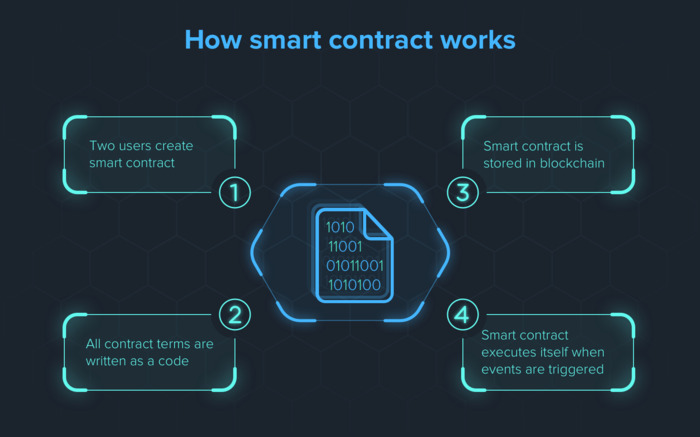

How do smart contracts work?

Smart contracts are self-executing contracts that are stored on a blockchain. They are written in code that defines the terms of the agreement between two or more parties. Once the code is deployed to the blockchain, it cannot be changed and is executed automatically when the conditions of the contract are met.

- The parties involved in the contract must define and agree on each term contained in the contract. This includes things like the price of goods or services, the delivery date, and the terms of payment.

- Once the terms of the contract are set, they are turned into programming code. This code is written in a language that is specific to the blockchain platform on which the smart contract will be deployed.

- Once the code is created, it is stored on the blockchain network and copied between all of the blockchain participants. This ensures that the code is transparent and tamper-proof.

- Next, the programming code is activated and executed by all the computers on the network. This is done using a process called mining. Miners are rewarded with cryptocurrency for verifying and executing transactions on the blockchain.

- The transaction doesn’t happen until a term in the smart contract meets the condition and is confirmed by everyone in the network. This ensures that the contract is executed fairly and impartially.

Read also: Blockchain smart contracts: Role and Applications (Part 1)

Application of Smart Contracts in Blockchain

Token Management

Smart contracts are used to create tokens on the blockchain network, keep track of them, and decide who owns them. The issued tokens will provide holders with features such as:

- Utility/insurance in the DApp (utility token).

- Weighted Voting on the protocol (governance token).

- Equity in the company (security token).

- Claim ownership of digital assets.

For example: FIL token is used to pay for Filecoin’s decentralized storage services, and COMP token allows holders to participate in the management of the Compound protocol.

Financial Products/Services (DeFi)

Decentralized finance (DeFi) uses smart contracts to create financial products and services, such as lending protocols, decentralized exchanges (DEX), decentralized payment platforms , derivative products, stablecoins… Smart contracts can hold user money in escrow and distribute them to users based on conditions that have already been set.

For example: Aave (AAVE) uses smart contracts to make lending and borrowing easier in a decentralized way. Aave is a lending platform that has pools for users to deposit assets and lend to others. Aave uses smart contracts to facilitate lending and borrowing in a decentralized manner, or withdraw tokens to borrow. For lenders, when providing liquidity in the pool will receive a reward of AAVE tokens. While borrowers need to deposit collateral if they want to get a loan. For example, if you deposit $200 worth of collateral, you will get a loan of less than $200.

Gaming and NFTs

Smart contracts are used in blockchain-based games to stop hackers and cheaters who want to find errors and seriously harm the game. One example is the game PoolTogether, which lets people put their money into a pool. Then, it is sent to the DeFi Compound Finance lending platform, where it earns interest and increases the players’ passive income.

Insurance

Parametric insurance is a type of insurance in which payments are directly tied to pre-specified event occurrences. Smart contracts provide tamper-proof infrastructure for creating parametric insurance contracts based on input data.

For example: Crop insurance can be created by using smart contracts. In which the user buys a policy based on specific weather information, like how much rain falls in a certain area during a certain time of year. At the end of the policy, the smart contract will pay out automatically if rainfall is more than the amount that was set up in front. At this time, the final user will get payments on time at a low cost, and the insurance provider will be able to run more openly, honestly, and reliably thanks to smart contracts.

Conclusion

In short, a smart contract can run itself automatically based on a set of pre-programmed parameters. With blockchain technology, the main benefit is that it enhances security, transparency, and reliability between the signatories, which helps avoid misunderstandings and misrepresentations.

Disclaimer: The information in this article is not investment advice from CryptoChill. Overall, cryptocurrencies always carry many financial risks. Therefore, do your own research before making any investment decisions based on this website’s information.

No Comment! Be the first one.