Canto was an extremely “hot” Layer-1 in the past, when the project’s token increased by more than sixfold in less than one month. Numerous KOLs also mentioned Canto on Twitter. Consequently, what is this project, and should it be funded at this point? Let’s discover together in this tutorial!

What is Canto (CANTO)?

Canto (CANTO) is a Layer-1 project launched in August 2008 with the intention of building DeFi in accordance with its goals: decentralized, decentralized, inexpensive, and accessible.

Canto is based on Cosmos’ Tendermint consensus mechanism, which is managed by Canto Validation Nodes, while the execution layer is EVM via the Cosmos SDK builder.

Original Canto core products include:

- Canto DEX: a free DEX for liquidity providers.

- Canto Lending Market: a pool lending folk from Compound v2.

- Stablecoin NOTE: is a stablecoin issued by Canto Lending Market.

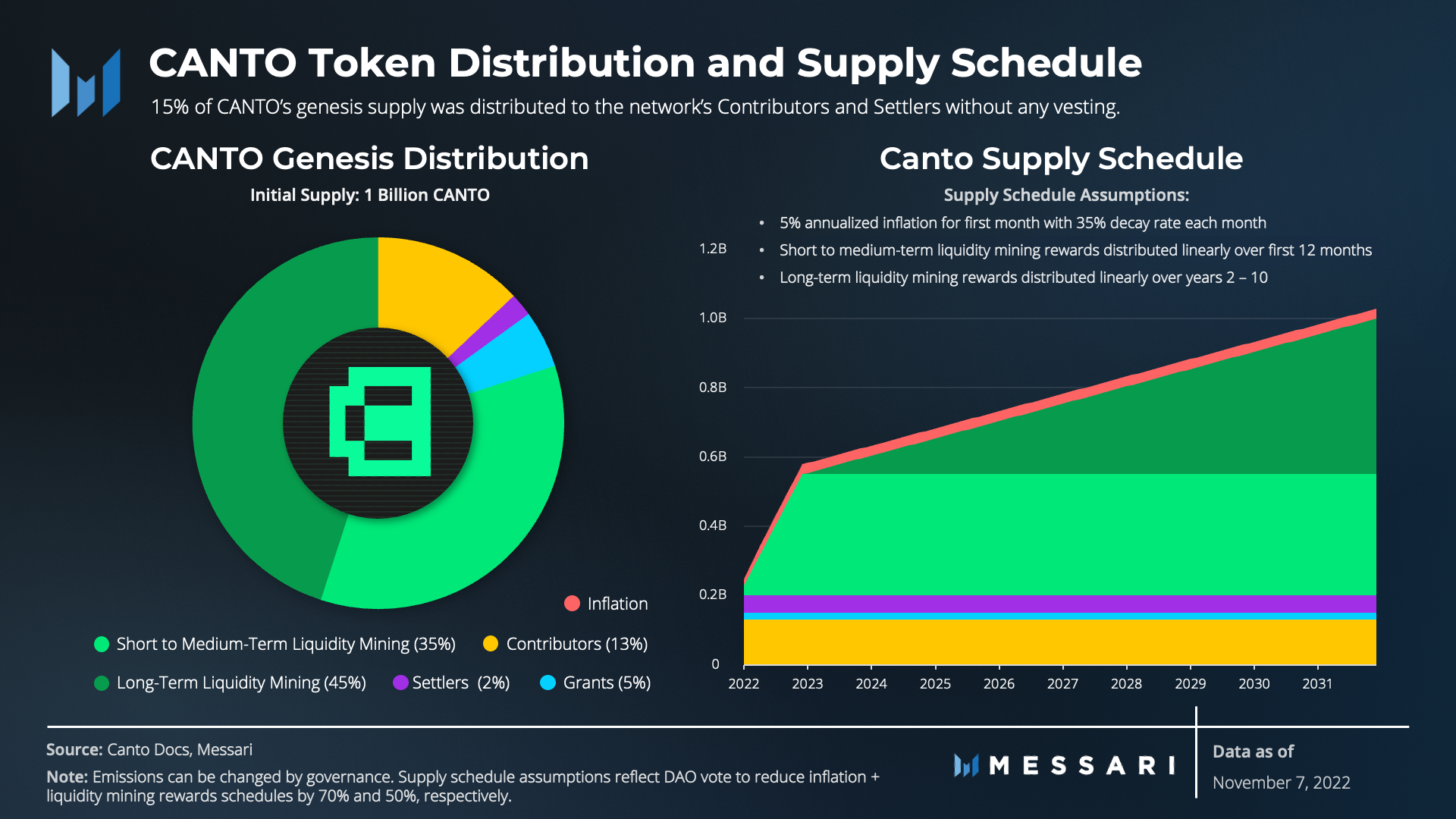

The project’s native token is CANTO. The initial total supply of CANTO tokens will be one billion (1 billion). Depending on the needs of the network, CANTO may continue to inflate and increase total supply in the future.

This article provides further information regarding CANTO.

CANTO is currently utilized primarily for staking and as a reward for Liquidity Mining, but it can also be utilized for governance. Specifically, you should note the following regarding the distribution of tokens for Liquidity Mining activities:

- In the next 5-10 years, 45% of the tokens will be used to reward liquidity mining over the long term.

