What is leverage yield farming ?

Leveraged yield farming is a strategy that combines the concepts of leverage and yield farming to potentially amplify returns in decentralized finance (DeFi) protocols. Let’s break down the key components:

- Yield Farming: Yield farming, also known as liquidity mining, is a practice where users provide liquidity to decentralized platforms, typically by depositing their cryptocurrency assets into smart contracts. In return for providing liquidity, users earn rewards, often in the form of additional tokens or fees generated by the platform.

- Leverage: Leverage refers to the practice of borrowing additional funds to increase the potential return on an investment. In traditional finance, this can involve borrowing money from a broker or institution. In the context of DeFi, leverage is often achieved through borrowing against collateralized assets using smart contracts.

Leveraged yield farming combines these two concepts by utilizing borrowed funds to increase the amount of capital deployed in yield farming strategies

About Camelot

Camelot is an ecosystem-focused and community-driven DEX built on Arbitrum.

Camelot has been built as a highly efficient and customizable protocol, allowing both builders and users to leverage our custom infrastructure for deep, sustainable, and adaptable liquidity

Feature-rich AMM

Camelot is based on a dual AMM able to support both volatile (UniV2) and stable (Curve-like) swaps and is also adding dynamic directional fees for their trading pairs, which allows various fees to be set for each pool, as well as varying fees depending on the direction of the swap (buying/selling).

Next-gen yield & incentives

A key feature for Camelot is the introduction of a brand new liquidity approach based on non-fungible staked positions.

These yield-bearing positions act as an additional layer on top of the usual LP tokens, adding new features that will benefit both users and protocols:

- The handling of locks on staked positions and their associated yield boosts

- Significantly improving capital efficiency through the introduction of various custom staking strategies

- A unique re-usability, whether it’s through our own protocol with for instance our Nitro Pools, or through the unlimited potential of external implementations

Permissionless

Camelot firmly believe that offering to protocols the right to directly interact with Camelot without any consent nor intervention from the team is essential, and that this should be the absolute standard for a modern AMM.

Through our permissionless Nitro Pools, projects have a full control on their incentives, and have extremely flexible options to build the exact type of liquidity they need to thrive. Whilst protocols will have full control to incentivize and manage their liquidity how they like, Camelot will additionally provide a tailored strategy to help achieve their goals.

Camelot custom launchpads will also be completely permissionless to give all projects the equal opportunity to bootstrap their token launch and liquidity, along with several models to choose from to cover every different need. Camelot itself will launch through the launchpad, and we therefore see it as a viable option that allows teams to raise funds and liquidity in a completely decentralized and community-driven way.

Long-term sustainability

Camelot is based on a dual token system, consisting of the native liquid GRAIL and its escrowed version xGRAIL, a non-transferable governance token, both being used as farming rewards.

Most emissions are distributed in xGRAIL, providing a high level of control on the supply flow on the market. This allows us to create a healthy balance between attractive incentives to grow initial liquidity, whilst ensuring that we are preparing for the long-term health of the protocol.

The set up of a supply hard cap, carefully crafted emissions and additional deflationary mechanisms, will be another important piece of the puzzle to ensure long-term sustainability of Camelot’s tokenomics.

Protocol earnings, initially coming mostly from the swap fees, will be partly redistributed to the xGRAIL users in the form of real yield, and used on buy back & burns in order to maintain a constant buying pressure on GRAIL.

