In the rapidly evolving world of cryptocurrencies, stablecoins have emerged as a surprising ally in bolstering the supremacy of the US dollar on the global stage. Contrary to some concerns that digital currencies could undermine the dollar’s dominance, stablecoins are proving to be a key driver of dollar adoption, particularly in non-US markets.

Demand for Dollar-Denominated Stablecoins Surges Globally

The recent remarks by Circle’s CEO, Jeremy Allaire, shed light on the significant demand for dollar-denominated stablecoins, such as USDC, originating from international users. Impressively, 70% of the demand for USDC hails from outside the United States. Notably, emerging economies are driving this surge in demand, showing strong interest across Asia, LATAM, and Africa.

Tether (USDT), the leading stablecoin issuer, echoes this sentiment, emphasizing the pivotal role of emerging markets in driving the ongoing adoption of USDT. For individuals residing in nations with volatile domestic currencies, stablecoins provide a powerful tool to hedge against inflation without the need for a USD-based bank account or holding physical cash.

Former Binance US CEO, Brian Brooks, highlighted the growing clamor for dollar-denominated stablecoins among citizens of countries plagued by high inflation rates. In regions where acquiring a dollar bank account is a challenge, stablecoins step in as the optimal solution for safeguarding earned money. Brooks even suggested that this demand surge could potentially “make the dollar relevant again.”

Leveraging Stablecoins to Cement Dollar Supremacy

While the global demand for stablecoins creates an opportunity to bolster the dollar’s dominance, Brooks cautioned that seizing this chance requires a well-defined regulatory framework. He critiqued the US government for stifling stablecoin adoption by not establishing appropriate regulations.

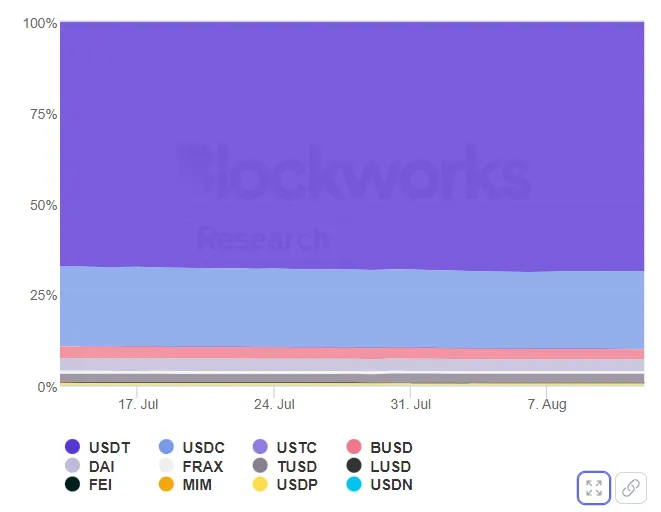

Stablecoin issuers, like Tether, now hold a critical position in the global economy, with assets under management reaching $81.8 billion in May, comparable to a small American bank or a substantial bank in an emerging economy. The market share dominance of USDT in the stablecoin arena, representing over two-thirds of the total supply, reinforces its sway. Meanwhile, alternative stablecoins, like BUSD, have faced a declining market share.

It’s crucial to note that the top competitors to USDT are also denominated in US dollars, setting a distinct trend. In contrast, the market for stablecoins tied to other currencies, such as the digital pound or euro, remains relatively small.

As the data suggests, the US dollar continues to assert its formidable influence in the global economy. The reign of dollar-pegged stablecoins, coupled with their escalating adoption, is poised to reinforce this position. However, ensuring the long-term success of this strategy necessitates swift regulatory actions, and the United States must seize the opportunity to pave the way for the enduring strength of both stablecoins and the dollar.

In an ever-fluctuating financial landscape, the convergence of stablecoins and dollar dominance might be the game-changer that keeps the US dollar firmly at the forefront of global transactions.

Disclaimer: The information in this article is not investment advice from CryptoChill. Overall, cryptocurrencies always carry many financial risks. Therefore, do your own research before making any investment decisions based on this website’s information.

No Comment! Be the first one.