In a remarkable turn of events, Base, an incubation project of Coinbase, has outstripped Solana to become the ninth-largest blockchain by Total Value Locked (TVL). This achievement comes on the back of a resurgence in Friend.tech activity and the launch of new DeFi applications within the Base ecosystem.

Base Surpasses Solana in TVL Value

DeFiLlama data reveals that DeFi protocols operating on Base have aggregated deposits amounting to an impressive $370.50 million, comfortably surpassing Solana’s $310.25 million.

Remarkably, within the realm of Ethereum layer-2 protocols, Base currently secures the third-largest network position in terms of the value bridged across its ecosystem, ranking only behind Arbitrum and Optimism, as reported by L2Beat.

Moreover, Base distinguishes itself as the most active network, outperforming both Ethereum and rival layer-2 networks with a daily average of 15.15 transactions per second (TPS). In contrast, Ethereum and other layer-2 networks lag behind with TPS counts of 11 or lower, according to L2beat data.

Friend.tech activity surge

Friend.tech is a social media platform with tokenized accounts. Only users who own the Keys of specific accounts get access to private chat groups on the platform. The number of Friend.tech Keys purchased and sold have increased significantly in recent weeks, driving up activity and deposits on Base.

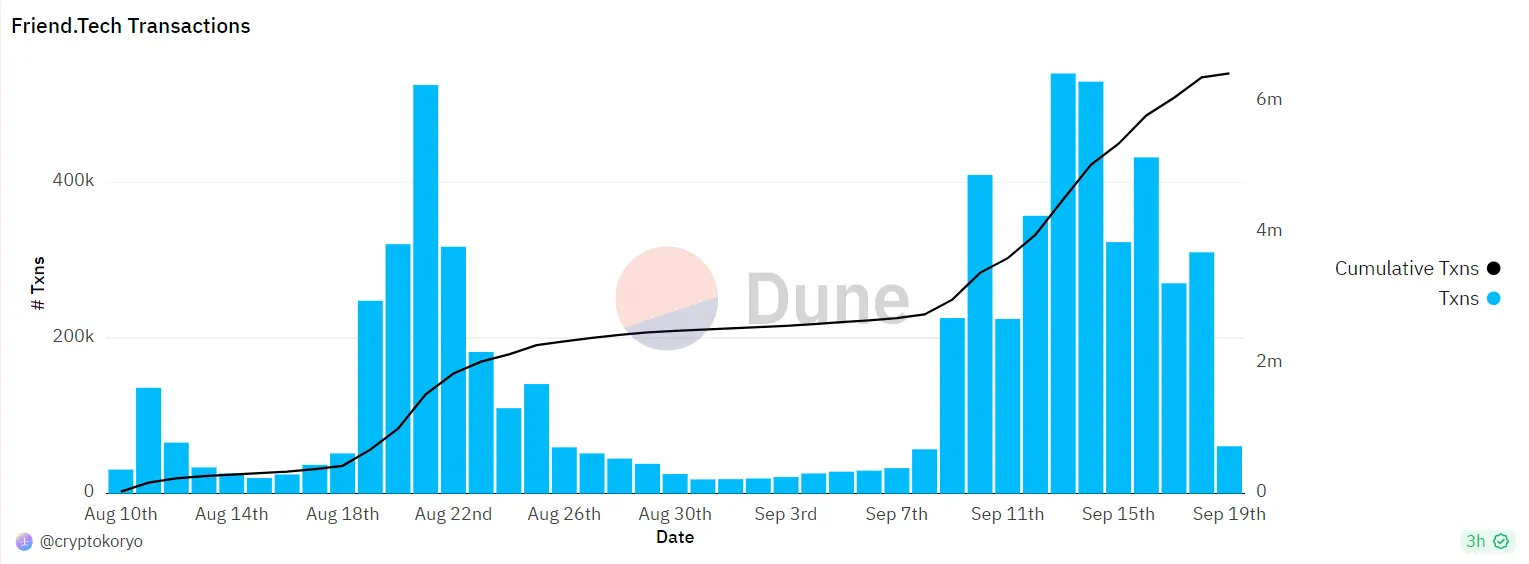

The number of Friend.tech Keys purchased and sold have increased significantly since September 9, reaching a new peak of 539,810 transactions on September 13, according to data from Dune dashboard analyst CryptoKoryo.

Additionally, over $130 million has been deposited into the application since September 9, as the number of deposits more than doubled from just over $100 million to $230 million presently.

The platform had a tremendous start in August. However, it gradually declined due to concerns about the application’s privacy policies and the steep bonding curve, which resulted in significantly higher costs for account keys as their popularity increased.

Still, activity on the platform has surged due to airdrop speculation, as early users hope to receive governance tokens for the platform.

Friend.tech also enables the sharing of trading fees as royalties for shareholders; the only way to earn from the platform is through royalty fees. Users who own Keys of accounts receive royalty fees every time a key is traded, which is likely fueling the purchases of Twitter accounts by the account holders themselves and other speculators.

Launch of new DeFi applications

A number of reputable DeFi applications have launched on Base in recent weeks, including lending platform Compound Finance, decentralized exchange Uniswap, and cross-chain bridging protocol Stargate. These launches have attracted new users and capital to the network.

The launch of these DeFi applications has made it easier for users to access and use financial services on Base. For example, Compound Finance allows users to lend and borrow cryptocurrency assets, while Uniswap allows users to trade cryptocurrency assets.

The launch of these DeFi applications has also made Base more attractive to developers. By building on Base, developers can access a large and growing user base and benefit from the network’s scalability and performance advantages.

Conclusion

Overall, Base’s growth is a positive sign for the Ethereum layer-2 ecosystem. As more users and developers adopt Base and other layer-2 networks, the Ethereum ecosystem will become more scalable and accessible to everyone.

Disclaimer: The information in this article is not investment advice from CryptoChill. Overall, cryptocurrencies always carry many financial risks. Therefore, do your own research before making any investment decisions based on this website’s information.

No Comment! Be the first one.