Sui (SUI token), the first product released by Web3 infrastructure company Mysten Labs, is one of the blockchain services that piques the most interest. In this article, we’ll explore the Sui blockchain and its components, key feature, and tokenomics model.

What is Sui?

Sui (SUI token) is a decentralized permissionless smart contract platform based towards low-latency management of assets. It uses the Move programming language to define assets as objects that may be owned by an address. Move programs define operations on these typed objects including custom rules for their creation, the transfer of these assets to new owners, and operations that mutate assets.

Sui is run by a group of authorities that don’t need to be given permission to do so. These authorities do work similar to that of validators or miners in other blockchain systems. In particular, it uses a Byzantine consistent broadcast protocol between authorities to make sure that common operations on assets are safe. This means that, compared to Byzantine agreement, it has lower latency and better scalability. Also, it depends only on Byzantine agreement to keep shared objects safe. As well as government operations and checkpoints, which were done off the critical latency path. Also, smart contracts are automatically run in parallel whenever that is possible. Sui has both light clients that can authenticate reads and full clients that can check the integrity of all transitions. These features make it possible to connect to other blockchains in a way that requires the least amount of trust.

The SUI token serves four purposes on the Sui platform:

- SUI can be staked within an epoch in order to participate in the proof-of-stake mechanism.

- SUI is the asset denomination needed for paying the gas fees required to execute and store transactions or other operations on the Sui platform.

- SUI can be used as a versatile and liquid asset for various applications including the standard features of money – a unit of account, a medium of exchange, or a store of value – and more complex functionality enabled by smart contracts, interoperability, and composability across the Sui ecosystem.

- SUI token plays an important role in governance by acting as a right to participate in on-chain voting on issues such as protocol upgrades.

Key Features of Sui

SUI’s high scalability is built on two main innovations:

- MOVE programming language.

- Narwhal-Tusk consensus algorithm.

MOVE is its own programming language used to develop applications in the Sui blockchain. MOVE is based on RUST and developed by FB’s Libra project, it is designed for parallel execution.

Narhal-Tusk is the consensus algorithm in Sui blockhain, which separates the data transfer process from the transaction consensus process. So solve the problem Mempool – consensus in traditional blockchain designs like Ethereum & Bitcoin.

Based on the two inovations above, the Sui blockchain allows the network to scale horizontally, being able to support millions of transactions per second without requiring the node dedicated in the network (these nodes cannot run on normal computer hardware because they require powerful configuration for fast processing and more transactions, which means spending more money on hardware).

Benefits of holding SUI tokens

Two main use cases of SUI tokens in Sui Network:

- Transaction fee: SUI is used as the currency for gas payments for all operations on the Sui blockchain.

- Staking/bonding/slashing asset: Validators stake SUI to participate in the transaction consensus process. In case of fraud, their SUI tokens will be cut off as a penalty.

Who Are the Founders of Sui?

Sui was founded by a team of ex-Meta engineers: Evan Cheng; Adeniyi Abiodun; Sam Blackshear; George Danezis; Kostas Chalkias.

Before founding Mysten Labs, the company behind the Sui blockchain, the group of five worked in the Novi division. Mysten Labs secured backing from high-profile crypto VC funds like a16z, which invested $36 million in a Series A raise in December 2021. Another $300 million Series B announcement followed, putting the company valuation at $2 billion. Funds with a stake in Mysten Labs include: Jump Crypto, Apollo, Binance Labs, Franklin Templeton, Coinbase Ventures, Circle Ventures, Lightspeed Venture Partners, Sino Global, Dentsu Ventures, Greenoaks Capital, and O’Leary Ventures.

Tokenomic

Sui’s tokenomic is designed at the frontier of economic blockchain research, aiming to deliver an economic ecosystem and financial plumbing at par with Sui’s leading engineering design. For further details, refer to the tokenomics white paper: The Sui Smart Contracts Platform: Economics and Incentives.

