The ability to unstake ETH will be a crucial component of the planned Shanghai upgrade in March 2023. This adjustment is anticipated to improve the likelihood of ETH staking (when the risk of staking falls), while simultaneously expanding the liquidity staking market on ETH. As ETH can be readily transferred between protocols to maximize yield, several alternative LSD (Liquid staking derivative) protocols will have the potential to develop and compete with Lido (the protocol comprising the majority of ETH staking).

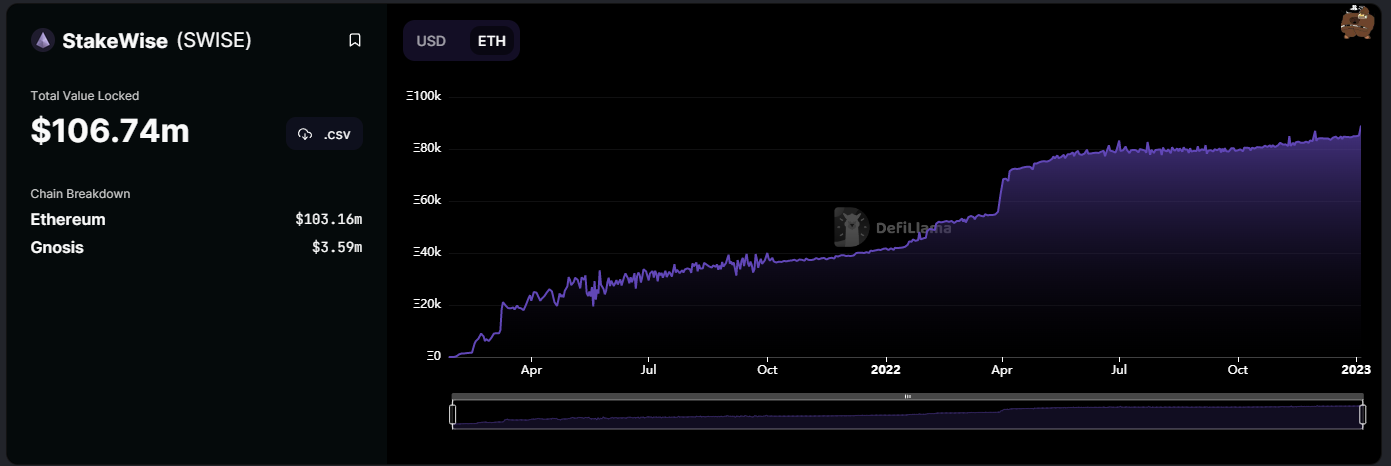

After Lido and Rocketpool, Stakewise is presently the third largest decentralized liquid staking system on the market. With ETH staked, the price of ETH remains at 90k and the MC/TVL ratio is only 0.16. (much lower compared to other LSDtocols).

Recent price increases for Swise can be attributed to the income from smart money. Who has purchased? Does investors sell #swise yet? Let’s discover below:

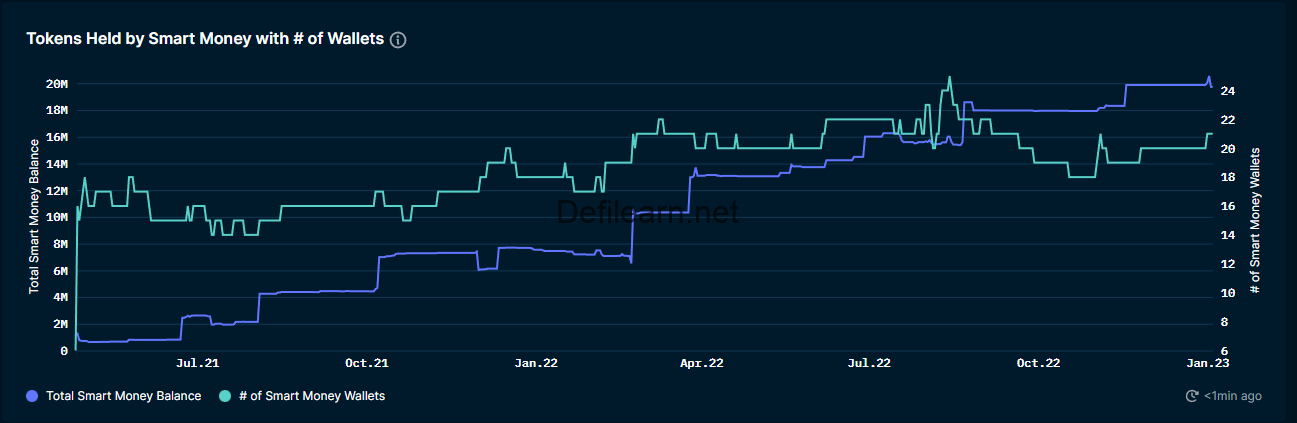

Smart money

The number of tokens accumulated by smart money increases over time.