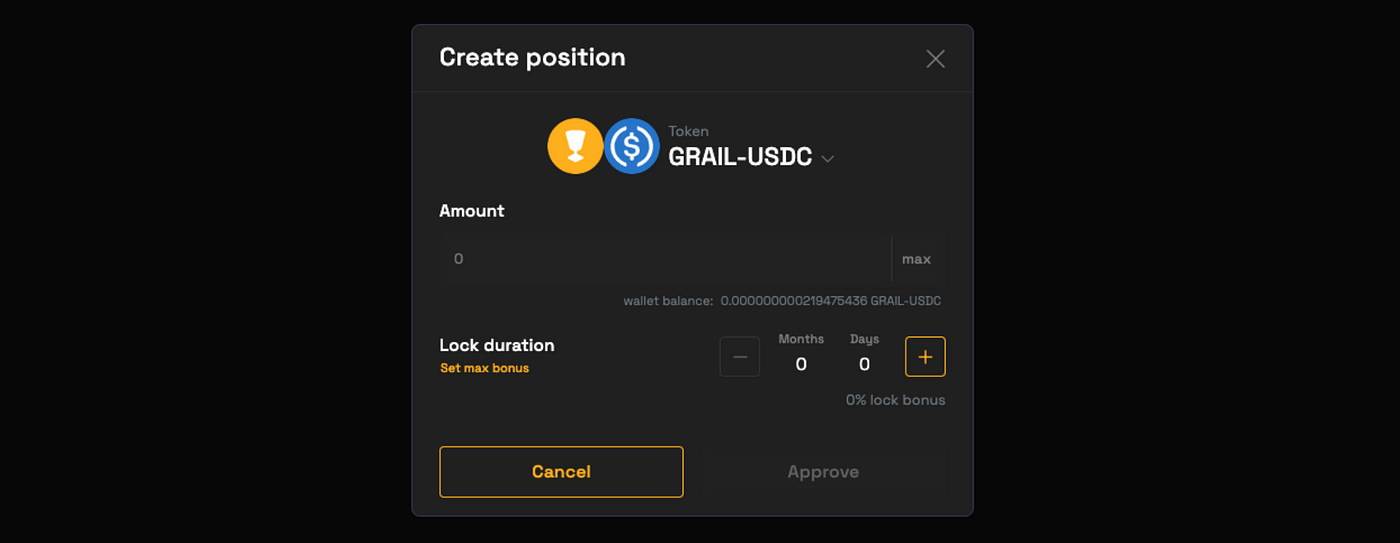

For Camelot Farmers

- First, swap to the exact amount (for single token holders only)

- Supply a pair of tokens to provide liquidity

- Create a staked position (spNFT)

- Look for available Nitro Pools and stake in them if they are accessible

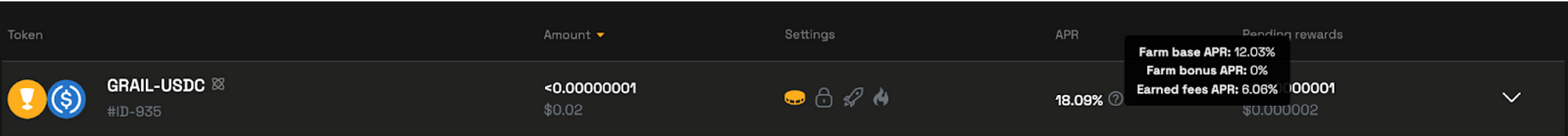

- Check yield farming

Providing a more through view of yield farming performance

About Single Finance

Single Finance is a super intuitive platform to all your DeFi investments minimizing correlations to the general market. At Single Finance, we deeply value the progress and innovation of DeFi

