The transaction happens when everyone in the network confirms a smart contract term. Smart contracts are an important component of blockchain technology. These contracts are completely autonomous, decentralized, and transparent, and cannot be changed or edited once deployed. Below, we’ll discuss in more depth how smart contracts work, their roles, and their functions.

What is a Smart Contract?

A smart contract is a digital version of the standard paper contract that can automatically verify whether or not the terms of the contract have been carried out. In 1994, the smart contract concept was first introduced by Nick Szabo. He is an American computer scientist and researcher in digital currencies.

Read more: Introduction to Cryptocurrency: Roles, Storage, Transactions

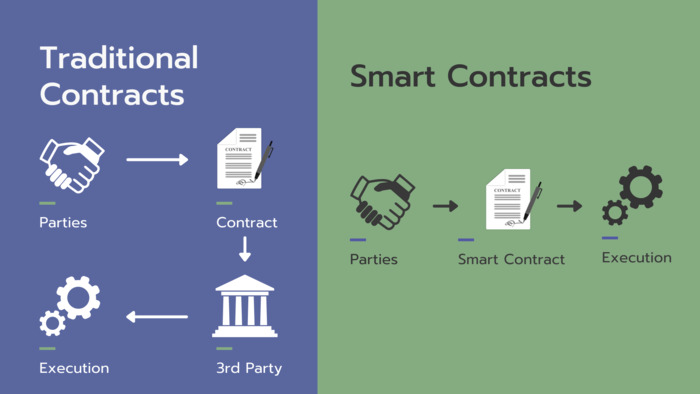

Smart contracts are carried out through a blockchain network, and the code for each contract is duplicated on many of the computers in the network. This ensures that contract terms are executed in a more transparent and secure manner. In other words, smart contracts automate agreement execution so all parties know the outcome as soon as possible, without an intermediary.

History of Smart Contracts

In 1994, the first smart contract was invented by American computer scientist, Nick Szabo. In his article, he gave a broad definition of a smart contract as follows:

“A smart contract is a computerized transaction protocol that executes the terms of a contract. The general objectives of smart-contract design are to satisfy common contractual conditions, minimize exceptions both malicious and accidental, and minimize the need for trusted intermediaries.”

The introduction of Bitcoin in 2009 is considered to have supported the first protocol smart contract—establishing a set of conditions essential for the transfer of Bitcoins between network members. These conditions include the user signing the transaction with a private key that matches their public address and having enough money to pay for the transaction.

After that, in 2012, Bitcoin blockchain developed a new type of smart contract known as a multi-signature transaction. In order to be valid, a multi-character transaction needs to be signed with a private key by a specific user. This increases the safety of assets by minimizing errors that can occur if the private key is stolen or lost.

The next big leap in smart contract occurred in 2013, when Vitalik Buterin published a white paper on Ethereum. In 2015, Ethereum came out as a new type of blockchain for programmable smart contracts. Ethereum smart contracts provide a “world computer” that can run numerous independent smart contracts at the same time. This is in contrast to blockchain, which only functions effectively as a single or limited application for smart contracts.

Advantages of Smart Contracts in Blockchain

- High Accuracy – Contract is executed immediately when a condition is met.

- Fast Speed – Paperwork is no longer necessary because smart contracts are based on automated blockchain technology.

- Trust and Transparency – Because no third party is engaged in the transaction and all transaction logs are encrypted and exchanged between participants, users do not have to be concerned about their information being tampered with.

- High Security – Blockchain transaction records are encrypted, making it very difficult to hack smart contracts.

- Time Savings – Smart contracts get rid of the need for middlemen, the time delays, and the costs that come with them.

How Do Smart Contracts Work?