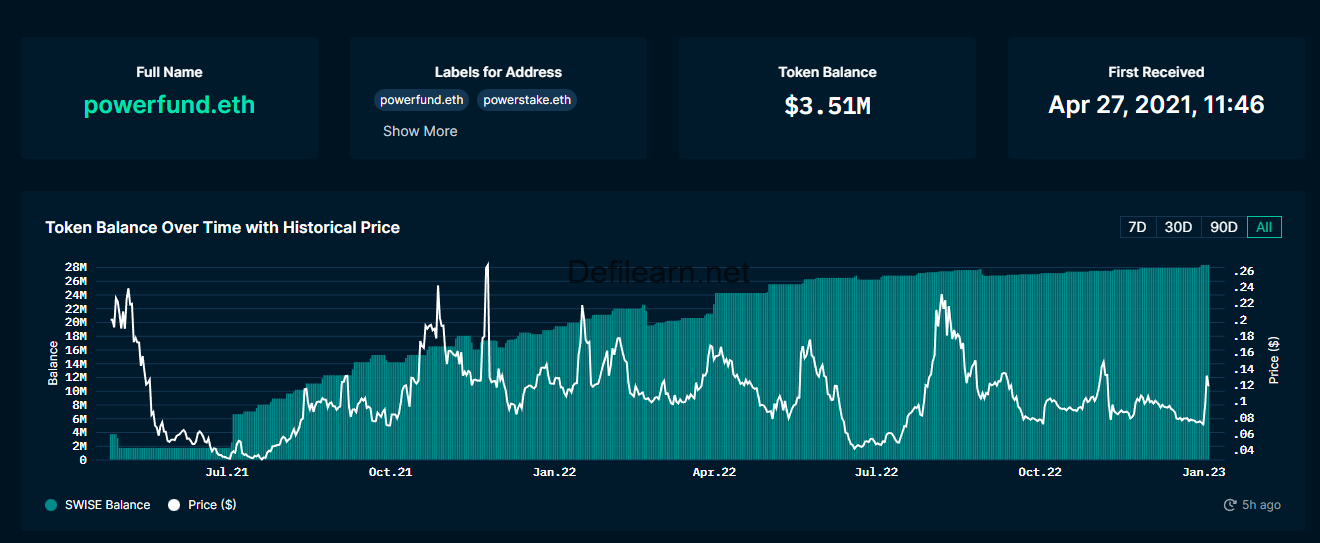

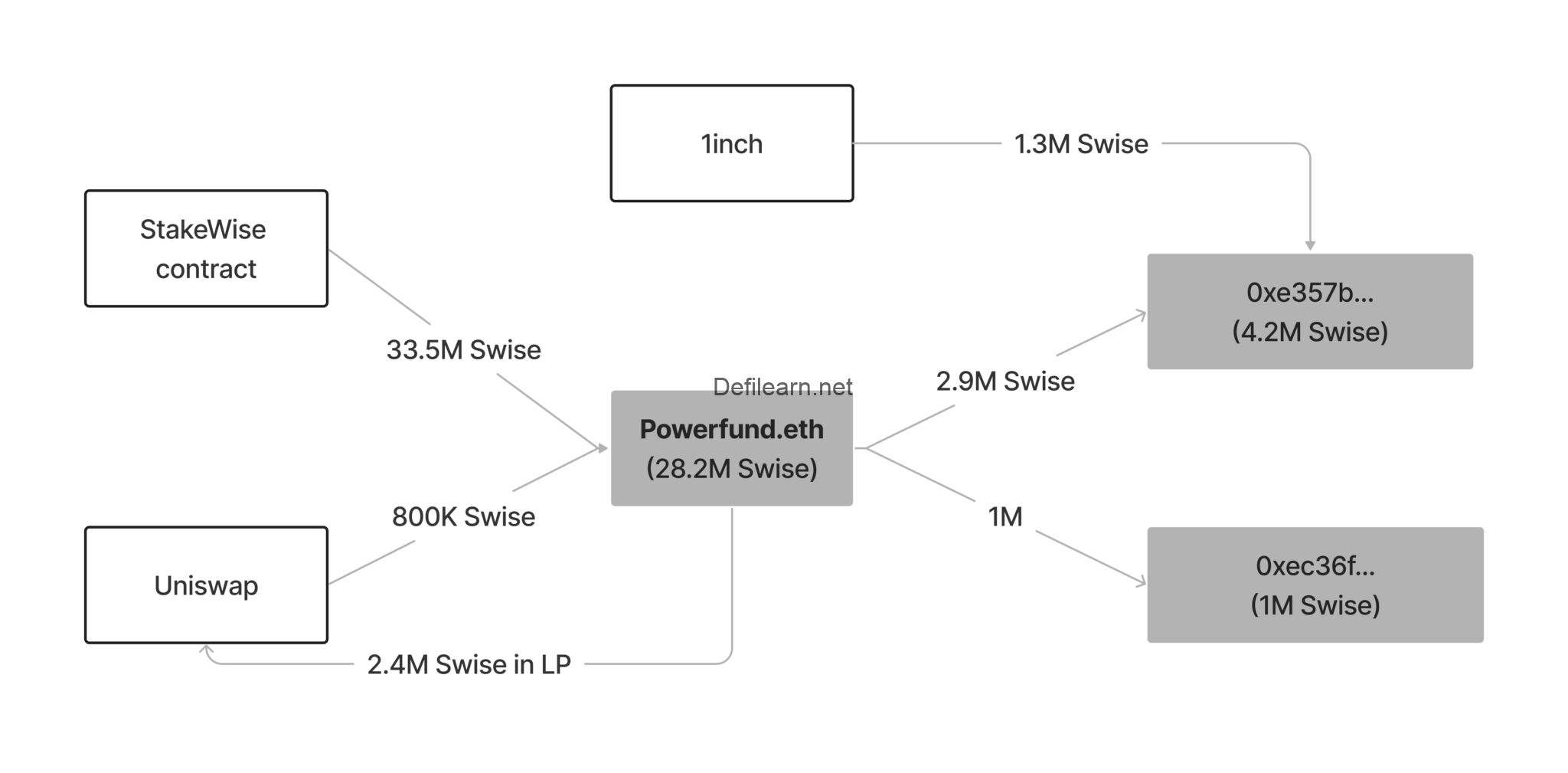

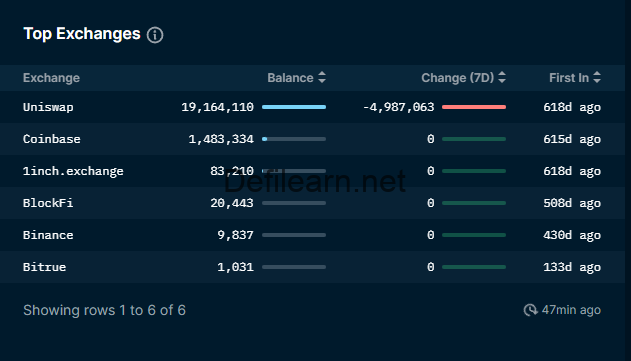

Currently, Powerfund.eth is the personal wallet holding the most Swise, with the majority of tokens coming from the project’s Reward contract and being constantly accumulated. A portion of the collected Swise is utilized to provide liquidity on Uniswap, 1inch, and to transfer funds to other sub-wallets. No wallet has yet to generate a profit.

Summary:

Powerfund.eth

– Obtained 33.5 million Swise from the contract for the project

– Acquired 800K Swise from Uniswap version 3.

– Moved 2,900,000,000 Swise to Sub-Wallet 1 0x357b… (1,600,000,000 Swise as 1inch-LP token)

– Transferred 1 Million Swise to Secondary Wallet 2 0xec36f44…

Current:

– Maintain: 28.2M Swise 3.51M$

– Provide liquidity: 2.4 million Swise ~ 288K$

Sub-wallets:

Sub-wallet 1: 0xe357b… retain 4.2M Swise (got from Powerfund.eth and bought from 1inch)

Second sub-wallet: 0xec36f44… retain 1M Swise (received from Powerfund.eth)

The overall value of Powerfund.eth and its sub-wallets remains at 35,8M Swise 4.3M USD, representing almost 20% of the total supply.