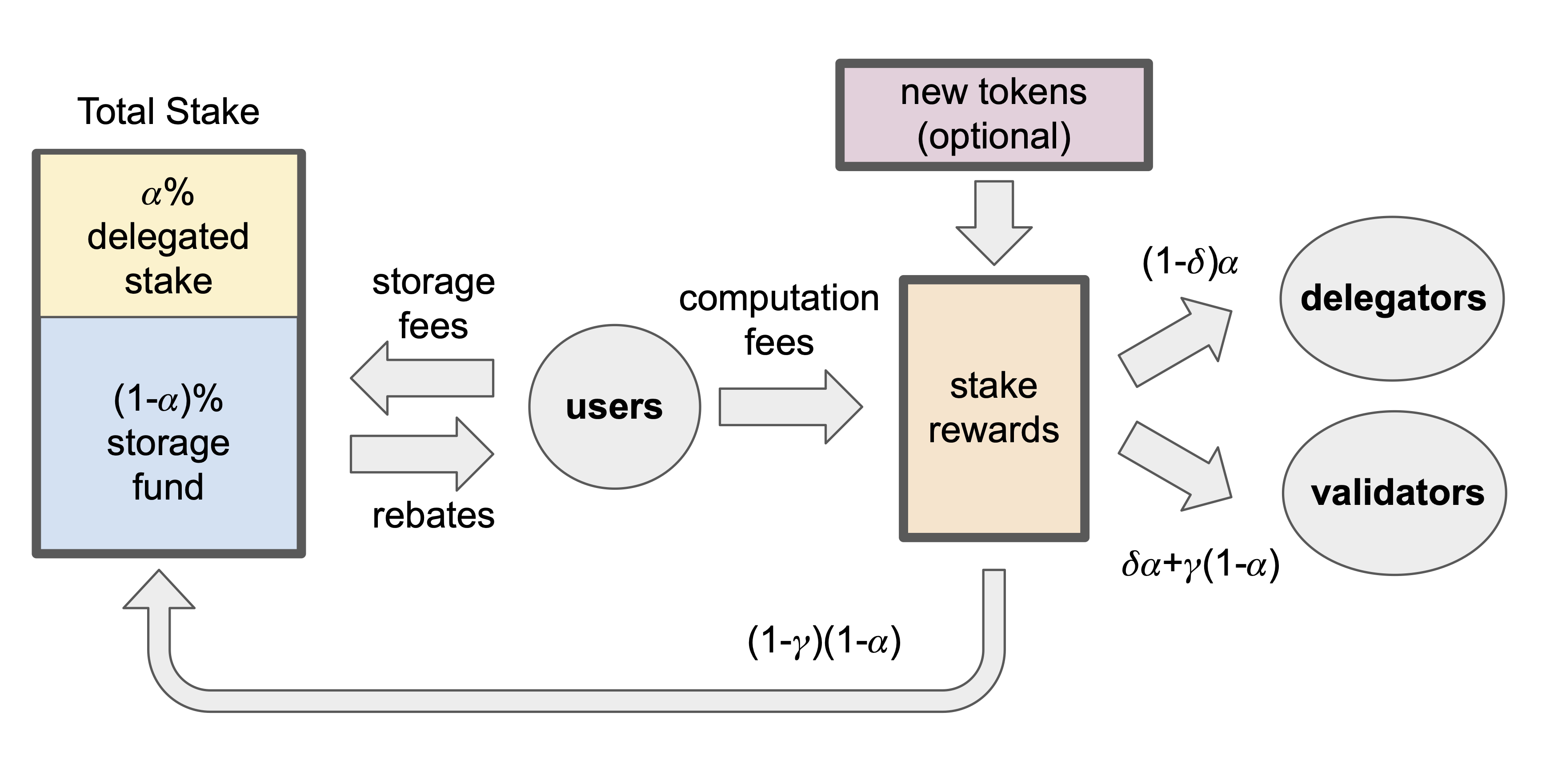

The Sui economy is characterized by three main sets of participants:

- Users submit transactions to the Sui platform in order to create, mutate, and transfer digital assets or interact with more sophisticated applications enabled by smart contracts, interoperability, and composability.

- SUI token holders bear the option of delegating their tokens to validators and participating in the proof-of-stake mechanism. SUI owners also hold the rights to participate in Sui’s governance.

- Validators manage transaction processing and execution on the Sui platform.

The Sui economy has five core components:

- First, the SUI token is the Sui platform’s native asset.

- Second, Gas fees are charged on all network operations and used to reward participants of the proof-of-stake mechanism and prevent spam and denial-of-service attacks.

- Third, Sui’s storage fund is used to shift stake rewards across time and compensate future validators for storage costs of previously stored on-chain data.

- Fourth, the proof-of-stake mechanism is used to select, incentivize, and reward honest behavior by the Sui platform’s operators – i.e. validators and the SUI delegators.

- Fifth, On-chain voting is used for governance and protocol upgrades (more info coming soon).

