You found an interesting crypto project, but you’re not sure if it’s safe to put money into it. At this time, having the ability to assess and analyze information is really important to help you make better decisions. To protect ourselves from falling victim to cryptocurrency and other types of financial fraud, let’s read the following article together to get knowledge about and analyze some of the factors that comprise a potential crypto project.

Vision

The mission and vision of a crypto project may not be a major determinant of future growth. Because many projects have made big promises about a revolutionary new technology that will change the world or at least shake up the whole blockchain industry. However, these promises are unlikely to come true and be feasible.

You should put more effort into finding projects that have a clear value proposition and a new approach to solving real-world problems. Creating value and the capacity to find solutions to issues are what make a project a worthwhile investment of both your time and money.

Here are some questions you should consider when looking at the mission, the vision of a blockchain project:

- Is there any specific solution to this issue?

- Is the blockchain-based method better than the traditional one?

- Is the project token really needed?

- Are the benefits clear and measurable?

Read also: What is a Scam? Common Crypto Scams to Avoid

Team

One of the most important factors that will determine the success of a project is the quality of the team working on it, especially their resumes and work experience. At the same time, you should also take a deeper look at the project’s team of advisors and partnerships, because advisors can become a unique factor as there are more and more competitors.

- Here are some questions you should think about when looking at the Blockchain project team:

- How well the people on the project team have done their jobs.

- What was the outcome of these projects?

- Are there any reports of scams involving team members?

- How experienced are the advisors?

- What contributions do the advisers make to the overall success of the project?

Market potential

Before you invest in a crypto project, you should think about whether or not it will be useful to a certain group of users. If yes, how. Also, the market that the project is focusing on is really potential compared to the size of traditional companies in the same field or not.

Overall, if you want to get an impressive return on your project investment, you’ll need a sizable market that can drive significant demand for the project token. There are two ways to figure out the market potential of a crypto project, which are:

- Take an in-depth look at the structure, characteristics, and size of the target market.

- If the project is customer-focused (B2C), you should consider the project’s social media channels. Pay attention to the size of the user base, and the enthusiasm of the community for the project in the given time period. For example, if an ICO round sells out in a short time and there is a friendly, active community, that shows real trust and could help the project succeed.

Here are some questions you should consider when evaluating a blockchain project’s market potential:

- How many potential users are there?

- Compare the token of the project you want to invest in with other projects that have been successful.

- Does the project have the potential to change the current market?

- Is the target market growing or shrinking?

- How many competitors are there?

- What makes the project different from the competition?

- What is the overall trend for this market?