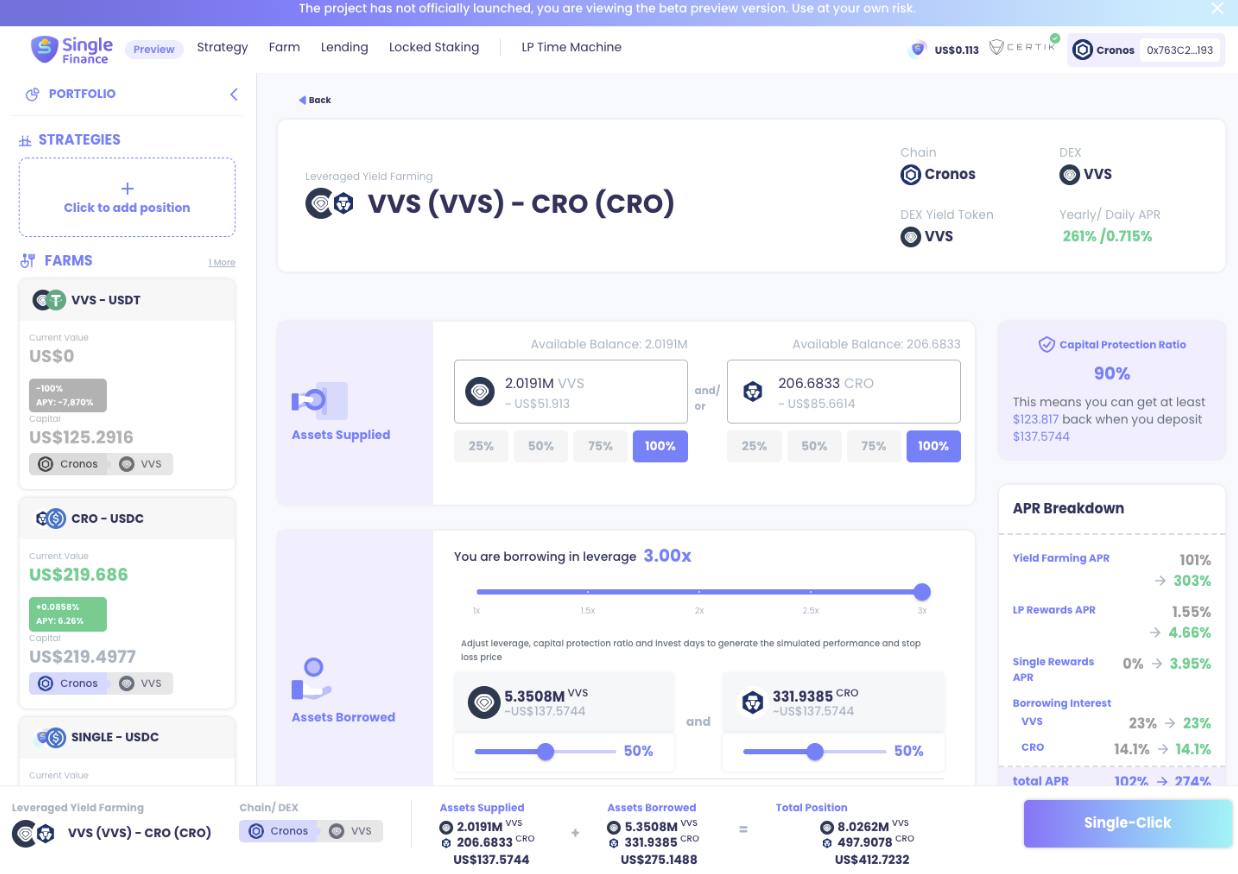

Single Finance has joined forces with Camelot (DEX) to offer users a seamless and convenient leverage yield farming experience. Everything here is worked out from your injected capital in USD. Everything is visualized. And everything is within your fingertips.

For Single Finance Farmers

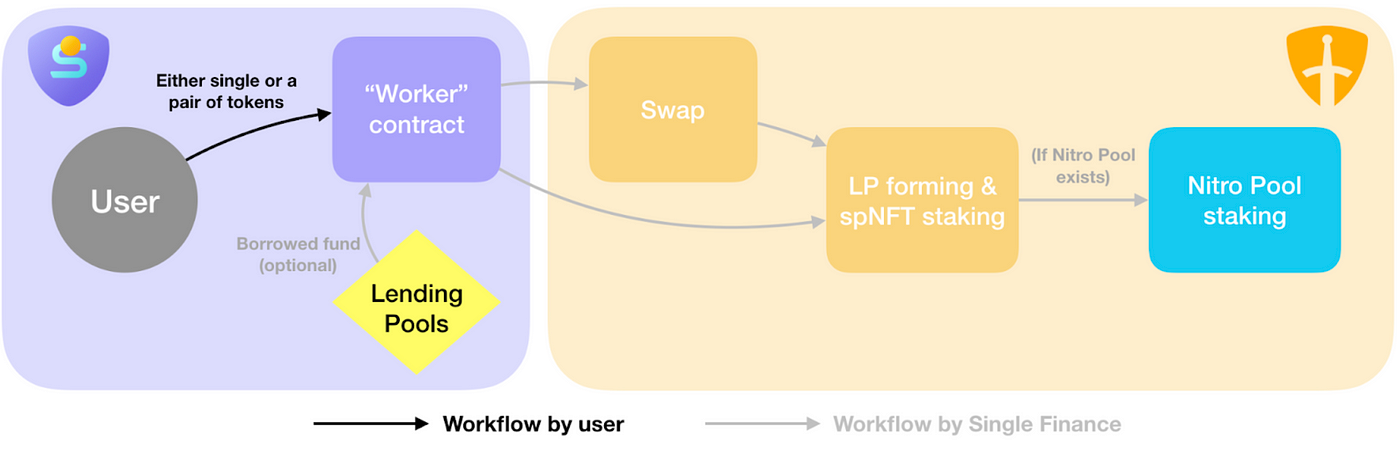

Everything become simple with “Single-Click”

