occurrence will result in Ethereum abandoning the PoW consensus method and relocating the whole DeFi network to a new location using the PoS consensus model.

The Twitter community has engaged in a heated discussion on a PoW fork of Ethereum that will operate in parallel with Ethereum PoS following The Merge event for the past week.

The explanation is straightforward: The Merge will transition Ethereum from PoW to PoS consensus. This “knocks down the rice bowl” for miners during the past seven years.

Many elements have complained and continue to exploit the Ethereum PoW “gold mine” despite the persistence of discontent and profit-seeking.

Since then, the entire market faces the possibility of two Ethereum PoW and PoS chains coexisting after The Merge.

Implications of continuing to fork out an Ethereum PoW

- Originating as a fork of a fork (ETH forked from ETC and ETHw forked from ETH), these chains frequently lack clear orientation, do not contain actual value, and lack stability, making them susceptible to mining assaults.

- ETHw will not receive service support from veteran DeFi platforms such as Chainlink Protocol because it is a lifeless clone.

- Due to the fact that many Ethereum dApp assets are tied to off-grid assets, the majority of dApps forked on ETHw will automatically fail.

- Ethereum Classic (ETC) is already an ETH PoW, hence it is unnecessary to create ETHw.

No DeFi on all the $ETH forks? Or what protocol does support it 👀

If no DeFi, what will it be used for then.

NFTs?

"Everyone wants my NFT which runs on ETHPoW" – No one$ETH $ETHW $LINK https://t.co/hjvu6aonMp— MartyFly | 👨🎓 = 🔑 | 🦋 (@Marty_cFly) August 6, 2022

It is evident that ETH PoW, after being forked, will be a Ghost Chain, as it lacks intrinsic value and will serve as a parasitic value trap, corroding retail investors and ETH PoW trading units.

What are ETHW and ETHS? Explain why there are tokens in 2 chains

- After The Merge, ETHS (ETH2 or Ethereum PoS) is the coin representing Ethereum’s Proof-of-Stake chain.

- ETHW (ETH1, or Ethereum PoW) is a coin representing the Proof-of-Work chain of Ethereum that will likely continue to exist and be mined after The Merge.

Since the Merge event has not yet occurred, why are there tokens for both chains? Both ETHW and ETHS exist as IOU tokens at present.

Simply defined, IOU tokens enable the trading and storage of tokens of blockchains that have not yet released their mainnet.

From there, you can purchase tokens at a discount prior to the launch of the project’s mainnet.

After The Merge, ETHW and ETHS will be delisted, trading will cease, and the tokens will be transferred to valid mainnet tokens (based on information from the Gate.io).

What will happen after The Merge: From a technical perspective and from a technological perspective?

Technically speaking, The Merge is a Hard Fork by definition. Thereafter, Ethereum will split into two independent chains, ETH PoW and ETH PoS, from a single chain.

The Merge has just begun, and we will soon have two blockchains with identical data. Concrete:

- $ETH tokens (including ETH PoW and ETH PoS)

- Stablecoins and all tokens belonging to the Ethereum blockchain

- The entire collection of NFTs on Ethereum

One copy will reside on the Proof-of-Stake (PoS) chain and the other on the Proof-of-Work (PoW) chain. It is possible for any Ethereum dApp asset to be instantly copied.

Technologically speaking, network-wide assets can be duplicated. However, the value of these assets is not fixed, since the decision of each service issuer on the chain will determine their genuine value.

In particular, if Chainlink continues to provide services on Ethereum PoS and rejects Ethereum PoW, its tokens and dApp services on Ethereum PoW will be worthless.

So what situation awaits Ethereum ahead?

The Inevitable Role of Stablecoin Issuers for Ethereum

Indeed, despite being known as the heart of the DeFi world, Ethereum’s primary values continue to derive from the community and service providers supporting the chain, such as CEX, DEX, Oracle, and stablecoins.

Vitalik Buterin himself addressed the subject of the future of Ethereum hard forks at the BUIDL Asia conference in Seoul.

