When cryptocurrencies like Bitcoin and Ethereum first emerged, they captured the attention of a few enthusiasts. However, as the popularity of digital currencies soared, governments worldwide have taken notice and are now contemplating their own Central Bank Digital Currencies, known as CBDCs. In this article, we will learn how CBDC could revolutionize the financial landscape and impact your digital transactions.

CBDCs, Explained:

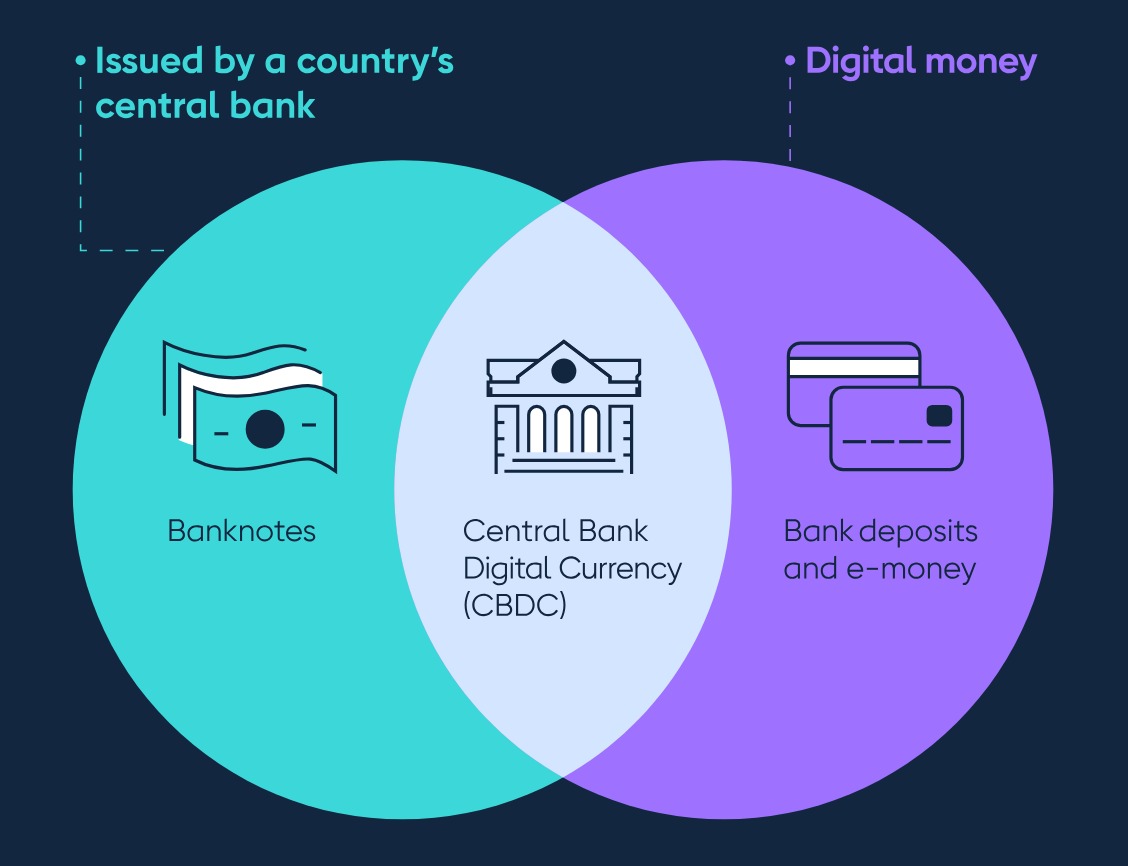

Central Bank Digital Currencies are digital versions of a country’s currency issued by its central bank. Unlike cryptocurrencies, CBDCs are backed by the government and tied to the value of the national currency. This makes them legal tender, enabling their use for everyday transactions such as buying goods, paying for services, and settling taxes.

Read more: Introduction to Cryptocurrency: Roles, Storage, Transactions

Why are CBDCs Becoming Popular?

The popularity of cryptocurrencies has created a demand for digital currencies, and CBDC can offer a more stable and regulated alternative to cryptocurrencies like Bitcoin. Additionally, with the increasing use of mobile payments, CBDCs can provide a convenient and efficient way for people to make transactions using their smartphones. The COVID-19 pandemic has further accelerated the shift to digital payments, making CBDC a potential facilitator of this transition. Moreover, CBDCs have the potential to increase financial inclusion by providing easier access to digital payments, particularly in developing countries where traditional banking services may be limited.

Proponents of CBDCs argue that they offer numerous benefits. These include more efficient implementation of monetary policies, better control over inflation, prevention of tax evasion, reduced corruption, and the ability to combat illicit activities such as drug trafficking and terrorism financing.

Risks and Concerns of CBDCs

While CBDCs offer promise, there are risks to consider:

- Privacy Concerns: CBDC could infringe on individuals’ privacy rights, as governments could monitor and track financial transactions, leading to unprecedented levels of surveillance.

- Centralization Risks: CBDC rely on private or permissioned blockchains, creating vulnerabilities with single points of failure, potentially leading to control by malicious actors.

- Data Security: Integration of existing digital payment systems into CBDCs could raise data security concerns, making centralized data storage attractive targets for hackers.

- Unstable Monetary Policies: Direct control over digital currency supply could lead to manipulation of interest rates and inflation, raising concerns about abuse of power.

- Financial Discrimination: Governments could potentially discriminate based on individuals’ financial behavior, questioning the fairness and inclusivity of CBDCs.

- Impact on Financial Institutions: CBDCs could compete with commercial banks, possibly reshaping the financial landscape and affecting traditional financial institutions.

While some countries have made progress in piloting and implementing CBDC, the mass adoption of CBDCs depends on various factors such as public acceptance, regulatory frameworks, technological infrastructure, and international cooperation. Striking the right balance between innovation and safeguarding individuals’ rights and financial stability will be crucial in shaping the future of CBDCs.

Read also: $AAVE skyrocketed, what was the cause?

Conclusion

While some countries have made significant strides in piloting and implementing CBDCs, the future remains uncertain. Widespread adoption will depend on public acceptance, regulatory frameworks, technological infrastructure, and international cooperation. Striking the right balance between innovation, individuals’ rights, and financial stability will be crucial to shaping the future of CBDCs.

Disclaimer: The information in this article is not investment advice from CryptoChill. Overall, cryptocurrencies always carry many financial risks. Therefore, do your own research before making any investment decisions based on this website’s information.

No Comment! Be the first one.