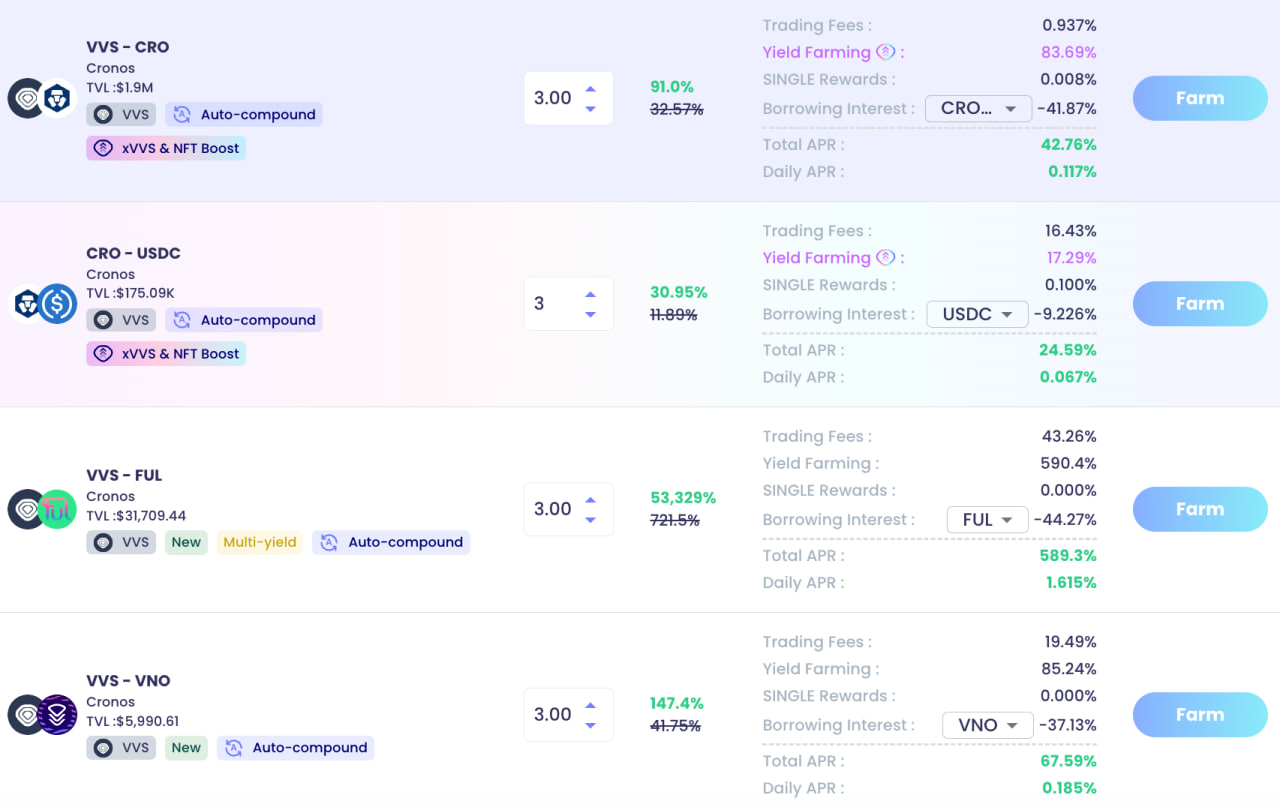

- Choose your favorite farm from available farm list

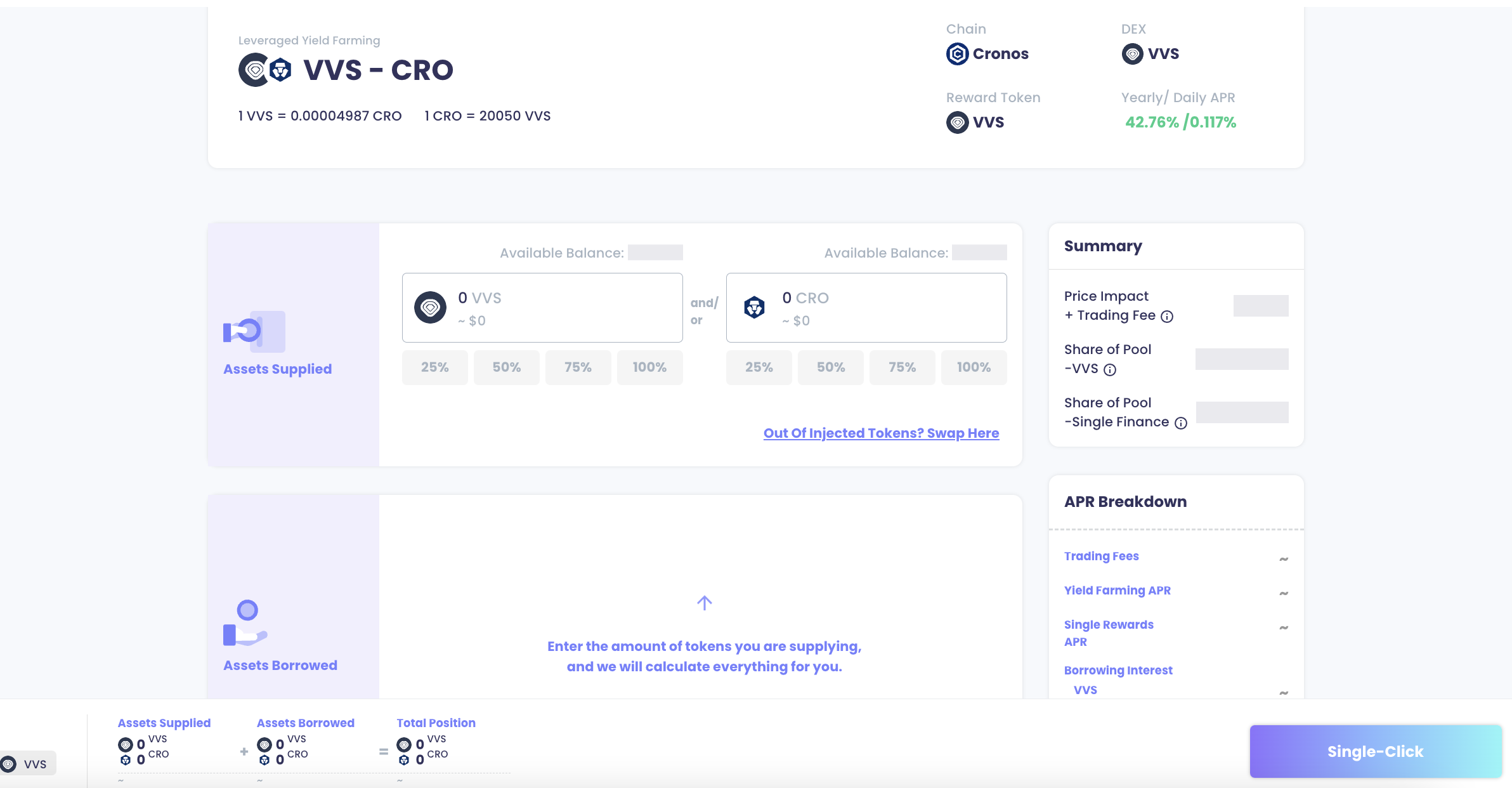

- Select your leverage level and borrowable asset to simulate the performance. Then click “Farm”

- Supply either one of the assets or both assets, then it will trigger the calculation of the borrowed assets

- You may adjust the leverage and ratio of borrowable assets (if there are two available borrowable assets)

- You can also set your favorite capital protection ratio from 0% – 90% (i.e. 0% means no capital protection mechanism is set).

- After configuration, you can click “Single-Click” button. Please note you may have to approve the amount in the wallet for the first time before opening the farming position.