Investor wallets

When they have earned a large number of tokens through the Stakewise contract, the wallets 0x12822…, MLP investors (0xa0f7…), and individual investors (0x38051…) might be Investor wallets of the project. Currently, all wallets are holding and there are no signs of movement or profit taking.

Wallets with large buy/sell orders on DEX

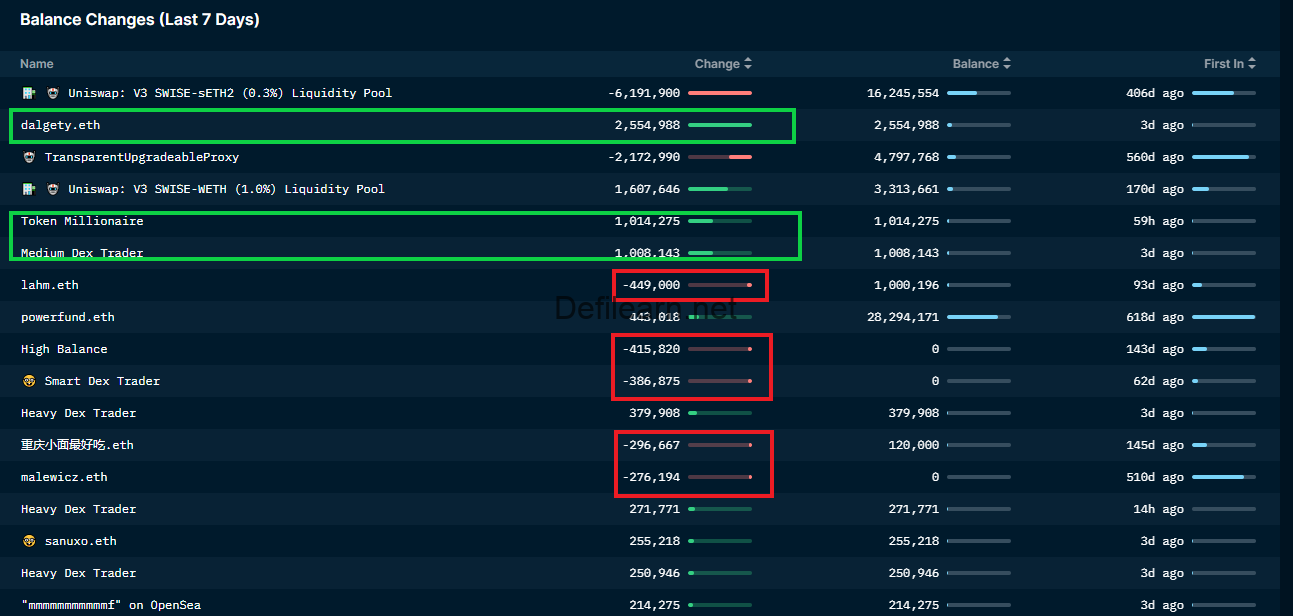

The amount of Swise purchased on Uniswap increased sharply as rumors of LSD spread out.

Several wallets have been purchasing in bulk at an average price of $0.12 to $0.13 since 2 January. There are three prominent dalgety wallets. eth (purchased for $2.5 million), millionaire token 0xfe0875… (purchased for $1 million), and Medium dex trader 0x6dbde.. (bought 1 million dollars)

When Swise remains between 0.12 and 0.13, there are also indications of profit-taking from Dex trader wallets. The majority of these are short-term investment wallets acquired by Swise during 8-11/2022. Nonetheless, the number is modest.

The bottom line

In recent days, there have been numerous good indications. However, Swise is currently a highly inflated cryptocurrency, and Powerfund’s wallet contains a vast quantity of tokens. eth and the project’s investors, this may have a detrimental impact on the price of Swise in the near future. It is vital to closely monitor these wallets at all times in order to swiftly respond to any variations.

Contact

Website: https://stakewise.io/

Whitepaper: https://docs.stakewise.io/

Twitter: https://twitter.com/stakewise_io

Discord: https://discord.com/invite/8Zf7tKyXeZ

Telegram: https://t.me/stakewise_io

Summing up

Through the above article, CryptoChill has helped you know about the StakeWise project and the highlights of the project.

Disclaimer: This post is not investment advice. You will be 100% responsible for your investment decisions.

Please follow and subscribe to support the CryptoChill.news.

No Comment! Be the first one.