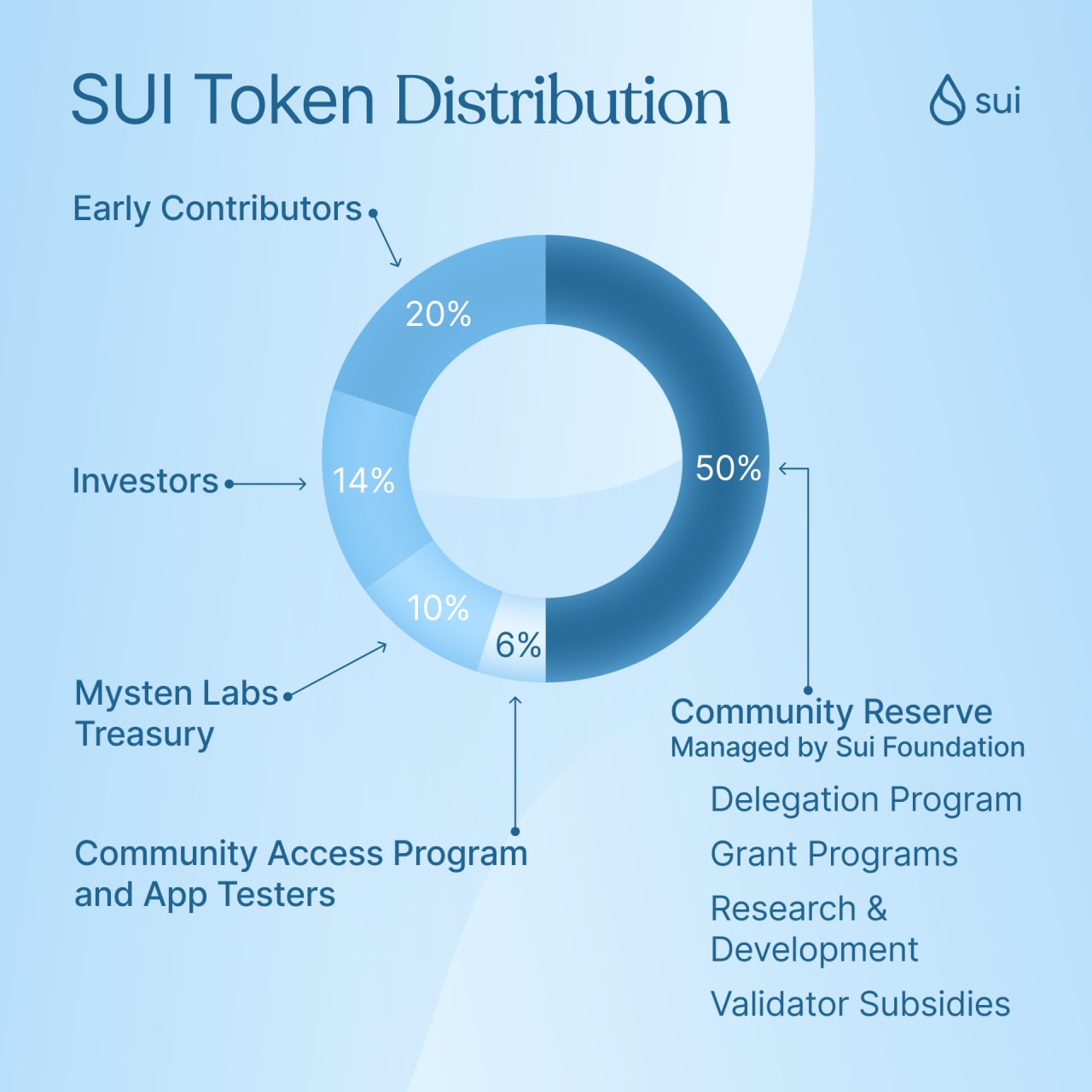

Sui Token Allocation

Early Contributors: 20%

Investors: 14%

Mysten Labs Treasury: 10%

Community Access Program and App Testers: 6%

Community Reserve (Managed by Sui Foundation): 50%

Sui Explorer

Sui Explorer lets you view data about transactions and activity on the Sui network. In addition to viewing activity on the network, you can use Explorer to:

- View up-to-date information about the activity and metrics on the Sui network.

- Look up, verify, and track your assets and contracts.

- Especially, utilize fast, reliable, and transparent debugging and auditing data to help identify and resolve issues.

- Get go-to-definition support for all smart contracts, referred to as packages in Sui.

- View validators and geographic locations of currently active full nodes.

Sui Wallet

You can use the Sui Wallet to create an address, complete transactions, mint NFTs, view or manage assets on the Sui network, and connect with blockchain dApps on Web3.

The early versions of Sui Wallet let you experiment with the Sui network for testing. The Sui network is still in development, and the tokens have no real value. Next, accounts reset with each deployment of a new version of the network. Then, view the devnet-updates channel in Discord for updates about the network.

Sui’s information channel

- Website: https://sui.io/

- Twitter: https://twitter.com/mysten_labs

- Discord: https://discord.com/invite/sui

- Medium: medium.com/mysten-labs

Disclaimer: The information in this article is not investment advice from CryptoChill. Cryptocurrency investment activities are not recognized and protected by the laws of some countries. Cryptocurrencies always carry many financial risks. So, do your own research before making any investment decisions based on this website’s information.

[…] Read more: SUI Token – All information about SUI […]

[…] Read more: SUI Token – All information about SUI […]