“I think this is a problem in the distant future. Basically, the decision of a stablecoin issuer like USDC to support will influence the decisions of the user community.”

Vitalik: Centralized USDC could decide the future of contentious ETH hard forks Speaking at the BUIDL Asia event in Korea, Vitalik Buterin said that centralized stablecoins like USDC & USDT will become significant deciders in future hard forks. https://t.co/rRiRN2E8gY

— BitRss News (@RssBit) August 5, 2022

It is logical that the function of stablecoin issuers is stressed. Because if USDC and USDT do not own the value on Ethereum PoW, the entire DeFi mechanism on the blockchain will collapse.

In particular, when USDC and USDT lose value on the PoW chain, the tokens backed by these two stablecoins in liquidity pools will lose value.

For on-chain dApps, loans collateralized in USDT and USDC will likewise lose credit and become bad debts.

The issuers of stablecoins hold the authority to decide the survival of the two Ethereum chains Ethereum PoW and Ethereum PoS.

Tether and Circle “choose” Ethereum PoS; is this the end of the game?

Recently, Circle, the corporation behind the stablecoin USDC, publicly declared its support for Ethereum PoS.

“USDC can only exist under a single valid chain, and as previously stated, our plan is to fully support the Ethereum PoS chain after The Merge.”

USDC is not only the largest stablecoin (dollar peg) on Ethereum, but also the largest ERC-20 asset overall, having a capitalization of nearly $38 billion (as of 11/08/22).

Following in the footsteps of Circle, Tether promptly announced support for Ethereum PoS.

According to the above research, this move by Tether and Circle appears to have struck a deadly blow to the entities attempting to mine Ethereum Proof of Work.

In addition, key Ethereum DeFi protocols including Chainlink, Argent, and DeBank have rejected ETH PoW support and chain split plans.

The above data presents a scenario in which ETH PoS becomes the sole mainnet chain accepted by the majority of the community and the DeFi world.

Meanwhile, ETH PoW is a soulless shell for miners to continue squeezing out the remains of Ethereum’s profits.

Cryptochill.news comments on: Should you invest in ETHW, experience ETHW safely?

Why do reputable centralized exchanges compete with ETHW and ETHS lists?

As The Merge approaches, CEX exchanges such as Bitmex, Gate.io, and MEXC list ETHW in order to generate transaction fees — the primary source of profit for CEX exchanges.

In addition, Gate.io emphasized that ETHW and ETHS are IOU tokens that would be delisted following The Merge.

Therefore, a big number of supporting exchanges is not indicative of ETHW’s growth potential.

Should I invest to profit from ETHW?

Being listed on exchanges will assist ETHW maintain a certain price despite the influx of speculative capital.

However, owning ETHW will be risky, as there is neither a community nor a Market Maker supporting this coin. On the other hand, there are numerous components ready to dump items employing high-performance MEV trading bots.

In conclusion, if you are an average retail investor, you should safeguard your position and assets against ETHW. Let’s explore ETHW hazards or opportunities?

How secure is the ETH PoW process?

Circle (USDC) will not support Ethereum PoW, therefore you can use USDC to borrow ETH on protocols predating The Merge.

After the fork, your USDC deposit on the ETH PoW chain will no longer be valid. Therefore, the aforementioned USDC will not be required to be returned on the PoW chain. You will have more ETH PoW to discharge once The Merge has been completed.

However, you will need to keep an eye on the Ethereum protocol interest rate as The Merge approaches, as the figures can reach three digits just before the event.

As we get close to merge date watch all the $ETH be borrowed, not just with stETH collateral but everything else.

Watch interest rate on lending rate rocket on $ETH rocket in 3 figures, with massive pump of $ETH price in days leading into merge.

— Cryptoyieldinfo (@Cryptoyieldinfo) August 6, 2022

Please note that the material is merely a personal view provided for informative purposes and does not constitute investment advice.

Cryptochill.news has given you with the most relevant and up-to-date information regarding ETHW and ETHS, as well as significant pre-event information regarding The Merge. Hopefully, you have gained a great deal of insight from this essay and invested wisely!

No Comment! Be the first one.