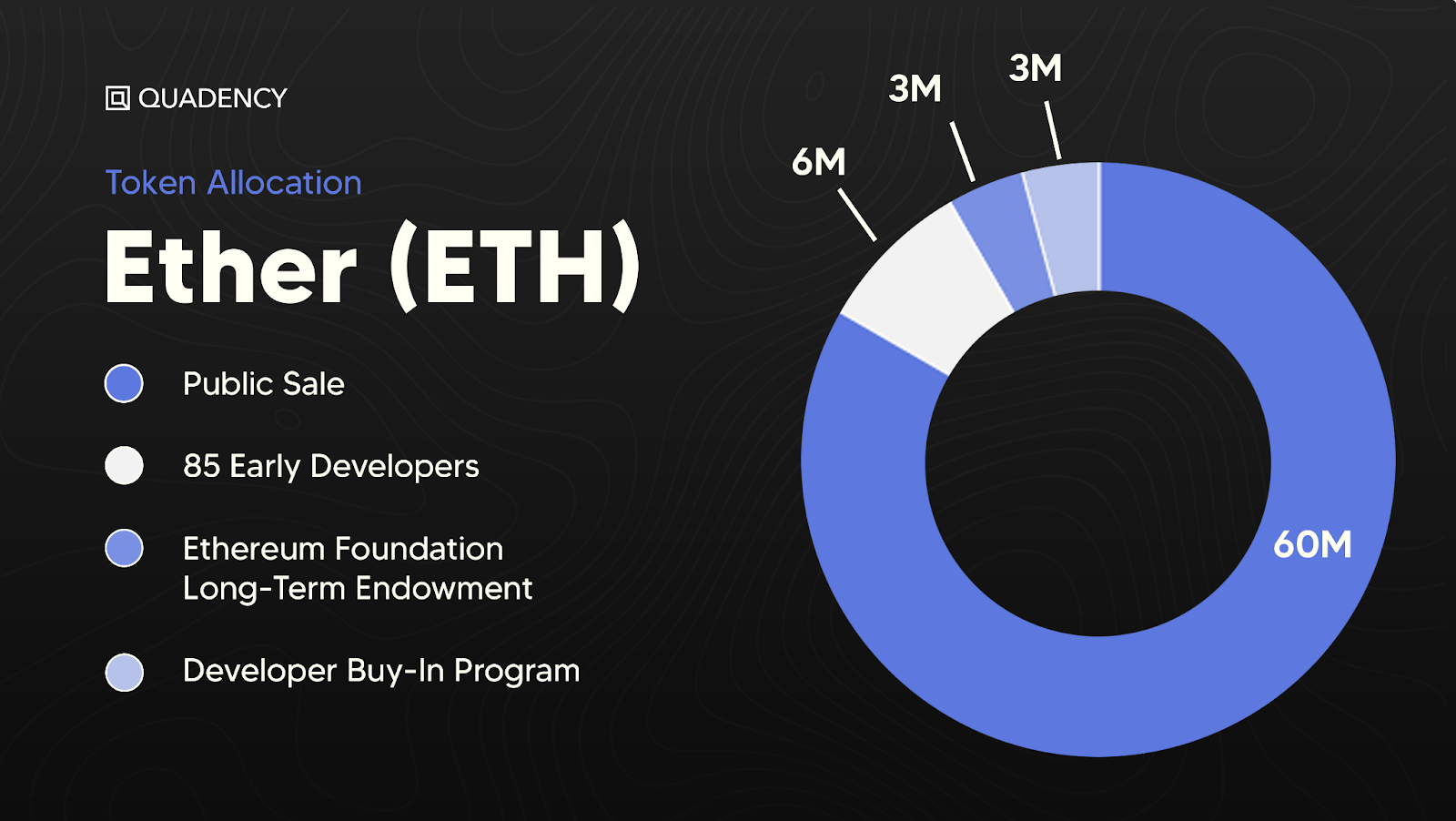

Tokenomics

Tokenomics describes the design of the token, as well as how it works within the project ecosystem. The project needs to create demand for tokens among users, such as using them as a means of payment for specific products/services in the network or participating in maintaining the stability of the network.

A good Tokenomics design should include the following:

- Deliver value to all parties involved.

- There is a real function.

- Reward users and investors for early adoption.

- Reward users for attracting new users to the network.

- Provide long-term incentives for token holders.

On the other hand, it is also necessary to pay attention to the following criteria:

- Price per token.

- Total circulating supply.

- Market capitalization (Price multiplied by total supply).

- Trading Volume (Is the amount of cryptocurrencies traded in a given time, usually 24 hours).

- Time required to transfer tokens from wallet A to wallet B.

Roadmap

Even if you have a great idea, without a specific, detailed, and accurate development roadmap, it might not be successful. Most blockchain startups are very open about how they will promote the distribution of tokens as well as plans in the project development roadmap. Roadmap is an important aspect that helps evaluate a blockchain and crypto startup. It gives the investor an overview of what is planned and what the project is aiming for.

The best roadmap should clearly show the plan for the next 24 months. Never underestimate what is outlined in the project roadmap. Keeping the trust of the community depends on following the proposed order and making progress all the time. Here are some important questions to consider when evaluating a blockchain project roadmap:

- Does the roadmap have a clear and realistic strategy?

- What is the team’s marketing strategy?

- What percentage of the roadmap has been completed?

Product

Take Ethereum as an example. The Ethereum project provides a comprehensive and clear White Paper. Some competitors, like EOS, NEO, LISK, etc., said they can solve the technical problems Ethereum is facing. But so far, no real competitor has been able to beat Ethereum, and it still holds the most important market share in the crypto space.

The current block time of the Ethereum blockchain is 15 seconds. Many use cases and decentralized applications are built based on blockchain and its smart contracts. Besides, the Ethereum roadmap shows clearly what plans are for the future.

Community

Building a strong community promises to greatly benefit the project in different ways. Customers are provided with full information about the project, which enables them to understand the product, fostering brand loyalty and providing positive feedback. All of these are important factors that will drive a strong growth platform in the future.

If people are extremely concerned about your product, you can talk about it in casual conversation, whether it’s online or in person. Therefore, the project should focus on developing social channels such as Telegram, Slack, Twitter or Discord for the purpose of building, nurturing, engaging and encouraging the community.

Network

In the medium to long term, the success of a project is highly dependent on network effects. The more users, fans, and investors there are, the easier it is for everyone to use the project token. The goal of the project network is to increase the number of people who own, use, or have heard of a certain crypto project.

For example, the Bytecoin (BCN) project has nearly 7,700 Twitter mentions and 350 News mentions in a month, and Reddit community reaches over 13,000 people and has 44,000 Twitter followers.

Conclusion

Before investing in a project, you should do extensive study on it if you want to see profits over the long run. This guarantees that the risk is as low as possible while also maximizing the possibility of profit. Hopefully, the above analysis should have given you a good overview and a big picture of what it takes to evaluate a great project.

Disclaimer: The information in this article is not investment advice from CryptoChill. Overall, cryptocurrencies always carry many financial risks. Therefore, do your own research before making any investment decisions based on this website’s information.

No Comment! Be the first one.