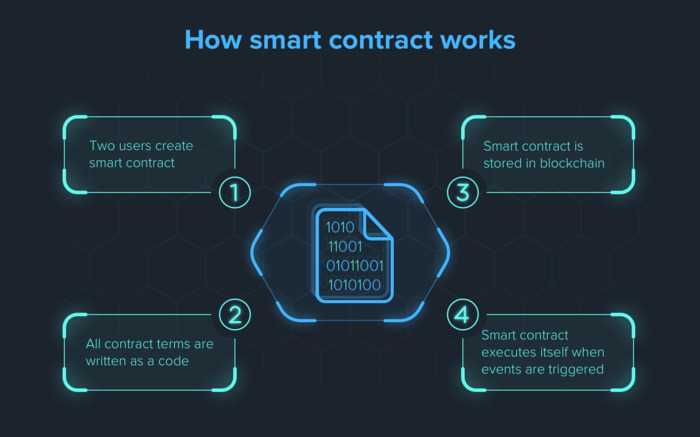

- Step 1: It is necessary for the parties involved in the contract to define and come to an agreement on each term contained in the contract. Once the terms of the contract are set, they are turned into programming code. Basically, the programming code represents a variety of conditional statements that each describes the situation that could occur in an upcoming transaction.

- Step 2: Once the code is created, it is stored in the blockchain network and copied between all of the blockchain participants.

- Step 3: Next, the programming code is activated and executed by all the computers on the network. The transaction happens when everyone in the network confirms a smart contract term.

Application of Smart Contracts in Blockchain

Token Management

Smart contracts are used to create tokens on the blockchain network, keep track of them, and decide who owns them. The issued tokens will provide holders with features such as:

- Utility/insurance in the DApp (utility token).

- Weighted Voting on the protocol (governance token).

- Equity in the company (security token).

- Claim ownership of digital assets.

For example, FIL token is used to pay for Filecoin’s decentralized storage services, and COMP token allows holders to participate in the management of the Compound protocol.

Financial Products/Services (DeFi)

Decentralized finance (DeFi) uses smart contracts to create financial products and services, such as lending protocols, decentralized exchanges (DEX), decentralized payment platforms, derivative products, stablecoins… Smart contracts can hold user money in escrow and distribute them to users based on conditions that have already been set.

For example, Aave (AAVE) uses smart contracts to make lending and borrowing easier in a decentralized way. Aave is a lending platform that has pools for users to deposit assets and lend to others. Aave uses smart contracts to facilitate lending and borrowing in a decentralized manner, or withdraw tokens to borrow. For lenders, when providing liquidity in the pool will receive a reward of AAVE tokens. While borrowers need to deposit collateral if they want to get a loan. For example, if you deposit $200 worth of collateral, you will get a loan of less than $200.

Gaming and NFTs

Smart contracts are used in blockchain-based games to stop hackers and cheaters who want to find errors and seriously harm the game. One example is the game PoolTogether, which lets people put their money into a pool. Then, it is sent to the DeFi Compound Finance lending platform, where it earns interest and increases the players’ passive income.

Read also: What’s NFT & GameFi? A Look Into How They Are Related

What is Bitcoin.com’s VERSE Token?

Insurance

Parametric insurance is a type of insurance in which payments are directly tied to pre-specified event occurrences. Smart contracts provide tamper-proof infrastructure for creating parametric insurance contracts based on input data.

For example, Crop insurance can be created by using smart contracts. The user buys a policy based on specific weather information, such as annual rainfall. The smart contract will pay out automatically if rainfall exceeds the amount set up front. The final user will get on-time, low-cost payments, and the insurance provider will run more openly, honestly, and reliably thanks to smart contracts.

Conclusion

In short, a smart contract can run itself automatically based on a set of pre-programmed parameters. With blockchain technology, the main benefit is that it enhances security, transparency, and reliability between the signatories, which helps avoid misunderstandings and misrepresentations.

Disclaimer: The information in this article is not investment advice from CryptoChill. Cryptocurrency investment activities are not recognized and protected by the laws of some countries. Cryptocurrencies always carry many financial risks. Do your own research before making any investment decisions based on this website’s information.

No Comment! Be the first one.