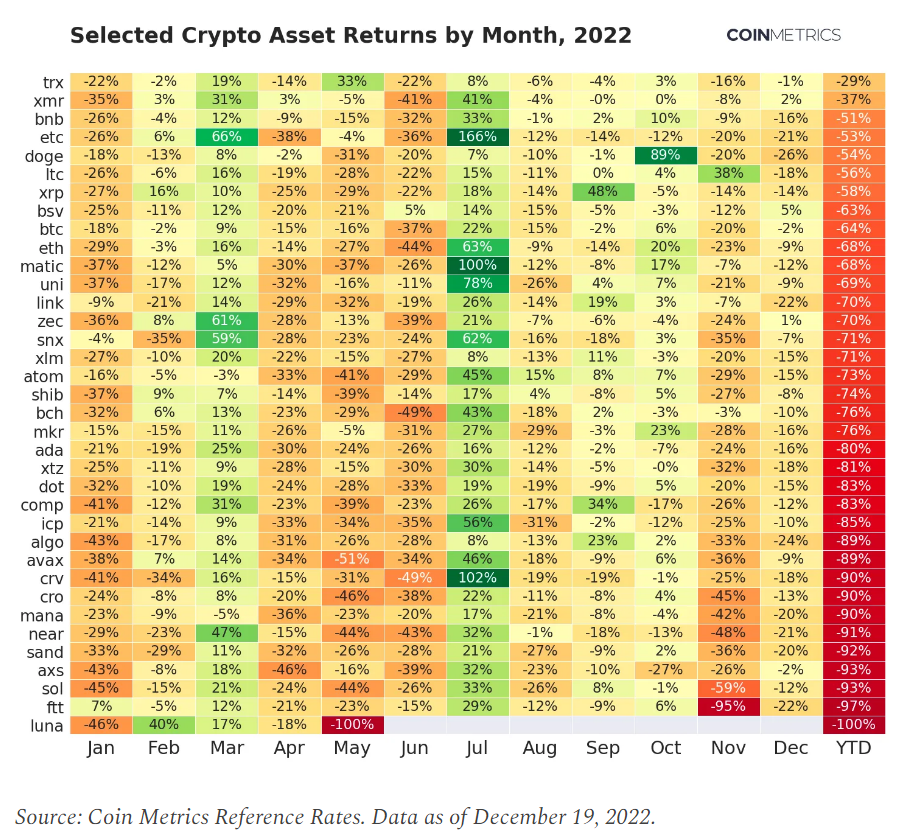

A new annual analysis has shown that while the cryptocurrency market saw some big losses in 2022, some of its assets fared better than others, notably in terms of returns each month.

Tron (TRX), Monero (XMR), Binance Coin (BNB), Ethereum Classic (ETC), and Dogecoin (DOGE) were specifically the top five best-performing assets in 2022, according to the new “State of the Network” report by the blockchain analytics platform CoinMetrics published on December 20.

All 36 assets included in the analysis saw their returns diminish over the course of the year as a whole, but the drops were most modest for the aforementioned five cryptocurrencies.

As expected, the battered Terra (LUNA) token had the worst performance, doing somewhat lower than the FTX Token (FTT).

Stats of the top achievers.

Tron had the best results among the top five performers in May, when its returns climbed by 33%, and in March, with +19%. With losses of 22% each, January and June tie for the worst months for TRX.

The month that had the most increases for Monero was July (41%), followed by March (+31%). Following June, which was its least profitable month, July saw monthly returns fall to 41%. XMR’s January performance was equally subpar, with returns declining by 35%.

Binance’s BNB cryptocurrency had the strongest performance in July, with a 33% increase in asset returns, and +12% in March. The token suffered losses of 32% in June and 26% in January in comparison to this.

A remarkable +166% returns in July and +66% in March put Ethereum Classic in fourth place by the best returns performance over the course of the year, as contrasted to losses of 38% in April and 36% in June.

The strongest month for Dogecoin, October, witnessed gains of +89%. March was close behind at +8%. In contrast to this performance, May was DOGE’s worst month, during which the token suffered a 31% loss, followed by a decline of 26% in December.

Losers in returns

On the bottom of the graph, LUNA recorded a 100% loss of returns in May, after which the tracking ceased with the collapse of the Terraform Labs ecosystem, which also caused the de-pegging of Terraform’s stablecoin TerraUSD (USTC).

Other loss is FTT, the native token of the cryptocurrency exchange FTX, whose demise reverberated throughout the industry and resulted in the arrest of its founder and former CEO, Sam Bankman-Fried. FTT saw a 95% collapse in returns in November, then a pause and a 22% loss in December.

With a 93% loss in returns for the entire year, Solana (SOL) joined the ranks of other “losers,” with its worst performance occurring in November when it lost 59% amid worries about the company’s future following the release of a total of 50.7 million SOL, which at the time was worth nearly $1 billion.

No Comment! Be the first one.