Stablecoins are a type of cryptocurrency that are designed to maintain a stable price. There are four main types of stablecoins: fiat-backed, commodity-backed, crypto-backed, and algorithmic. Each type has its own advantages and disadvantages. Learn more about the different types of stablecoins and how they work.

Read also: Stablecoins: How They Came to Be (Part 1)

Distinguish 4 types of stablecoins

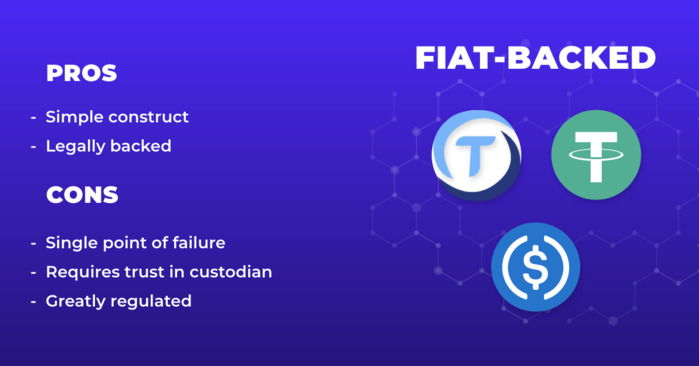

Fiat-backed stablecoins

Fiat money is government-issued money that is not backed by physical goods. Its value is kept by a balance of supply and demand. Most fiat-backed stablecoins are backed at a 1:1 ratio. For instance, USD Coin (USDC) is a stablecoin that is backed 1:1 by the US dollar, which means 1 USDC is equal to 1 USD.

Crypto-backed stablecoins

These are stablecoins that are backed by crypto. Since cryptocurrencies are inherently unstable, it is not possible to pegged a stablecoin at a 1:1 ratio. Instead, crypto-backed stablecoins are more often collateralized. It is meant to make up for the fact that the collateral’s price could go up or down a lot. People often use the phrase “commitment to confidentiality” to describe this process.

For example, the stablecoin Dai (DAI) can be borrowed from the MakerDAO lending platform as long as the borrower deposits some crypto collateral. Collateral can be either USD Coin (USDC), Ethereum (ETH), Basic Attention Token (BAT), or Compound Token (COMP). Anyone who wants to borrow DAI must deposit more collateral than they withdraw. And if their collateral loses too much value after being deposited, they might have to sell it to pay back the DAI they borrowed.

Another example of a crypto-backed stablecoin is Wrapped Bitcoin (WBTC). Although this coin exists on the Ethereum blockchain, it is backed by Bitcoin. In fact, the Wrapped Bitcoin project currently holds over 280,000 BTC as a reserve for WBTC.

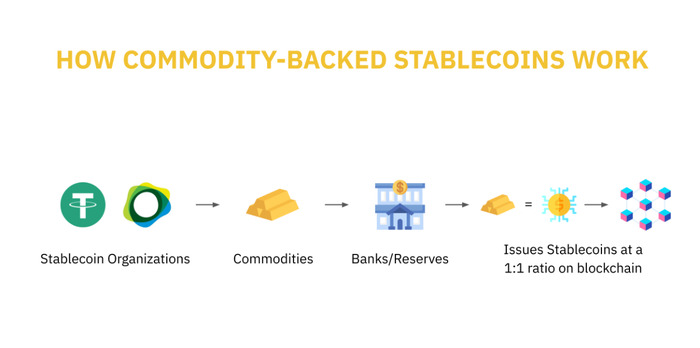

Community-backed stablecoins

These are stablecoins that are backed by physical commodities like gold, silver, or oil. This stablecoin can be backed by anything from cash to real estate. As a result, you can see that commodity-backed stablecoins are a digital version of a real-world asset.

Investing in a commodity-backed stablecoin, such as one backed by gold, gives the investor something of equal value and can be liquidated at any time. Commodity-backed Stablecoins may be a safer way to invest because the value of these assets is not nearly as volatile as that of fiat currency or cryptocurrencies.

Gold is the most popular collateral to use for commodity-backed stablecoins. Take for example Paxos Gold (PAXG). The value of one PAXG is pegged 1:1 to the value of a London Good Delivery gold bar.

Algorithmic stablecoins

The Algorithmic stablecoin is another stablecoin that has become more popular over the past few years. Stablecoins that are based on algorithms aren’t tied to a reserve asset like the US Dollar. In other words, it uses an algorithm that can make more coins when the price goes up and buy them back and burn them when the price goes down.

TerraUSD, which is an algorithmic stablecoin pegged to the US dollar, maintains its value by burning Luna (LUNA). If Terra’s price exceeds $1, some of that asset will be burned, but if it falls below $1, some LUNA will be burned.

However, a series of events led to investors selling off their USTs, causing the supply to skyrocket. And, as usual in the crypto industry, the price of a coin has the potential to plummet if demand is low and supply is high. This also caused a massive collapse in the LUNA price.

The UST/LUNA fiasco shows how risky algorithmic stablecoins are. Price instability is likely to happen if there is no legal collateral. In return, algorithmic stablecoins don’t need to be centralized or controlled by a central entity. This is a sign of the decentralized structure that crypto fans trust and respect.

Conclusion

Stablecoins have a considerably better level of trust in terms of value than other cryptocurrencies. The risk of a stablecoin fall is significantly lower than the risk of a cryptocurrency crash, even though it has happened in the past. As a result, stablecoins are viewed as more secure by the crypto community. Hopefully, the above article has helped you better understand the birth and role of Stablecoin.

Disclaimer: The information in this article is not investment advice from CryptoChill. Overall, cryptocurrencies always carry many financial risks. Therefore, do your own research before making any investment decisions based on this website’s information.

No Comment! Be the first one.