- In the coming months, 35% of the tokens will be distributed as a reward for short-term liquidity mining.

Highlights of Canto

To accomplish its objectives, Canto focuses on three competitive advantages:

- Free for Liquidity Providers (LPs): Those who provide liquidity on Canto will incur no fees for deposits and withdrawals.

- DeFi protocols on Canto will not issue tokens or use tokens as a “borrowing from the future” method to attract liquidity, thereby limiting future inflation.

- Minimize the “ownership” of users: Canto will only serve as a liquidity platform; the manipulation will primarily be delegated to third-party protocols.

Observe:

Typically, DeFi projects will use their own tokens to attract liquidity and users via programs like Liquidity Rewards, Retroactive…

Limiting token launches to DeFi protocols could make attracting liquidity and users difficult for the project. To resolve this issue, Canto will proceed as follows:

“Attracting liquidity by waiving costs to liquidity providers and allowing third-party DeFi solutions to build on top of their liquidity layer => attracting users through a good trading experience => gaining additional costs => continuing to attract liquidity.”

This direction despite the benefit of avoiding the “future inflation” of many old DeFi projects; however, the actual liquidity offering/withdrawal may not cost too much, so simply reducing the cost of LPs may not be a sufficient condition.

In addition, if you learn about the project’s tokenomics, you will immediately realize that Canto is using the CANTO token to encourage liquidity through rewards for providing liquidity. The only distinction between Canto and conventional ecosystems is that Canto uses layer-1 tokens rather than creating other project tokens.

Development and Backer team

Currently, information about the project development team is still unknown. The project also did not undergo any fundraising.

Actual operating situation

Bridge, Staking, LP Interface, Lending-Borrowing, and Governance are among the products that Canto has created.

Bridge

Ethereum will initially serve as a bridge between Canto and other ecosystems for the transfer of assets.

According to Dune Analytics data, the total cash flow between Ethereum and Canto as of noon on January 30 was approximately $1 million, with $347.225 million coming in and $5.194 million going out.

As a new ecosystem’s bridge that was just put into operation on August 8, 2022, the total amount of $347 million circulating between Ethereum and Canto demonstrates that this bridge is functioning quite well and securely.

The majority of the assets that are rotated are stablecoins (USDC, USDT), as well as WETH.

Staking

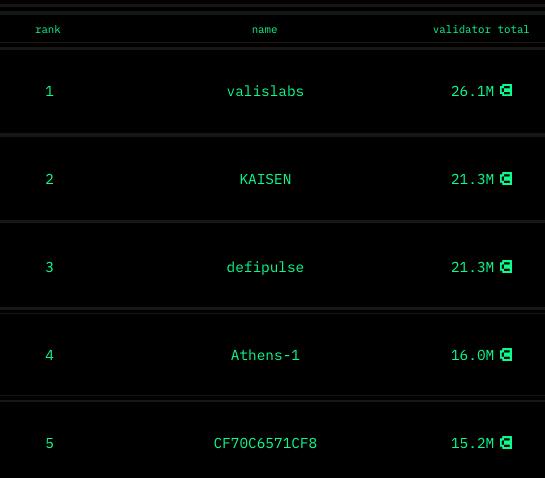

Currently, Canto has 93 active validators with a total staking value of approximately 95.97 million USD, which represents approximately fifty percent of the circulating capitalization. Pay special attention to the fact that the first three wallets hold more than 30 percent of all staking tokens.

Lending & Borrowing

This product’s operating model will resemble that of Compound, which permits users to use crypto assets as collateral and borrow other types of crypto assets at a specified interest rate. Currently, Canto Lending only accepts USDC and USDT as collateral. To diversify collateral, the project will add additional asset classes in the future, including LP Token.

According to data from DeFiLlama, Canto Lending’s total assets amount to approximately 47.9 million USD, of which 267,570 USDT have been loaned. The aforementioned data indicates that the capital utilization efficiency on Canto is currently very low. The majority of funds are deposited into the ecosystem in order to reach CANTO.

Canto DEX & LP Interface

This product allows users to both provide liquidity to Canto DEX and conduct transactions. Currently, there are five liquidity pools, which include CANTO/ATOM, CANTO/ETH, CANTO/NOTE, NOTE/USDC, and NOTE/USDT.

NOTE/USDC and NOTE/USDT are the stablecoin pools with the highest TVL. This is understandable given that the provision of liquidity in stablecoins is extremely secure, posing almost no risk of Impermanent Loss. The CANTO/NOTE liquidity pair is also very liquid because the majority of ecosystem participants must purchase CANTO with stablecoins.

External links

It is a product that allows token holders to vote on protocol governance implementation proposals. You may stake CANTO in order to vote.

Contact

Website: https://canto.io/

Twitter: https://twitter.com/CantoPublic

Discord: https://discord.com/invite/ucRX6XCFbr

Github: https://github.com/Canto-Network

Summing up

Through the above article, CryptoChill has helped you know about the Canto and the highlights of the project.

Disclaimer: This post is not investment advice. You will be 100% responsible for your investment decisions.

Please follow and subscribe to support the CryptoChill.news.

No Comment! Be the first one.