Workflow of yield farming on Single Finance

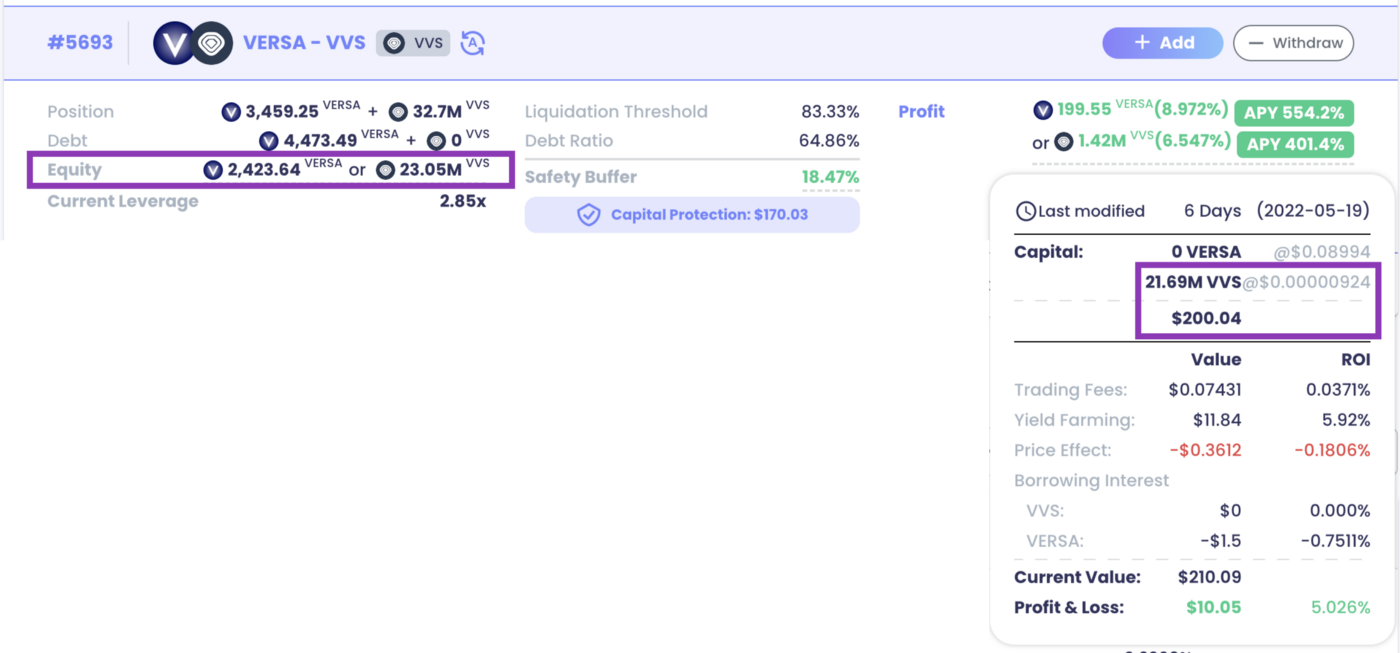

Single Finance offers a Token-based view on leveraged yield farming. “My Farming Positions” is defaulted to show the performance in token amount, which allows users to review their position return in terms of number of tokens rather than USD value

Specially designed for organic yield farmers

On the other hand, the newly added “Token Amount” view shows the position status in terms of both farming tokens. We use the same farming position as quoted previously in the “USD Value” view for illustration. All the profit and loss would be shown in token-based, like below:

How the users can benefit from the integration

There are numerous benefits that users can enjoy by utilizing Single Finance. Here is a list of some of the key advantages

- Save time on calculation, simulation and multiple operations

- The rebalancing amount is based on the “Net” delta value, so it minimizes the transactional cost as well as Price Impact.

- Completes complicated steps with just a Single-Click

The yield Farming View is a key for farmers well-known about their position performance, let us summarize the benefits of the Token-based view by Single Finance and others

| Display Items | With Single Finance | Without Single Finance |

| Projected trading fee % | Yes | Yes |

| Projected farming yield % | Yes | Yes |

| Real Trading Fee Amount | Yes⭐ | No |

| Real Trading Fee | Yes⭐ | No |

| Real Farming Yield Amount | Yes⭐ | No |

| Real Farming Yield ROI | Yes⭐ | No |

| Effect on token price change | Yes⭐ | No |

| Farming Profit in token-view | Yes⭐ | No |

| Overall farming ROI (%) | Yes⭐ | No |

Let us summarize the difference between Farm with Single Finance with Normal Farming :

| Farm with Single Finance | Normal Farming | |

| Step involved in position opening | 1⭐ | 3-4 |

| Time used in position opening | 45s⭐ | 6m 30s |

| Gas used in a position opening | 0.00040 ETH⭐ | 0.00059 ETH |

| Locate Nitro Pool | Auto locate and stake⭐ | Manual Search |

| Time used in liquidity removal | 20s⭐ | 3m |

Social Media Single Finance

Website: https://app.singlefinance.io/single-click

Twitter: https://twitter.com/single_finance

Discord: https://discord.gg/bG8CFrTtCA

Telegram: https://twitter.com/single_finance

Medium: https://blog.singlefinance.io/

Gitbook: https://docs.singlefinance.io/home/

Audit report: https://skynet.certik.com/projects/singlefinance#audit

No Comment! Be the first one.